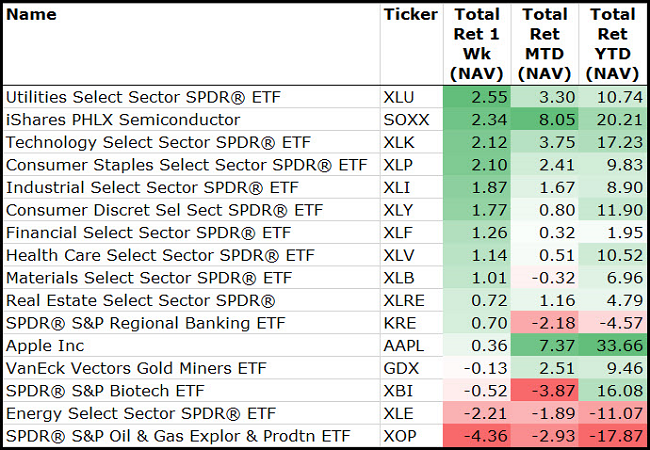

Don’t forget to send your portfolio on the road this summer as there are likely to be many more gifts found overseas than in the U.S. this summer. The international markets have lower valuations, improving growth and possibly even more political certainty than here in the U.S. Foreign currencies are rising against the U.S. dollar as economic trade flows shift and investors want to diversify away from the United States.

It is getting increasingly more difficult to make business and investment decisions with Washington D.C. policy proposals and reactions being so fluid. CEOs are confused, foreign leaders are confused and even I am confused whether buying an American made car without the Ford or GM logo on it is still a pro-American purchase.

Luckily, for the markets, there is less confusion as the trend continues to point towards buying overseas.

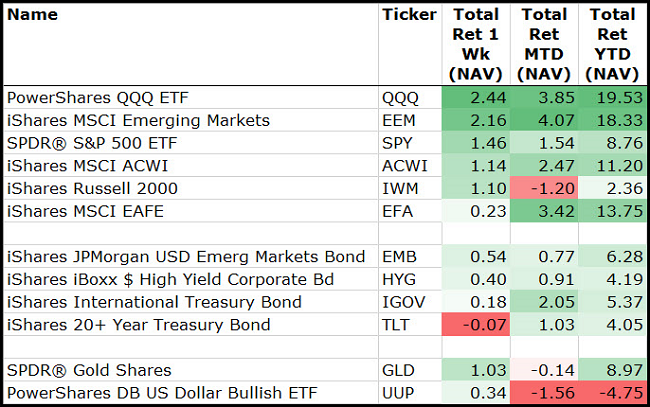

Even with the terrible events in Manchester last week, the markets continued to push higher led by Growth stocks and the Emerging Markets. And with May ending this week, barring an unseen event, Growth and International stocks will take home the top gains. With the U.S. dollar still looking for answers and waiting for Washington, there is no reason to believe that these trends will change.

Some food for thought when considering how large U.S. equities are to your portfolio.

Germany is having a good month.

Here is a chart of IFO which is now at the highest level ever.

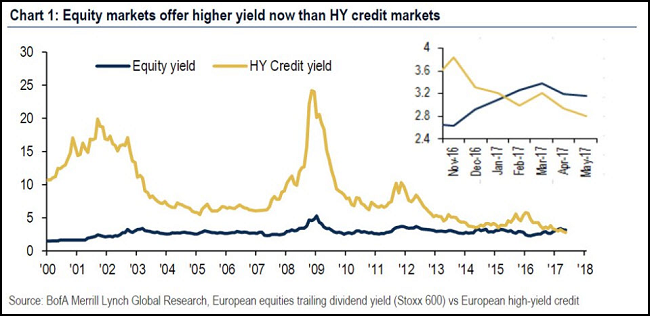

When looking at European valuations, their stocks now yield more than their junk bonds.

(In Europe, equities are literally the new high-yield. BofAML)

Need a new Emerging Market to invest in? How about Argentina which will be producing half of the global lithium output in three years.

