Most amateur gold market investors look for “road signs”that suggest gold is in a bull market or a bear market.

In contrast, professional bank and FOREX traders focus on price levels.

These levels are powerful support and resistance zones where professional investors buy weakness, sell strength, and do so very aggressively.

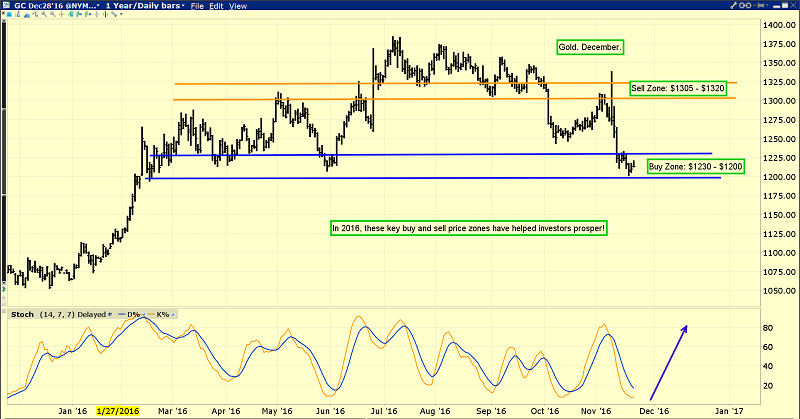

This is the important daily gold chart.

Investors should not waste too much time trying to discern whether gold is going to “hold” at a certain level when the price goes there.

When the price of gold enters a key buy or sell zone, it’s better to think less, and simply act with firm buy or sell action.

There were a lot of reasons why gold should have gone higher in the $1305 - $1320 area, and it did go to about $1380, but that doesn’t change the fact that $1305 - $1320 is a selling level of importance.

Likewise, I’m sure that most gold investors are nervous now. They likely have many reasons why the $1230 - $1200 area should not be bought.

Unfortunately, I don’t believe that analyzing a key support zone builds any wealth. Buying it does.

It’s true that gold can move lower than $1200, like it moved higher than $1320, but that doesn’t change the fact that $1200 is a good buying area.

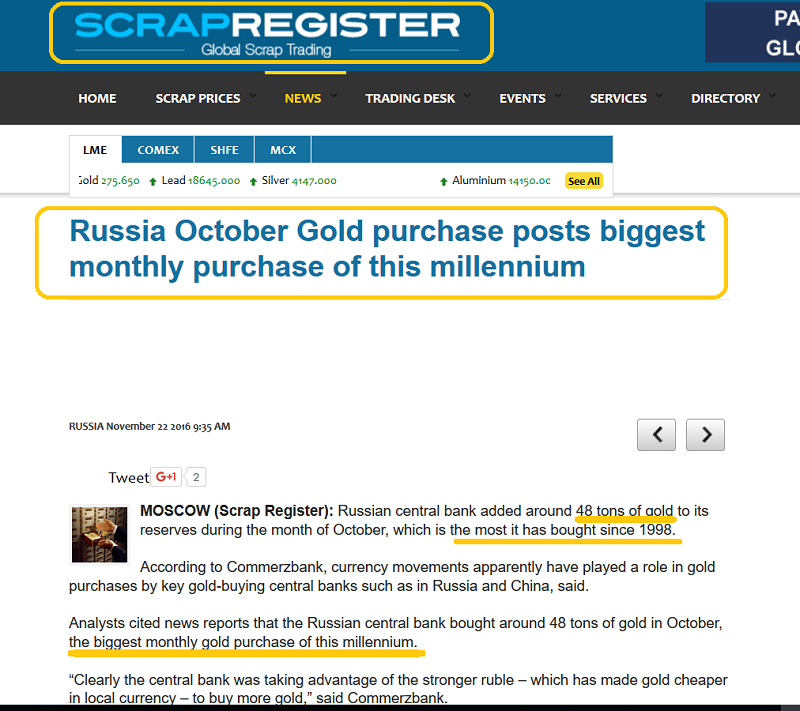

Central banks continue to buy substantial amounts of gold, and that’s generally price-supportive.

