Cruise ship operator Norwegian Cruise Line (NYSE:NCLH) stock has been steadily climbing since its pandemic lows were hit in 2020. The Company plans to have 75% of its fleet operating by January 2022 and expects that to rise to 100% by April 2022. The Company is seeing the result of the pent-up demand showing tangible bookings with the acceleration of COVID vaccinations.

The cruise line is in a battle with Florida over its all passengers including children must be vaccinated policy. The CEO of Norwegian feels it provides the Company with a competitive advantage by having a zero-tolerance vaccination policy for all passengers and crew including young children. Despite missing out on a few bookings, as a result, the unprecedented pent-up demand has bookings looking to exceed 2019 levels in 2022. Patient investors seeking exposure another key play in the epicenter recovery can look for an opportunistic pullback in shares of Norwegian Cruise Lines.

Q2 2021 Earnings Release

On Aug. 6, 2021, Norwegian released its second-quarter earnings for the quarter ending June 2021. The Company reported an EPS loss of (-$1.93), beating consensus analyst estimates for a loss of (-$2.00 by (-$0.07). Revenues fell (-74%) year-over-year (YoY) to $4.4 million versus consensus analyst estimates for $9.14 million. Norwegian CEO Frank Del Rio commented:

“As we recommence operations, we are putting health and safety at the forefront with our robust, science-backed SailSAFETM health and safety program, including our 100% vaccination policy which applies across all voyages on our three brands. We are ready and eager to welcome guests back on board and continue to see incredible strength in our booking trends for future cruises. Our team is working tirelessly to execute our plan to return our full fleet to operation by April 2022 to capitalize on this unparalleled pent-up demand.”

Booking and Demand

The 2022 booking and pricing trends continue to be very position based on pent-up demand and expect 2022 cumulative book position to be ahead of 2019 pre-pandemic levels. Advance ticket sales grew to $1.4 billion including $800 million in of FCCs as of June 30, 2021.

Conference Call Takeaways

CEO Del Rio set the tone:

“Against a still ever-changing COVID backdrop, we remain vigilant and ready to adapt as needed, keeping a close watch on port availability, travel restrictions, and any changes to the global public health environment, which could affect our planned operations. Overall, we are encouraged to see some relaxation of travel restrictions and opening of borders in recent weeks, particularly for vaccinated travelers. Just a few weeks ago, Canada moved up its plans to allow the return of cruise ships in November, 4 months earlier than previously announced. Many countries in the EU are now allowing travelers from the U.S. And in the past few weeks, both Canada and the U.K. announced entry to vaccinated travelers without quarantine. Travel restrictions and port closures do remain in place in other parts of the world, but we are ready to execute on our cruise assumption strategy and have backup plans ready to go, which we can implement and adapt to as needed.”

Florida Preliminary Injunction

CEO Del Rio talked about the situation with Florida courts in the guest vaccine mandate:

“I'd like to address our request for a preliminary injunction that we filed last month, which will allow us to confirm guest vaccination status for sailings departing from the State of Florida that has been heard in a Miami Federal Court today. Combating this virus is an unprecedented historic challenge. That requires everyone, including governments at the local, state, and federal levels plus private enterprise and society at large, to do their part. I have tremendous empathy for our elected officials, business leaders, friends and families, neighbors who are all doing the best they can under enormously difficult circumstances to beat back this virus.”

On Oct 5, CEO Del Rio stated that of the eight Norwegian ships sailing, all passengers are required to be vaccinated and unvaccinated children are not allowed on the ship. The Company’s all passenger vaccination policy has put it in conflict with Florida. CEO Del Rio commented:

“If anything, the world is opening up, more people are getting vaccinated. Pent-up demand continues to be very, very strong for the sailings we’ve operated thus far.”

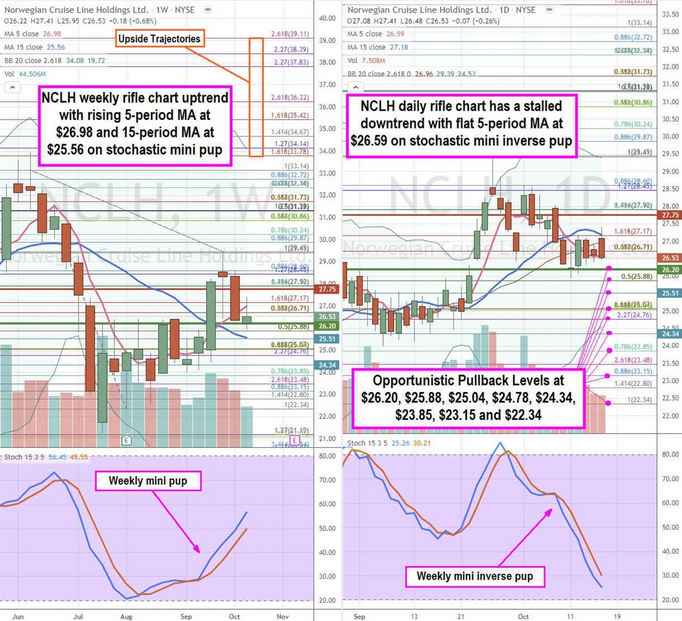

NCLH Opportunistic Pullback Price Levels

Using the rifle charts on the weekly and daily time frames provides a near-term view of the landscape for NCLH stock. The weekly rifle chart uptrend peaked at the $29.45 Fibonacci (fib) level. The weekly 5-period moving average (MA) is rising at $26.98 with 15-period MA at $25.56. The weekly stochastic has a mini pup with upper weekly Bollinger Bands (BBs) at the $34.14 fib. The weekly market structure low (MSL) buy triggered above $26.20. The daily rifle chart downtrend has stalled with a flat 5-period MA at $26.59 on the stochastic mini inverse pup oscillation down towards the 20-band. The daily 15-period MA is sloping down near the $27.17 fib. Prudent investors can watch for opportunistic pullbacks levels at the $26.20 fib, $25.88 fib, $25.04 fib, $24.78 fib, $24.34 fib, $23.85 fib, $23.15 fib, and the $22.34 fib. The upside trajectories range from the $33.78 fib upwards to the $39.11 fib level.