Industry heavyweights Albemarle Corp., Soc. Quimica y Minera de Chile SA, Eramet SA and Jiangxi Ganfeng Lithium Co. are among groups looking at expanding or building new lithium operations in Argentina, as part of a $20 billion pipeline of mining projects through 2025, Meilan said Monday in an interview. China’s CITIC is also looking for opportunities, according to the government.

If all of the projects go ahead, Argentina’s annual output of the metal used in electric-vehicle batteries would surge to 165,000 metric tons, or about 45 percent of global supply, according to government projections. Prices will increase as much as 15 percent this year, Albemarle predicted last month.

“Conservatively, Argentina will represent about half of global lithium production by 2020,” Meilan, who also headed up mining under former President Carlos Menem in the 1990s, said from Toronto, where he’s participating in the PDAC mining conference. “This shows us that we’re starting to be well-regarded globally.”

If you have to invest in the U.S., then let’s look back at sector performances.

Here I see a strong performance tilt towards growth (Semis & Tech) with rising strength in defensive (Utilities & Staples). I would have no interest in being invested in Energy or Financials right now.

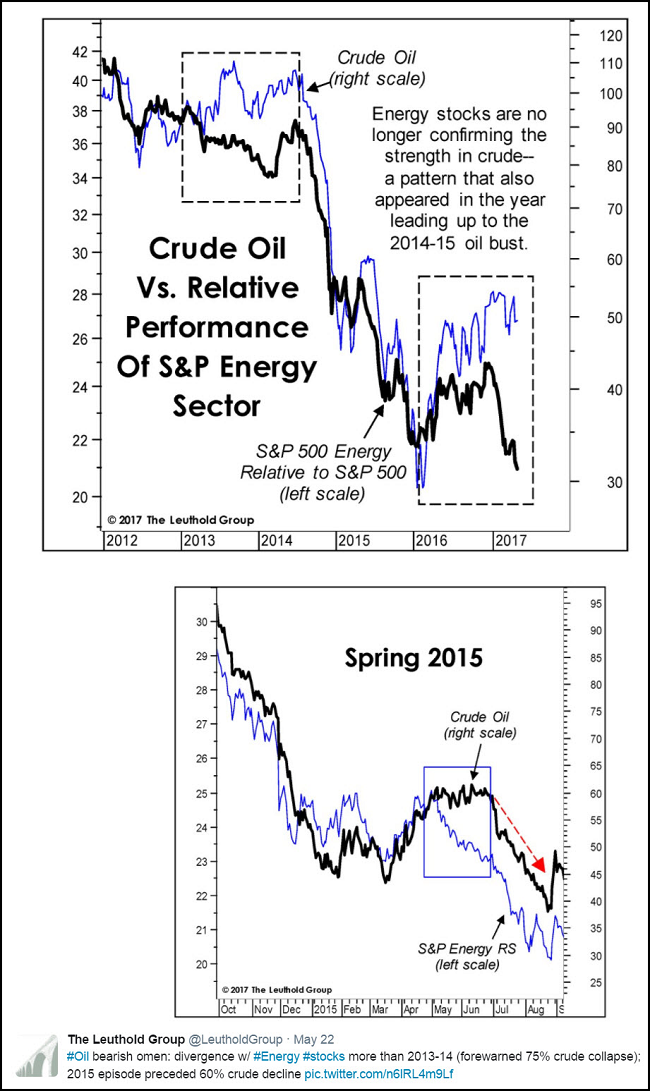

The Leuthold Group warns you to look out below for crude oil prices.

The last two times that Energy stock prices diverged from the S&P 500, crude oil prices broke lower. will this be the third time?

Even the team at JPMorgan (NYSE:JPM) unplugged their seismic thumping equipment this weekend.

David Martin, executive director at JP Morgan, says the decision to lop its crude forecasts was driven by the expectation that the deal to extend production cuts will likely fail, which, along with higher US production levels, will lead to an increase in global supply.

He says:

As we have previously flagged, the longer-term consequences of OPEC’s actions will likely prove unpleasant for the cartel’s members.

We assume that the OPEC/non-OPEC deal collapses at the end of 2017, as cheating becomes untenable for core OPEC members. Consequently, the 2018 oil market balance now points to rapid builds in inventories which, absent continued OPEC support, should depress oil prices.

Contributing further to price weakness, Martin says that US production levels are still likely to increase for several quarters yet given lower breakeven costs for producers and increased investment as a result of previous price strength.

Falling oil and plastic prices should be a positive for Hasbro (NASDAQ:HAS). Unfortunately the CEO warns us that a pair of dice may be needed to predict the next moves in Washington D.C.

Alan G. Hassenfeld, whose family founded America’s second largest toymaker in the 1920s, said: “We thought, you know, if you run a business today you would like to know what the rules of the game are,” Hassenfeld at told the Horasis conference, attended by business leaders, politicians and academics to discuss globalization and other challenges for corporations.

“Right now in America we don’t know what the rules of the game are. They are changing constantly,” said Hassenfeld, a billionaire with a large stake in Hasbro, whose stock has risen 34 percent this year and is now at all-time highs.

Hasbro makes many of its toys outside of the United States and has markets worldwide. Hassenfeld said there was great uncertainty on trade with Trump.

Hassenfeld said:

Right now we don’t know whether we are friendly with Mexico, whether we are friendly with Canada, whether we are friendly with China, whether we are friendly with Russia.

One sector not dependent on politicians right now is Semiconductors as chip design applications are growing significantly.

Nintendo Co (T:7974).’s biggest battle these days isn’t against other game makers. It is against companies such as Apple Inc (NASDAQ:AAPL). that are gobbling up the same parts Nintendo needs to make its hit Switch machine, people in the industry say.

Nintendo has told suppliers and assemblers it hopes to make nearly 20 million units of the Switch device in the year ending in March 2018, people involved in the discussions said. Though the company’s official sales target for the year is 10 million, strong demand suggests it can sell many more—if it can make them.

The problem is an industrywide capacity shortage for components used in smartphones, computer servers and other digital devices. These include the NAND flash-memory chips that store data, as well as liquid-crystal displays and the tiny motors that enable the Switch’s hand-held controllers to imitate the feel of an ice cube shaking in a glass.

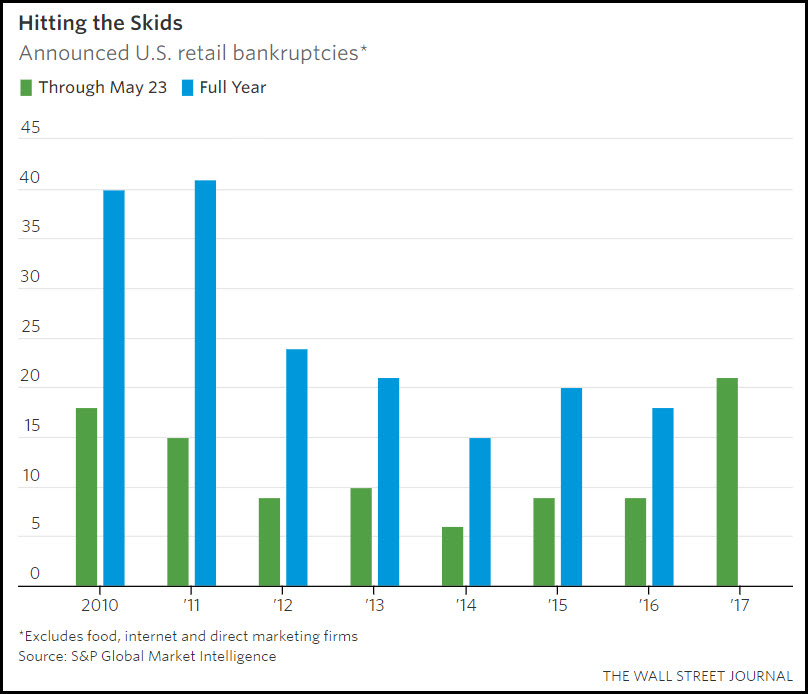

Don’t get too concerned about U.S. Retail bankruptcies harming U.S. credit quality.

