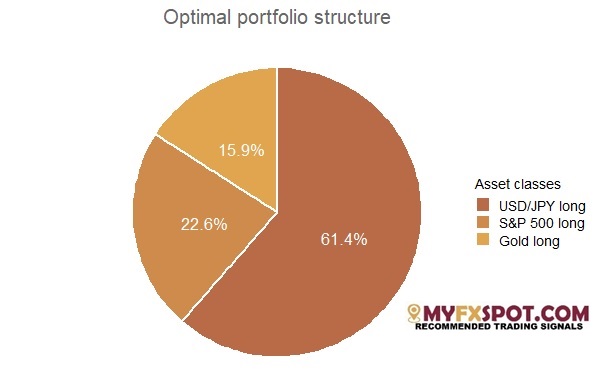

Today we have added EUR/USD, USD/JPY, gold and S&P 500 to our portfolio structure optimizer and that is what we’ve got as a result:

The model maximizes the expected rate of return and minimizes the risk and suggests USD/JPY long, Gold long and S&P 500 long as an optimal combination for the current phase of the economic cycle.

Recent Data From Japan

Japanese companies' expectations for inflation over the next year stagnated, a Bank of Japan survey showed on Tuesday, underlining the daunting challenge facing policymakers as they seek to boost growth and prices amid slowing global demand.

Companies expect consumer prices to have risen 0.9% a year from now, unchanged from their projection three months ago, according to a quarterly survey by the BOJ.

Firms expect consumer prices to have risen by an annual 1.1% three years from now, unchanged from the previous survey. Companies also saw inflation at 1.1% five years ahead, slightly below a 1.2% increase expected three months ago.

The discouraging inflation expectations reading comes in the face of increasing risks to Japan's economy as global trade slows in a blow to profits and consumption.

There are also uncertainties over the government's plan to raise the sales tax later this year.

A separate survey from the BOJ on Monday showed business sentiment slumped to a two-year low in the March quarter, underscoring concerns that Sino-U.S. trade dispute and softening global demand were taking a toll on the export-reliant economy.

The BOJ's next policy meeting ends on April 25.

Core consumer prices rose an annual 0.7% in February, slower than a 0.8% increase in the previous month, while in the same period exports fell for a third month, suggesting the central bank might be forced to offer more stimulus eventually to temper the effects of slowing external demand and trade frictions.

Slowing global growth, the Sino-U.S. trade war and complications over Britain's exit from the European Union have already forced many policymakers to shift to an easing stance over recent months.

Many in the BOJ expect Japan's economy to emerge from the current soft patch in the second half of this year, assuming China's stimulus plans can revive demand there.

However, global trade friction will not subside as the United States re-negotiates trade deals to lower its trade deficit, meaning Japan's economic slowdown could be prolonged.

The government plans to raise the nationwide sales tax to 10% from 8% in October to generate extra revenue for rising welfare costs. This plan may weaken consumer spending.

Short-Term Trade Idea

USD/JPY saw the second biggest one-day rise of 2019 according to prices, when it closed up 71 pips on Monday, to probe the 200-day moving average now at 111.48. A daily close above the 200-day moving average will unmask the 2019 112.13 high. Our short-term trade ideas is to get long on dips at the 111.05, which is ahead of the 100-day moving average which is currently at 110.98.

Economic research and trade ideas by MyFXspot.com