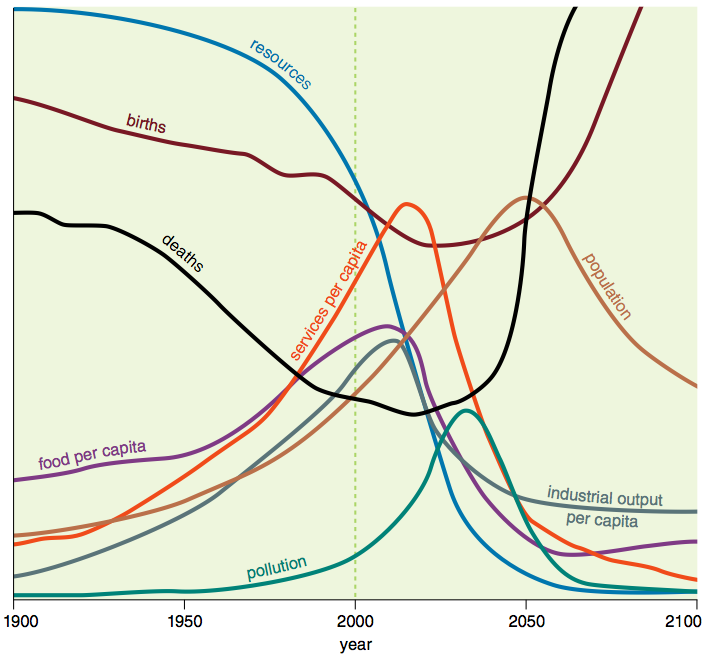

In a recent post, I talked about why we may be reaching Limits to Growth of the type foretold in the 1972 book 'Limits to Growth.' I would like to explain some additional reasons now. Figure 1. Base scenario from 1972 Limits to Growth, printed using today's graphics by Charles Hall and John Day in "Revisiting Limits to Growth After Peak Oil"

Figure 1. Base scenario from 1972 Limits to Growth, printed using today's graphics by Charles Hall and John Day in "Revisiting Limits to Growth After Peak Oil"

In my earlier post, I talked about how rising oil prices are associated with rising food prices, and how these high prices can make it harder for borrowers to repay their loans, as is now happening in Europe. These same problems can lead to a contraction of credit availability.

A contraction in credit availability can be doubly problematic: it can lead to a cutback in demand because buyers cannot afford goods using oil, such as new cars, and it can lead to a drop in financing for industrial uses, including expanded oil drilling. All of these issues may lead to contraction of the type expected in Limits to Growth. US governmental debt limit problems and European debt defaults are also outcomes of the type expected with rising oil prices.

In this post, I would like to discuss some other basic issues that seem to be associated with Limits to Growth, and that may eventually lead to an abrupt downturn or collapse.

Limits to Growth: More Basic Issues

1. The over-use of resources by humans seems to be of very-long standing origin, dating to the time-period 100,000 BC when there were fewer than 100,000 people on earth. Capitalism today is an extension of this long-term pattern.

2. World systems often seem to work as a gradual build-up of forces followed by a cataclysmic release. Examples include earthquakes and hurricanes. Even getting hungry, and then eating, follows this pattern. A similar pattern may happen with the Limits to Growth that we seem to be reaching.

3. The extent to which humans can gather resources for their own use depends on their geographical reach. As hunter-gatherers, our reach was quite limited. This reach has gradually grown through inventions such as ships, through the settling of new lands and colonialism, and most recently through international globalization. Globalization is necessarily the end of this growth.

4. Globalization sows the seeds of its own demise because factory workers are effectively forced to compete for wages with workers from around the world. Workers in the Global South can get along with lower wages for a number of reasons, including the fact that they tend to live in warmer areas, so do not need to build as sturdy homes and have less need to heat them. With fewer jobs and less investment in the Global North, demand falls and debt defaults become more of a problem.

5. In the normal scheme of things, world systems would rest and regroup once resources reach some sort of crisis point, defined by Liebig’s Law of the Minimum. Soils would build up again; aquifers would refresh; climate would reach a new equilibrium; and a different group of plants and animals would become dominant. Oil and gas supplies might even be rebuilt, over millions of years. It is not clear that humans will be part of the new world order, however.