Banks generally take reserves against potential losses when they see borrowers that might be at risk. In the case of retailers, the amounts generally haven’t been big enough to show up in broader reserve levels at big banks, Mr. Schorr said. That is a contrast to last year, when energy lending led banks to post large increases in reserves broadly.

One reason for the difference: In energy, the commodity-price declines were felt widely across the industry. Loans to troubled retailers, on the other hand, are balanced out by online stores and other chains that are performing better.

Another distinction is that the value of the retailers’ collateral underlying the loans has held up better than in energy. “The inventory and accounts receivable value doesn’t fluctuate as much as commodities’ prices do,” Mr. Hillman said.

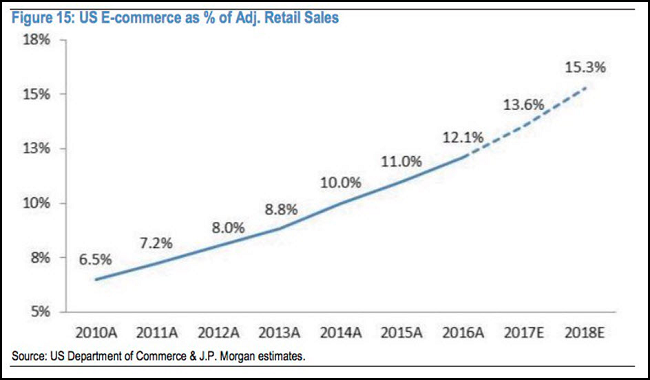

Speaking of Retail, J.P. Morgan is estimating online retail will eventually move to 30%, so still lots of gas in this tank.

@JakeCahan: JPM: “We are still early in the secular shift online with a long runway ahead before reaching ~30%+ penetration [e-commerce at ~14% in ’17]”

North of the border, Toronto is finally seeing strong evidence of a real estate slowdown.

Carissa Turnbull, a Royal LePage broker in the Toronto suburb of Oakville, who didn’t get a single visitor to an open house on the weekend, said:

We are seeing people who paid those crazy prices over the last few months walking away from their deposits. They don’t want to close anymore.

Case Feenstra, an agent at Royal LePage Real Estate Services Loretta Phinney in Mississauga, Ontario, said:

In less than one week we went from having 40 or 50 people coming to an open house to now, when you are lucky to get five people. Everyone went into hibernation.

Chicago is about to see a slowdown in the real estate prices of portfolio managers and financial advisors.

The Illinois bill would put a 20% levy on fees earned by investment advisers. It passed the state Senate in a 32-24 vote Tuesday, and backers are hoping to get it through the House before the legislative session ends May 31.

The new tax is pitched as a way to squeeze more revenue—as much as $1.7 billion a year—from hedge funds and private-equity firms, which purportedly get off easy on their federal taxes because of the “carried interest loophole.” But under the current version of the bill, Illinois would keep collecting the privilege tax even if Congress were to cease taxing carried interest at the lower capital-gains rate.

This is a terrible solution to a budget crisis. If your child’s school tries to go to four days a week from five, move to another school district.

A deepening budget crisis here has forced schools across the Sooner State to make painful decisions. Class sizes have ballooned, art and foreign-language programs have shrunk or disappeared, and with no money for new textbooks, children go without. Perhaps the most significant consequence: Students in scores of districts are now going to school just four days a week.

The shift not only upends what has long been a fundamental rhythm of life for families and communities. It also runs contrary to the push in many parts of the country to provide more time for learning — and daily reinforcement — as a key way to improve achievement, especially among poor children…

School districts staring down deep budget holes have turned to shorter weeks in desperation as a way to save a little bit of money and persuade increasingly hard-to-find teachers to take some of the nation’s lowest-paying jobs.

Of 513 school districts in Oklahoma, 96 have lopped Fridays or Mondays off their schedules — nearly triple the number in 2015 and four times as many as in 2013. An additional 44 are considering cutting instructional days by moving to a four-day week in the fall or by shortening the school year, the Oklahoma State School Boards Association found in a survey last month.

A good piece in the WSJ on the rapid slowdown in Small Town U.S.A.

