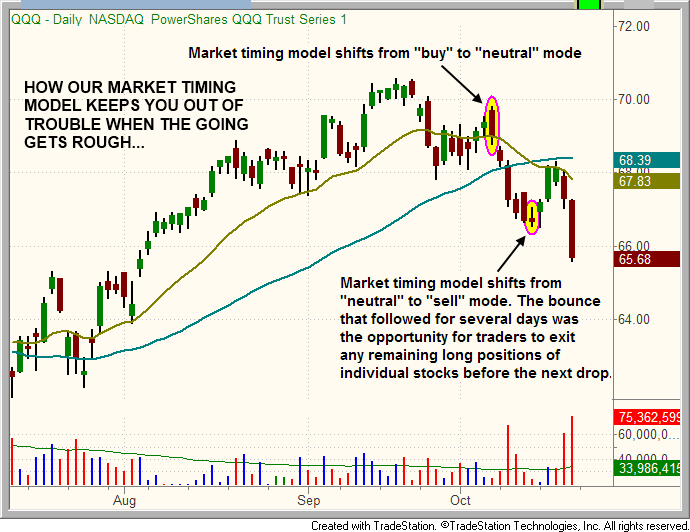

After the major indices began pulling back from their highs in late September, then subsequently bounced in the beginning of October, our disciplined, rule-based market timing system shifted from “confirmed buy” mode to “neutral” mode on October 5. This change in our market bias perfectly coincided with the peak of the bounce off the lows of late September.

In “neutral” mode, we can be positioned either long or short, but position size of all new trade entries will be lighter than usual, in order to reduce risk. Also, our portfolio will be primarily (or fully) in cash, with only a few positions in either direction. As we entered into neutral mode on October 5, we exited all long positions in individual stocks and began focusing primarily on swing trading ETFs with a low correlation to the direction of the overall stock market (ie. currency, commodity, fixed income, and international ETFs).

One week later, on October 12, the necessary signals were generated for a new “sell” signal. The recent changes in our sentiment, based on our market timing system, are shown on the daily chart of the PowerShares QQQ Trust ($QQQ) below. Notice how the model is designed to keep you out of trouble when the going gets rough:

As broad market conditions have been eroding over the past month, we certainly hope subscribers of this newsletter have been following the signals of our market timing system. Subscribers who have been doing so should be quite happy now, as they would have been out of all long positions of individual stocks just a few days before last Friday’s big decline, thereby avoiding substantial losses and the pain that is certainly being felt by traditional “buy and hold” investors right now.

While many subscribers to The Wagner Daily newsletter like to follow the exact entries and exits of our individual stock and ETF trade picks, there are also many traders and investors who subscribe merely for the benefit of knowing when to be in and out of the market, and how much exposure to assume, while trading their own trade picks and ideas. The accuracy of our market timing system alone is worth the price of the subscription many times over, especially when market conditions rapidly change, as has been the case over the past month.

Presently, we have three open ETF positions in our model ETF trading portfolio, each of which is showing an unrealized gain due to its low correlation to the direction of the broad market. US Natural Gas Fund (UNG) is presently showing a 4.2% gain since our October 9 entry, FirstTrust Natural Gas Index (FCG) is up 2.2% since entry, and our partial position of iShares Colombia Index (GXG) is now trading 2.6% above our entry price. Since these ETFs have exhibited solid relative strength as the market sold off sharply over the past week, we anticipate further gains in the days ahead and will soon be raising our protective stops to lock in gains along the way.

If we enter any individual stocks right now, the trades will be on the short side. But with ETFs, we have the choice of being short, buying an inversely correlated “short ETF,” or simply trading ETFs that are not correlated to the direction of the broad market. The latter is what we are doing right now. In addition to our three open positions, there are two new ETFs on our trading watchlist for potential entry in the coming days [(FXE)and (SIL) long]. The technical setups of both these potential trades were discussed in the October 19 issue of The Wagner Daily. Both of these ETF trade setups are low-risk ways to profit from weak market conditions for traders who are unable to sell short if they have a non-marginable cash account (such as an IRA).

In last Friday’s commentary, we said, “We can’t expect much from the S&P 500 if the Nasdaq is not on board. Over the past few weeks, two key Nasdaq leadership stocks, (GOOG) and (AAPL), have broken down below their 50-day moving averages. These leaders are being replaced this week by insurance and utility stocks….this is not the type of rotation that inspires confidence.”

Given that AAPL declined another 3.7% in last Friday’s session, further deterioration in leading Nasdaq stocks indeed played a big role in the day’s sharp decline. We continue to expect further pressure on the broad market as long as leading tech stocks remain weak. This week, all eyes will be on the quarterly earnings report of AAPL, which is due to trumpet its latest results on Thursday after the close.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Our ETF Trading Strategy With New 'Sell' Signal On Market Timing Model

Published 10/22/2012, 06:50 AM

Updated 07/09/2023, 06:31 AM

Our ETF Trading Strategy With New 'Sell' Signal On Market Timing Model

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.