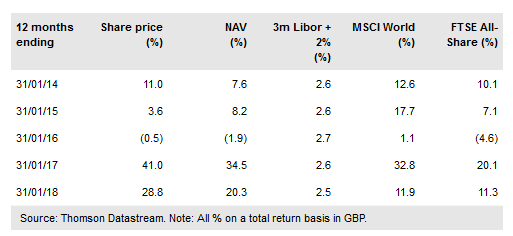

Miton Global Oppurtunities PLC (LON:MIGO) seeks to achieve capital growth, primarily through exploiting the pricing inefficiencies of investment trusts. The manager, Nick Greenwood, has over two decades of experience in identifying funds trading at deep discounts to embedded value. The unconstrained mandate also focuses on portfolio diversification across a broad range of asset classes and countries. Share price performance over the past two years has been strong in absolute terms and relative to global indices. Added to successful board initiatives to improve liquidity and promote the trust, MIGO has attracted significant interest from investors, and its shareholder base has rebalanced towards self-directed retail investors. The shares currently trade at a 1.4% discount to NAV, a significant narrowing from the five-year average discount of 7.9%. The board is currently seeking shareholder approval for a further issue of up to 10% of share capital.

Investment strategy: Deep discounts, diversified

MIGO focuses on smaller-sized funds, where mispricing of underlying assets is more prevalent. Greenwood undertakes detailed due diligence of valuation and management to gain conviction in the underlying value of a fund, and identify catalysts for the discount to narrow. He also seeks broad diversification across asset classes and countries, as a result of which MIGO has low correlations to the FTSE 100 and MSCI World indices.

To read the entire report Please click on the pdf File Below: