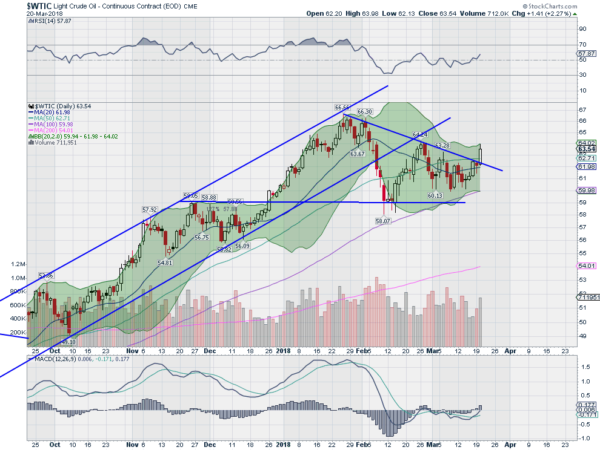

Crude Oil went through a steady rise in a channel over the back half of 2017 and into January. At that point it broke down through support and ran sideways. The sideways motion has continued for 2 months now against falling trend resistance and over horizontal support. This type of digestive move after a long run to highs is useful in resetting momentum and shaking out both profits and loosely held beliefs. In the end this allows for new sentiment to filter in and take hold, leading to another change of character.

Much like Melania changing her facial expression to a smile above, there is a positive change occurring now in Crude Oil. Tuesday’s price action broke through that falling trend resistance and ended over the 50 day SMA again. Should it continue over the late February high at 64 74 a full change of character could be underway. And as I write in the early morning Wednesday it is on the cusp of a higher high.

Continuation out of the triangle it was building gives a target to the upside of about 70. It has momentum on its side. The RSI is rising again into the bullish zone and the MACD is crossed up and turning positive. Even the Bollinger Bands® are shifting to the upside to allow a move. The next potential resistance above the February high sits at 66.50, the high from January. Clearing that level gives a much stronger chance of touching 70 again.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.