No, I don’t mean the dating site. I am talking about various asset classes.

Yesterday’s big story was 10% + drop in VIX. What is the story for today?

If you have not guessed it already, it is Nat.Gas. For the past few days I have written in the blog that I am scaling into Nat.Gas. How many of you did take the trade? Because if you did, you would be very happy person today.

After a long time, I got some free time to Tweet in the morning when I wrote that I am expecting a bounce. We got some bounce which did not last but the most important thing is that /ES 1370 held another day. In fact after the cash market closed, SPX futures are up 4 handles and Nasdaq futures are up 15 handles. Go figure how it will be tomorrow. Let us see how it goes but I am neither short nor long equities at this point of time. The market played with bulls and bears alike. In the morning the bears covered and in the evening the bulls covered. At this rate who will be left playing the day trading game? Only your broker will laugh to the bank. Again and again I want to emphasize the point that correction does not mean collapse. We do not have to be short in every correction nor have we to chase every up tick. But we must learn to disregard the noise coming out of the Russian propaganda machine better known as “Mad as a rabid dog” blog.

I want to show you a chart from Chris Kimble.

As you can see, there are about 40 asset classes in that chart. Equity indices are somewhere in the middle and in the last 6 months they have not given much return. On the other hand risks associated with equities have never been higher. Why not look for other fish to fry. As of now I am waiting for an upward break of Gold which is short term in nature.

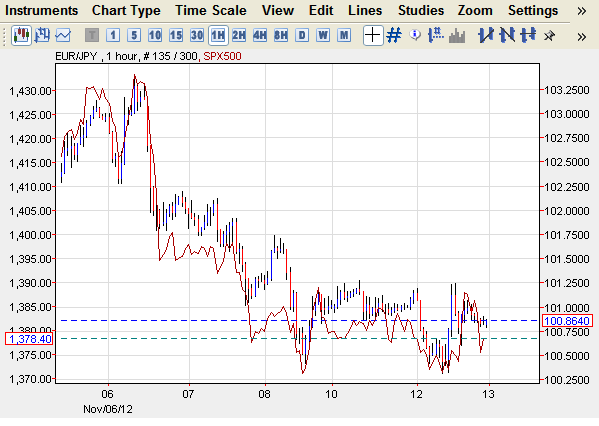

The king of carry trade Euro/yen is showing a kind of double bottom.

I think a bounce up-to 102.25 is very possible in the near term. And if it closes above that level, then we can look for a good bounce in SPX. I am not saying it will happen; I just want to draw your attention to all possibilities. On the other hand if it breaks down below 100, we can safely short the market. As of now, things do not match and 2+2 = 5. So better be safe than sorry. Even AUD is acting strange. It was up today and there is no reason for AUD to go up while cycles are down.

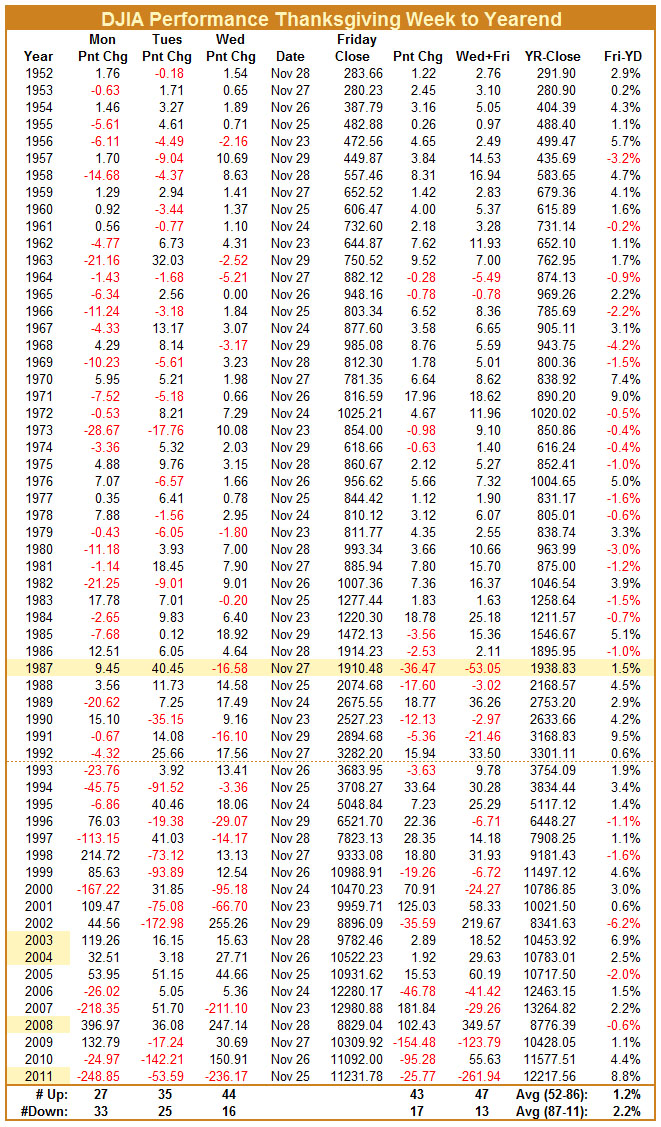

The following table is from Stock Trader’s Almanac and it shows the DIJA performance during the Thanksgiving Week.

According to them: The best short-term trade appears to go long into weakness this week or on Monday of Thanksgiving week and selling into any subsequent rally before the Friday of Thanksgiving week.

I find that it is good to know the seasonal pattern but we cannot absolutely always depend on past trends for a correct call. But yesterday I said that I am not going to short the market before November 23rd and this call from Stock Trader’s Almanac re-confirms my thought process.

That’s all for today. Hope you all are making money in this casino. With black Friday coming up, please remember to use the Amazon link if you plan to buy anything from Amazon. Thanks for sharing my thoughts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Plenty Of Fish In The Trading Sea

Published 11/13/2012, 05:24 PM

Updated 07/09/2023, 06:31 AM

Plenty Of Fish In The Trading Sea

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.