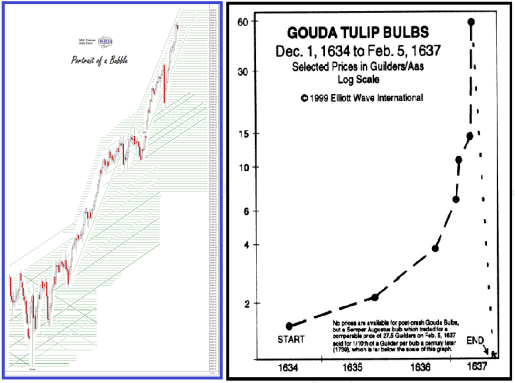

Just like the Dutch Tulip Bulb bubble, internet stock bubble, and the mid-2000’s financial asset bubble, the current stock market is no longer a price-discovery mechanism. It has deteriorated into a venue in which Central Bank-manufctured liquidity – in the form of printed currency and credit creation – has flooded into the system, enabling investors to chase the few stocks rising in price at the highest velocity (click to enlarge, graph on the left sourced from Jesse’s Cafe Americain).

The drivers of this modern day Dutch Tulip phenomenon are the so-called “Five Horsemen” stocks – Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Facebook Inc (NASDAQ:FB), Alphabet (NASDAQ:GOOG),Microsoft (NASDAQ:MSFT).

To that grouping I toss in Tesla Inc (NASDAQ:TSLA). Among all of those bubble stocks, TSLA has become, by far, the most disconnected from any remote intrinsic, fundamental value. AAPL alone is responsible for 25% of the YTD gain in the Dow and 13% of the YTD gain in the S&P 500. AAPL’s revenues and operating income have declined over the last three years (2014 to 2016). More often than not, even on days when the S&P/Dow are red, most if not all of the Five Horsemen + TSLA seem to close green.

Eventually, the music will stop and this “no-price-discovery-possible” market will become a “can’t find a seat” market. The abruptness and rate of decline will be breathtaking. Perhaps only matched by the outflow of capital from the cryptos by “investors” who leveraged up their cryptocurrency holdings to throw more “money” at TSLA.

The good news is that a lot of money can be made shorting stocks. Since April, stocks like IBM (NYSE:IBM), Goldman Sachs (NYSE:GS), Sears (NASDAQ:SHLD), Beazer (NYSE:BZH)and General Electric Company (NYSE:GE)presented in the Short Seller’s Journal as shorts have outperformed the SPX/Dow. SHLD is down 47% in 7 weeks – a home run. BZH is down 18% in three weeks. In the next issue, a “funky” financial stock will be featured that has the potential to drop at least 50% over the next 12 months if not sooner.

No one knows what event will trigger the stock bubble collapse. One possibility is the ongoing financial implosion of the State of Illinois. In stock bubble periods, all news is imbued with “the glass is half full.” As an example, Illinois’ credit rating was reduced recently to BB+/Baa3. That is a junk rating. But the media characterizes it as a “the lowest investment grade” rating – i.e. the “glass is half full.”

Both rating agencies never downgraded Enron to junk until it was weeks from Chapter 7 bankruptcy. Illinois is on the brink of financial disaster. See this article as an example: Illinois Owes Billions. This problem is absolutely dwarfed by Illinios’ public pension problem, which Illinois underfunded by a couple hundred billion (officially about $130 billion but that’s not on a true mark-to-market basis).

When the music finally stops, the perma-bubble bulls will be looking for that proverbial “seat” in all the wrong places. But the next stampede of capital will be out of stocks, bonds, cryptos and “investment” homes and into physical gold, silver and mining stocks.