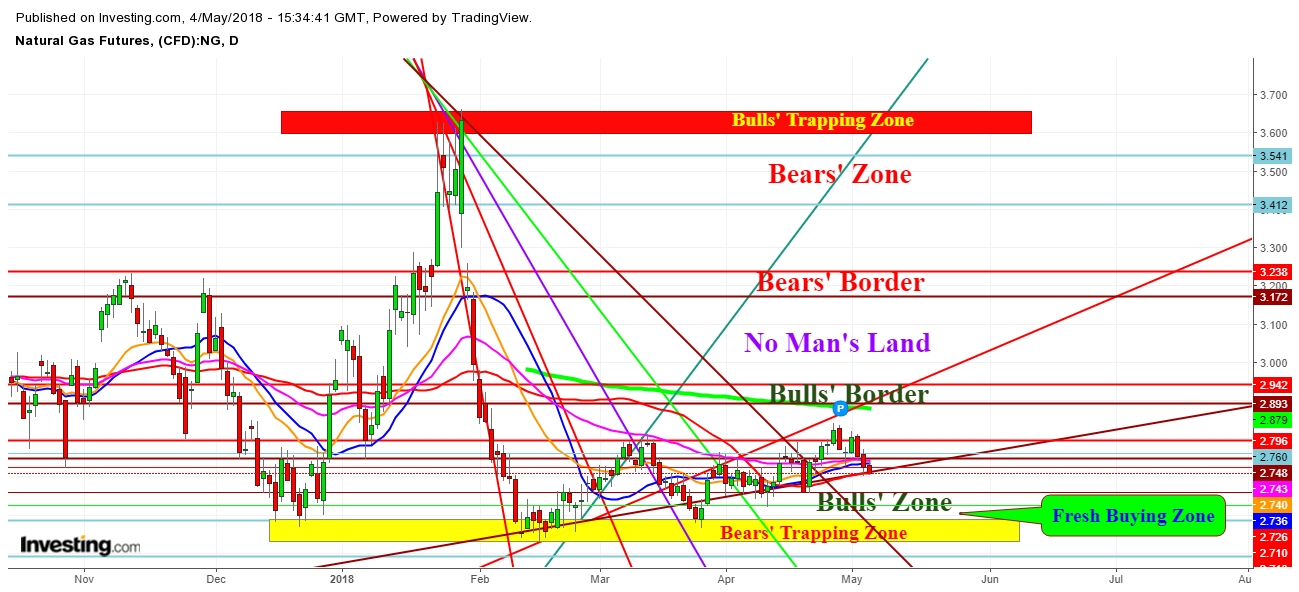

Since my last analysis of natural gas, I find that natural gas futures seems to reflect liquidation pressure due to changes in weekly withdrawals to weekly injections. No doubt that the cold weather continued to retreat during this week but at the same time, warmer conditions began to impact energy demand.

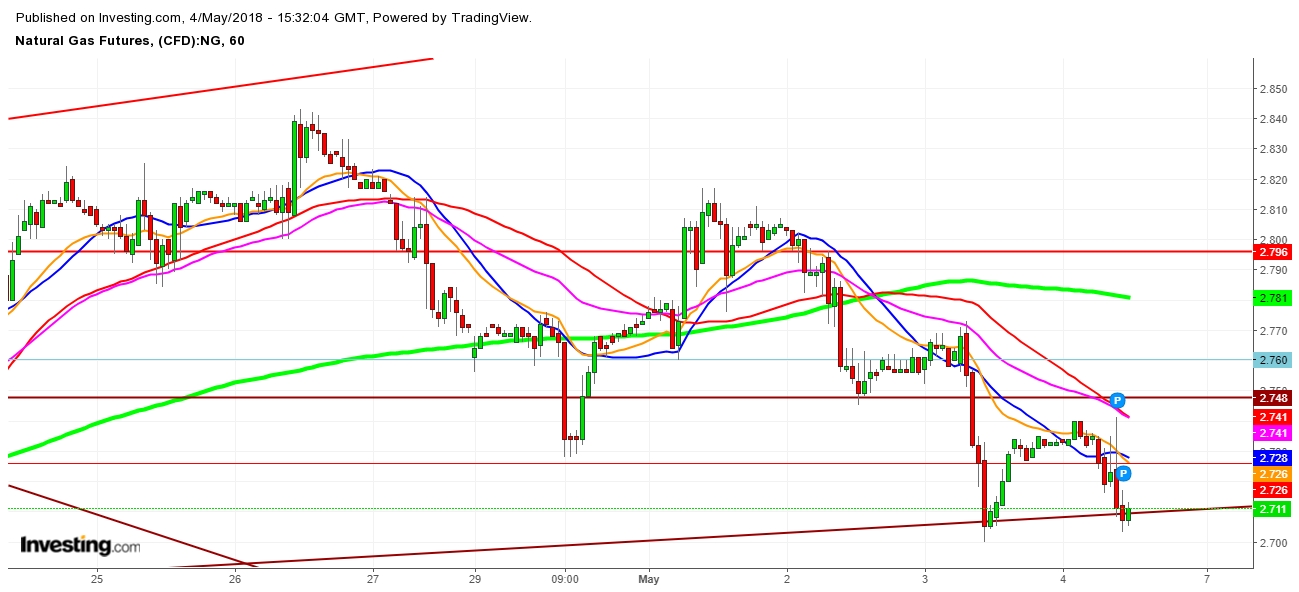

As I noted, that above $2.717 will provide strong supports. No doubt that natural gas inventories created a gap down but the sustainable move since then has not only filled that gap but also enhances the possibilities of a swinging move from current levels as the natural gas seeks support at current levels. Natural Gas futures may find a clearer indication from next week's opening levels. A weekly close above $2.748 will result in a gap-up opening on the first trading session of the upcoming week.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.