Long-Term Overuse of Resources

Over the past 100,000 years, man’s record of sustainably using natural resources has been poor. Humans differ from other primates because of their relatively larger brain size, but humans have not used this intelligence to preserve the environment. Colin McEvedy and Richard Jones in Atlas of World Population History report that the final increase in Homo sapiens’ brain size to the current average of 1450 cc took place about 100,000 years ago.

There have been five periods in the history of the world in which large numbers of species have died off. These are sometimes called “mass extinctions“. (See my post European Debt Crisis and Sustainability.) According to Niles Eldridge, the Sixth Extinction is occurring now:

* Phase One began when the first modern humans began to disperse to different parts of the world about 100,000 years ago.

* Phase Two began about 10,000 years ago when humans turned to agriculture.

According to Eldridge, humans have been like bulls in a China shop. They disrupted ecosystems by overhunting game species and perhaps also by spreading disease organisms. Regarding the development of agriculture, he says:

Homo sapiens became the first species to stop living inside local ecosystems. . . . Indeed, to develop agriculture is essentially to declare war on ecosystems – converting land to produce one or two food crops, with all other native plant species all now classified as unwanted “weeds” — and all but a few domesticated species of animals now considered as pests.

The development of fossil fuels ramped up the attack on natural systems further. Fossil fuel could be used for irrigation, and to produce herbicides, pesticides, and fertilizer, allowing farmers to choose the crops they preferred to grow. Fossil fuels also enabled large fishing boats to deplete the oceans of large fish.

Capitalism furthered this attack on the natural order by giving those who extracted resources from the earth profits based on this extraction. While governments may have taxed these profits, these taxes, too, were used for developing infrastructure so that man could continue his attack on the natural order, and this extraction of resources would become more efficient.

The final tool man found in his attach on natural ecosystems was debt based financing. While debt had been used for many years, it took on a new role when economists started realizing that greater debt could be used to increase demand for goods. This happens because debt financing gives people money to spend in advance of when it is earned (for example, a car loan allows a person to buy a car that he could not otherwise afford).

Because debt allows people to buy thing that they would not otherwise be able to afford, it has a tendency to raise commodity prices. These higher commodity prices make it economic to extract more marginal resources, such as oil in difficult locations.

Natural systems often operate through a build up of forces, followed by a cataclysmic release

There are no doubt some natural forces operate at a pretty steady level indefinitely–gravity, for example. But many of the processes we experience are “batch processes”. We remain awake during the day; by evening we become tired, and fall asleep until the next morning. We eat, digest the food, and become hungry again. Movement of earth’s plates gradually builds up forces which are released by an earthquake. When force is released, the change can be quick and dramatic.

