The Fed's hubris has led it to the Dark Side.

It's not just a movie, it's real life: the Fed-Farce awakens. Now that the Federal Reserve has finally voted to "restore order to the galaxy" with a tiny .25% rate increase, the true measure of our travesty of a mockery of a sham economy--in a phrase, The Fed-Farce--has been revealed.

Here's a snapshot of the Fed meeting, "restoring order to the galaxy" in a show of unanimous galactic-scale hubris:

If we had to list the fatal wounds inflicted on the economy by the Fed-Farce's financial repression, we might start with: the Fed's flood of cheap credit has not boosted productivity, it’s only boosted speculation. Why is this fatal?

Productivity is the engine of wealth creation. Speculation is the engine of wealth inequality and devastating boom/bust cycles. This is self-evident, but unfortunately the Dark Side can also conjure mind-tricks in the weak-minded (for example, Congress, the mainstream media, etc.): the Fed has successfully conned the weak-minded into believing that speculative frenzies of mal-investment and Fed-fueled asset bubbles are the sources of healthy growth.

A funny thing happens when you give unlimited borrowing power at near-zero interest rates to financiers and corporations: they use the free money not to hire more people (that would be incredibly dumb--employees cost money!) but to buy up shares in their own companies and snap up income-producing assets such as rental apartment complexes.

$1 trillion in stock buybacks creates zero jobs. Borrowing $1 trillion to buy back shares (and thus boost the personal wealth of managers and owners) does not create a single job. Repurchasing the company's stock reduces the number of shares outstanding, which increases your earnings per share without increasing sales or net profits.

In other words, stock buybacks are just another Dark Side mind-trick.

Buying 1,000 units of rental housing and raising the rents 10 seconds after the sale closes also doesn't create a single permanent job. The sale generated a commission, but this is a one-off. It doesn't take even one more person to maintain the buildings after the sale or the rent increase.

As for the rent increase--it's just cheap digital processing and the cost of postage.

The supposed connection between cheap Fed credit and job creation is illusory--it's nothing but a Dark Side mind-trick played on the credulous and weak-minded.

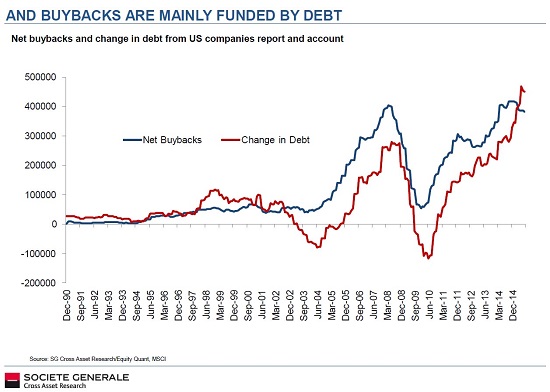

Courtesy of Zero Hedge and Societe Generale (PA:SOGN), here is a chart of U.S. corporate debt and stock buybacks.

Notice anything that looks like a speculative frenzy that subsequently triggers a collapse?

By slashing rates to zero, the Fed ruthlessly eliminating safe returns for savers, pension funds, insurers and the millions of people with 401K retirement nesteggs. In effect, the Fed-Farce has pushed everyone into risk assets--and then played another Dark Side mind-trick by masking the true dangers of these risky assets.

As oil-sector debt blows up, as junk bonds blow up, and emerging markets blow up, we are finally starting to see the real costs of going over to the Dark Side of endless credit expansion and throwing the gasoline of near-zero interest rates on the speculative fires of financialization.

The Fed's hubris has led it to the Dark Side, and now its Death Star of impaired debt, phantom collateral, speculative frenzy and bogus mind-tricks is about to blow up.