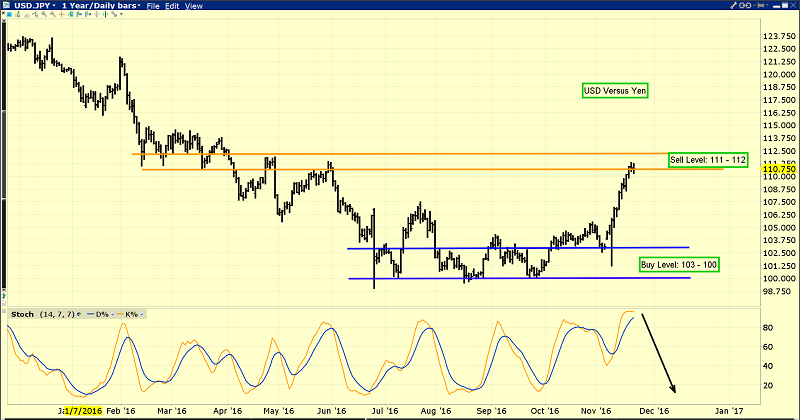

While most investors wonder if the dollar is beginning a new leg higher, Barron’s master analyst Shuli Ren wonders if it’s time to unwind long positions.

I think so, and the unwind could be the catalyst for a major gold price rally. On Friday, I sold the bulk of my long dollar/short yen position at the 110 price level.

The current key price levels for the dollar against the yen.

For investors whose main focus is getting richer, it doesn’t matter whether the dollar is in a bull market or a bear market. What matters are key buy and sell price levels, and the dollar is at a key sell level right now against the safe-haven yen.

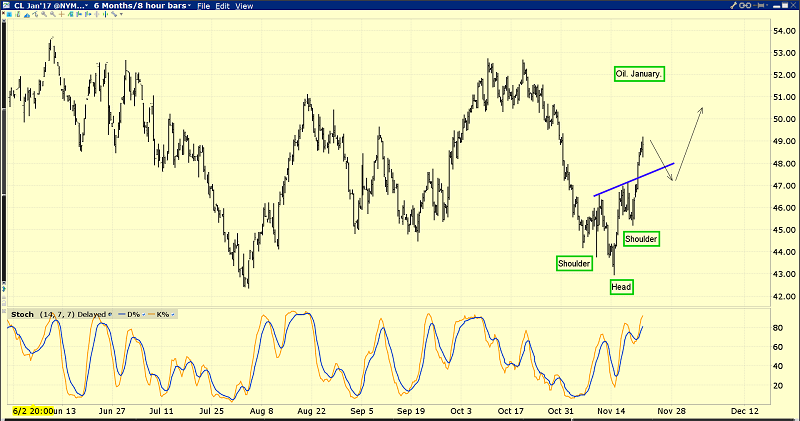

RBC Bank economists turned positive on oil in the fall, and now Goldman’s heavyweight team of analysts are joining the upside prediction fun.

Goldman is tactically bullish, and with good reason.

Oil is the largest component of most commodity indexes. The oil price has a huge effect on institutional inflation expectations.

RBC believes an OPEC deal with teeth is imminent. I agree. This is the eight-hour bars oil chart.

Goldman’s fundamentally-oriented analysts have a $55 target now, and I’ll note that if oil can hit $55, it would take out some key highs on the chart. That should usher in substantial commodity fund buying of both gold and oil.

A rollover in the dollar would add to the oil price rally.

What about gold stocks? This is the GDX (NYSE:GDX) daily chart.

GDX has arrived at the key $20 round number level. It’s done that just as gold has moved into the $1200 area buy zone. That’s significant.

Eager gold stock enthusiasts can be buyers here in the $20 zone. Note the action of my 14,7,7 Stochastics oscillator, at the bottom of the chart. It’s very positive right now. Also, Chinese jewellery companies are poised to begin their buying for the upcoming New Year celebratory season, and that tends to precede a great January rally for GDX. As Christmas approaches, tis the GDX season to be jolly.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?