For more than a century, rural towns sustained themselves, and often thrived, through a mix of agriculture and light manufacturing. Until recently, programs funded by counties and townships, combined with the charitable efforts of churches and community groups, provided a viable social safety net in lean times.

Starting in the 1980s, the nation’s basket cases were its urban areas—where a toxic stew of crime, drugs and suburban flight conspired to make large cities the slowest-growing and most troubled places.

Today, however, a Wall Street Journal analysis shows that by many key measures of socioeconomic well-being, those charts have flipped. In terms of poverty, college attainment, teenage births, divorce, death rates from heart disease and cancer, reliance on federal disability insurance and male labor-force participation, rural counties now rank the worst among the four major U.S. population groupings (the others are big cities, suburbs and medium or small metro areas).

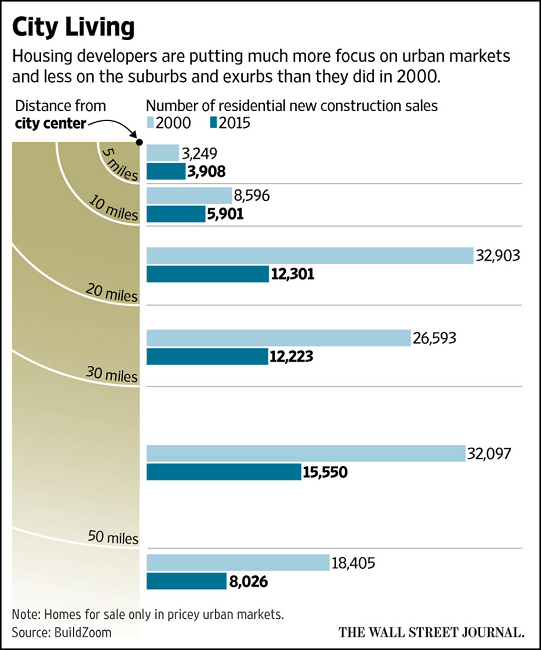

As inner cities flourish and small towns shrink, the housing industry is following the migration.

The rush of young people to U.S. cities over the past few years is partly to blame for America’s worsening housing shortage.

In some of the country’s largest and most prosperous markets, such as New York, San Francisco, Boston and Los Angeles, housing construction has been stronger than normal in the urban core but weaker in the suburbs, where new housing can be built abundantly and more cheaply, according to an analysis set to be released Monday by BuildZoom, a website for construction contractors.

That is a problem because suburbs are typically the main drivers of housing construction.

For decades during the late-20th century, suburbs were the place to build, as urban cores suffered from high crime, poor schools and stagnant or shrinking populations.

But preferences have changed among young people, many of whom want to live closer to transit, restaurants and their workplaces.

If Jeff Bezos or Elon Musk went into the cheese business, their last name would be Leprino.

After nearly 60 years running the business and more than a decade on Forbes’ list of billionaires, Leprino, worth an estimated $3 billion, is finally willing to be interviewed about how his family’s grocery in Denver’s Little Italy became the world’s top producer of pizza cheese–the slightly derisive term competitors use to describe its mozzarella. In all, Leprino Foods sells more than a billion pounds of cheese a year, to the tune of $3 billion in revenue.

The little-known Leprino (he declined to be photographed for this article) rates as one of America’s all-time monopolists. He lets others worry about fresh mozzarella balls and pizza that taste like they were made in the old country. His laser focus on large pizza chains has allowed him to control as much as 85% of the market for pizza cheese and somehow sell simultaneously to a set of customers — Pizza Hut, Domino’s, Papa John’s and Little Caesars — that try to cut each others’ throat in every way that doesn’t involve where they buy their milk products. Dominating the market has its advantages: He’s able to invest in technology that no run-of-the-mill dairy farmer ever could, resulting in more than 50 patents —and an estimated 7% net margin, which dwarfs the dairy-industry average.

Finally, the Cod Kroner is coming and the Norwegian Central Bank is pulling out all the stops to let you know about the new 200kr currency note. If only the U.S. Treasury was so hip

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.