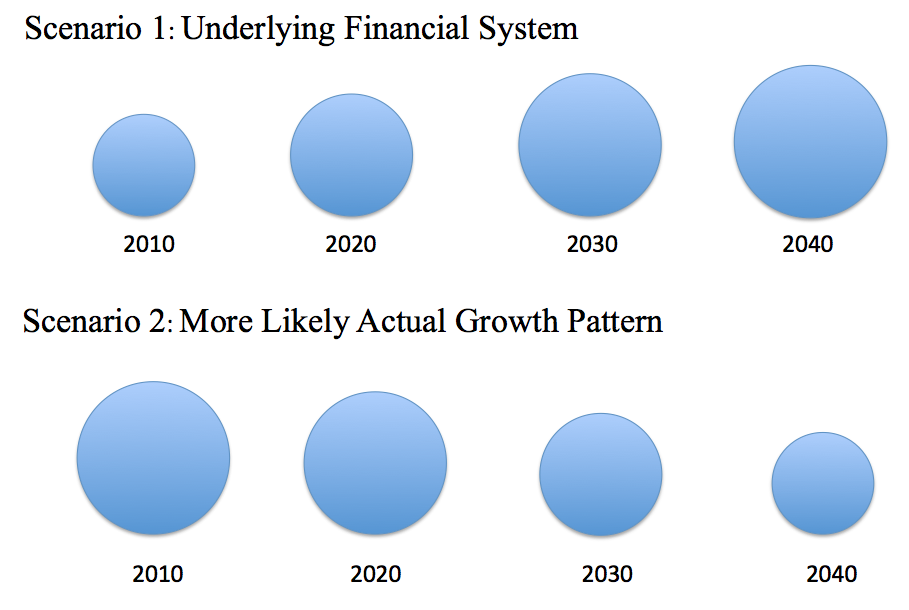

Right now, one stress is that of limited oil supply. This is leading to rising oil prices and stress on economies of oil importing countries. Figure 2. Two views of future growth

Figure 2. Two views of future growth

The problem is that when limited oil supply is rationed by high oil prices, economic growth slows down, and eventually decreases (Figure 2). When this happens, it becomes much less advantageous to borrow from the future, because the future is no longer better than today. If an economic contraction occurs for very long, the whole debt system can be expected to undergo a major “unwind”.

Logic says the result would be fairly cataclysmic. We recently started seeing the beginning of this unwind with the financial crisis of 2008-2009. We are seeing more of the potential unwind with the problems in Greece and the rest of Europe, and with the US government reaching limits on borrowed debt. Exactly how this will play out is uncertain, but debt defaults in Europe could spread to banks worldwide, in one scenario.

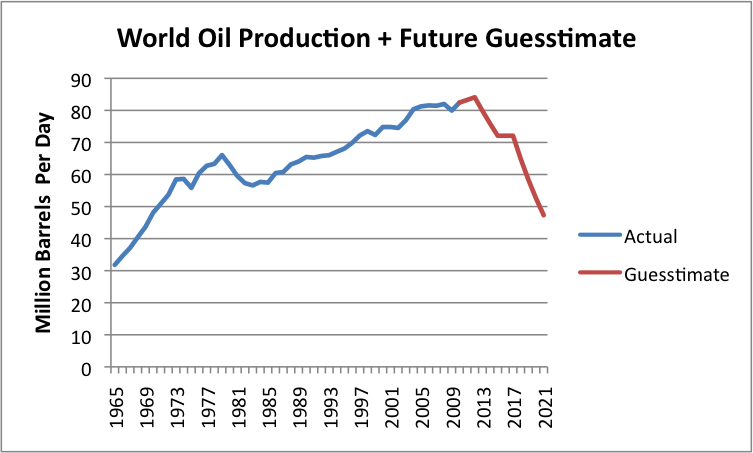

With much less credit available, demand for extracted energy products would fall, because with less debt, people can afford to purchase fewer products that use energy, such as new cars. Prices of oil and oil substitutes will fall, making oil extraction unprofitable in locations where extraction costs are high. The result is not likely to be a slow decline, of the type attributed to M. King Hubbert. Instead, a much more precipitous decline can be expected (Figure 3). Figure 3. Historical crude, condensate, and NGL production based on BP and EIA data, plus a Guesstimate of Future Oil Supply.

Figure 3. Historical crude, condensate, and NGL production based on BP and EIA data, plus a Guesstimate of Future Oil Supply.

Human Geographical Reach

The amount of food and other goods we have access to and the steadiness of supply depend very much on our geographical reach. In the earliest days, humans were nomadic, so that they could gather food from a wide area. It was not until about 10,000 years ago that humans began to settle down with agricultural existence. When a change to local agriculture took place, this change led to shorter stature and earlier deaths. Part of this was due to poorer nutrition from a less varied diet; part of this was due to an increase in the incidence of infectious diseases, because of closer proximity to other humans and domesticated animals.

Now, with globalization, we have reached the logical maximum in our geographical reach. Those who are rich enough can buy foods from around the world. We also have access to computers and other high-tech devices that can only be made with inputs from around the world. Most people’s expectation is that somehow we will keep up this wide reach, even if our world financial system fails due to debt defaults, but we have no guarantee that this really will be possible.

If we start re-localizing, we will likely run into problems that people have had since the dawn of agriculture. It is hard to grow a wide range of crops in one area. Weather conditions are often bad in one year, necessitating either multiple-year storage of crops, or trade with other areas. If we cannot maintain our use of antibiotics and of water and sewer treatment, deaths from infections may soar.

