Since Wednesday, global equity and commodity markets have felt the impact of a sudden tilt in global politics as Russian President Mr. Putin ordered the mobilization of reserves to fight in Ukraine and made a thinly veiled threat to use nuclear weapons. NATO labeled that a "reckless" act of desperation in the face of a looming Russian defeat.

This sudden change in geopolitics could worsen the inflationary pressure worldwide. Thus, the market could act irrationally, ignoring the fundamental realities while deciding the price of oil and natural gas.

On the other hand, Federal Reserve raised rates by 0.75% and signaled that there was more room for rate hikes after forecasting rates to reach about 4.4% by year-end, which is well above the 3.8% projected previously.

The Fed also projected that a recession might be avoided despite rate hikes to bring inflation under control. Meanwhile, Russia's moves in the energy market would continue to influence western countries even if it does not use a nuclear weapon.

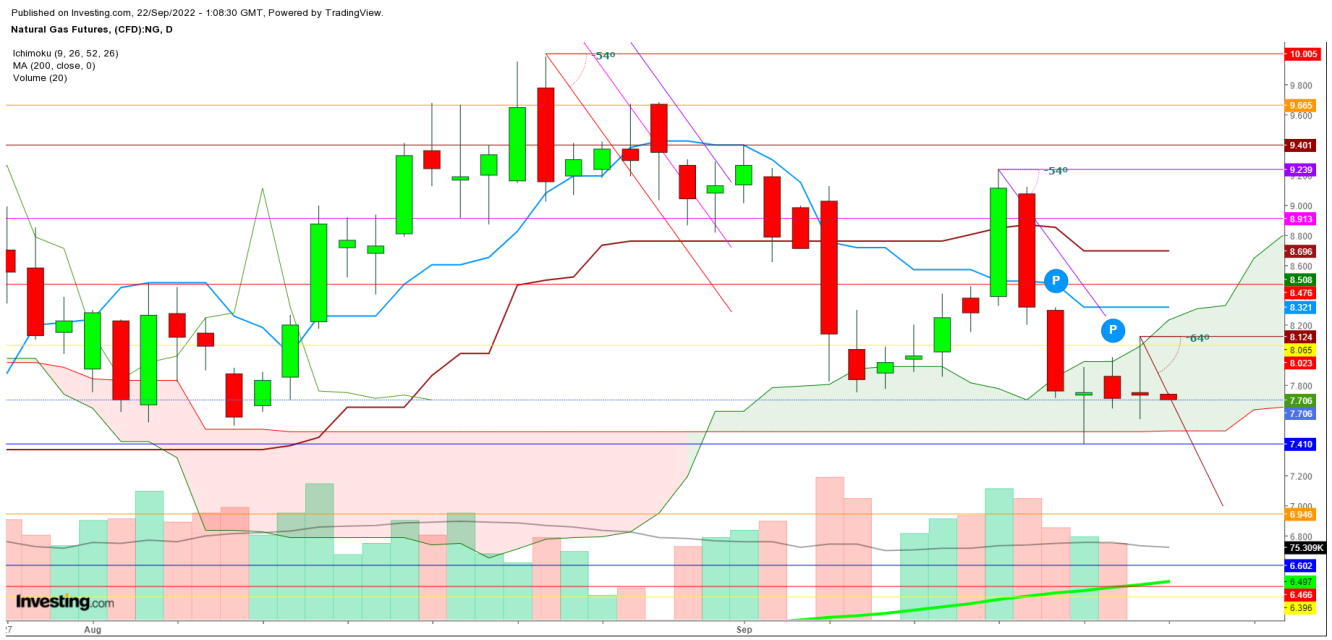

In a daily chart, natural gas looks to make a decisive move after the inventory announcement on Thursday as the stock build-up could be more than the expected levels this time could drag down the price up to lower levels.

If natural gas breaks below $7.4, the next target could be $6.4 before this weekly closing, as the current situation will defy the demand and supply equation, and a large build could keep the bears aggressive during the last two days of this week.

On the upper side, only a sustainable move above the immediate resistance at $8.321 could provide relief to the natural gas bulls as the formation of a ‘Bearish Crossover’ in a daily chart is still intact that may continue to encourage the bears to sell every rally above 8.913.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil futures. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.