We welcome you to a new trading week.

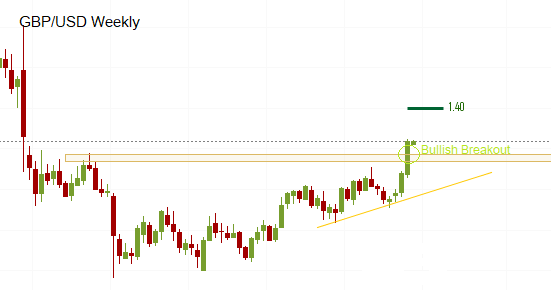

The best performing currency last week was the British pound which skyrocketed by more than 4 percent following the Bank of England’s hawkish shift, suggesting the possibility of a BoE rate hike in 2017. Now that GBP/USD broke significantly above 1.35, a movement that was seen as crucial bullish breakout, we expect further bullish momentum towards 1.3850 and 1.40. If the pound is unable to break above 1.3620 in the near-term, we may see some pullback following the sharp rise. Crucial supports are seen at 1.3450 and 1.34.

This week, there is plenty of scheduled event risk that will attract traders’ attention. The most important event risk is the FOMC rate decision on Wednesday. While the Federal Reserve is not expected to raise interest rates at this meeting, this gathering includes the Summary of Economic Projections (SEP) as well as Janet Yellen’s press conference. Market participants will scrutinize the Fed’s forecasts in order to shape expectations of a year-end rate hike. Moreover, the focus will be on the Fed’s plan to start reducing its balance sheet. The Federal Reserve is expected to be the first major central bank to start Quantitative Tightening and nobody knows how markets will respond. The market is still skeptical of the Fed’s ability to continue hiking rates while reducing its $4.5 trillion balance sheet. The U.S. dollar’s performance will thus depend on the Fed statement and the bank's future guidance.

Furthermore, leaders from the Bank of England and European Central Bank are scheduled to speak. BoE governor Carney will be speaking today at 15:00 UTC in Washington while U.K. Prime Minister Theresa May sets out the government’s position on Brexit in a speech on Friday. Towards the end the week, ECB President Mario Draghi is scheduled to speak in Frankfurt and Dublin.

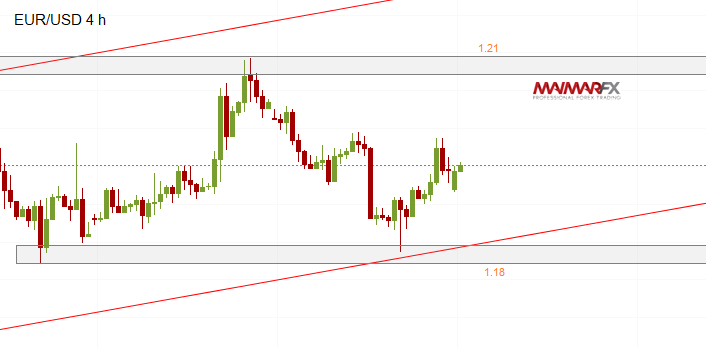

EUR/USD

Recently, we saw the euro trading more or less sideways between 1.21 and 1.18. We will focus on that price range in order to evaluate profitable trading chances.

Here are our daily signal alerts:

EUR/USD

Long at 1.1965 SL 25 TP 20, 40

Short at 1.1930 SL 25 TP 20, 40

GBP/USD

Long at 1.3605 SL 25 TP 30, 70

Short at 1.3540 SL 25 TP 20, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.