Globalization Sows the Seeds of Its Own Demise

From the point of view of profit-making businesses, globalization is wonderful. Workers can be found in “less developed” areas of the world who will work for lower wages. As a result, wages of workers in the Global North are put in direct competition with wages for workers in the Global South. Wages in the Global South can be lower for several reasons:

* Workers may expect to work more hours per week to earn the funds needed to support themselves and their families.

* Payments to workers do not need to include as much for healthcare benefits, or as much for retirement payments to the elderly, because of the younger workforce, and differences in the healthcare systems.

* Energy costs of workers are likely to be lower because of greater use of coal, smaller homes, less needed for heating in warm climates, and use of bicycles instead of cars.

But there are adverse effects of sending manufacturing oversees:

* The unemployed need to taken care of by government programs, even if they don’t have jobs.

* Demand for goods produced may fall. Neither the low-wage workers producing the goods in the Global South nor the workers without jobs in the Global North are likely to be able to afford the products that are being produced.

* Economic growth is likely to decline in countries of the Global North that outsource manufacturing and other processes.

* Debt is likely to become more of a problem in countries of the Global North, because of low economic growth or actual contraction. Laid-off workers are likely to find themselves less able to repay their loans. Governments are likely to find themselves in difficulty because of low tax revenues, high benefits to laid-off workers, and high debt levels.

Thus, globalization sows the seed of its own demise.

Regrouping is Likely to be Needed

At some point, the system can be expected to fail, and regrouping will be needed. The path to failure seems to be through debt defaults, leading to falling demand for the products that capitalism provides.

Once this decline starts, it is hard to see a natural “stopping point” for the decline. On the “way up,” businesses, governments, traditions, and even religious beliefs are built that reinforce the processes in that are in place. For example, if a certain amount of oil, gas, and coal is being extracted from the ground, businesses will be formed that use these fossil fuels, and traditions will be started (for example, expensive healthcare for many, and college education for most) that will use these fossil fuels. Economics becomes the new religion, touting the benefits of more consumption.

If the decline is to stop, we need a whole different set of businesses and traditions to support a much lower level consumption of fossil fuels and other inputs. It is not at all clear that we can adapt quickly enough for a change of this type.

When we look back a few thousand years, societies had a surprisingly rich tapestry of businesses and traditions to support them. For example, David Graber, in Debt: The First 5,000 Years talks about the ancient (2700 BC) Mesopotamian city-states being dominated by vast temples where trading was done. It wasn’t until about a century later that Abraham left “Ur of the Chaldeans” (Genesis 11:31), a major port at that time.

Part of our problem in going back is that we can’t even imagine what web of businesses and traditions would be needed to support a lower fuel use than we have now. We can build a garden in our backyard, and we can print some “local currency” for local citizens to trade, but these types of activities do not really fill the major void that would be left if our current approach to civilization fails.

Sustainability: What Would Work

If we think about it, it is pretty obvious how humans could fit into the natural world better. We could behave like other animals. We could stop wearing clothes. We could stop living in houses. We could eat food in its raw form. This food would be only that which we can pick or catch with our bare hands. We could co-evolve with our fellow creatures. If a virus or bacteria comes along and kills off a significant share of mankind, or if a woman dies in child-birth, we could simply accept that as the natural order of things.

I don’t think any of us would accept such a solution, though. It is just too harsh an outcome. Such a solution would not work except in very warm climates, and even there, we would need fire to cook meals and tools for killing animals. Under one theory, cooking of food is necessary for our current level of intelligence, so we could not give that up.

We can’t know how our current predicament will turn out. Logic says that the natural system needs to rest and regroup after Limits to Growth are reached, in one way or another. Perhaps there is a “happily ever after” solution that will include a large number of humans. Unfortunately, it is hard to see what that solution might be.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

More Reasons Why We are Reaching Limits to Growth

Published 01/25/2012, 10:07 AM

Updated 07/09/2023, 06:31 AM

More Reasons Why We are Reaching Limits to Growth

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.