In a significant turnaround for its aviation sector, Mexico’s air safety rating was upgraded from Category 2 back to Category 1 by the Federal Aviation Administration (FAA), the agency announced last week.

The reinstatement comes after a costly two-year downgrade that restricted Mexico’s airline growth and led to losses exceeding $1 billion for the industry.

For investors watching the aviation space, this upgrade could be a game-changer, offering opportunities for both Mexican airlines and their US joint venture partners. I believe the recent rise in oil prices, which has put pressure on airline stocks, has also created an attractive buying opportunity.

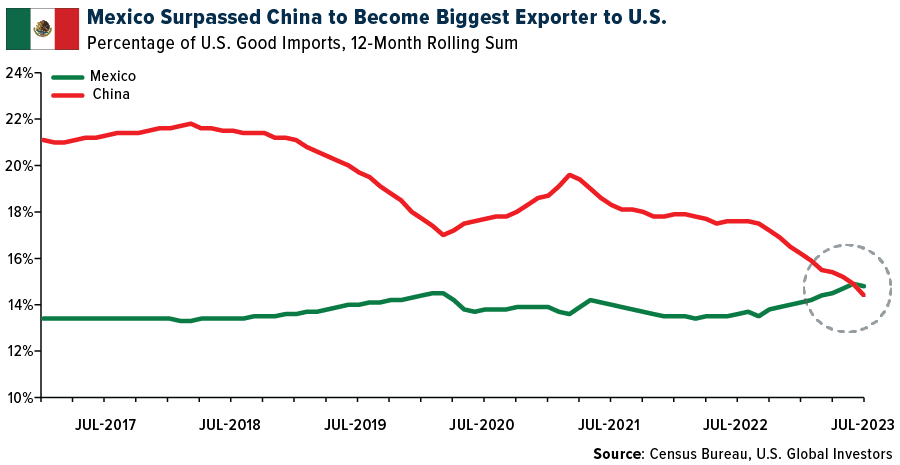

The upgrade to Category 1 is a watershed moment for the Mexican airline industry. This status allows Mexican carriers to add new routes to the US, a significant benefit given the Central American country’s status as the leading exporter to the US, displacing China.

Beyond opening up new routes, the upgrade is a green light for American Airlines (NASDAQ:AAL) to engage in joint ventures with Mexican carriers. Volaris, which had been constrained by the Category 2 rating, can now expand its US network, a development that should also make it more attractive to investors.

Delta Air Lines Inc (NYSE:DAL), with its joint venture with Mexican flagship carrier Aeroméxico, is another beneficiary, especially as Aeroméxico plans to go public in the US after delisting from the Mexican stock exchange late last year. Ultra-low-cost carrier (ULCC) Allegiant Air also stands to gain, thanks to its proposed partnership with Viva Aerobus, currently being reviewed by the Department of Transportation (DOT).

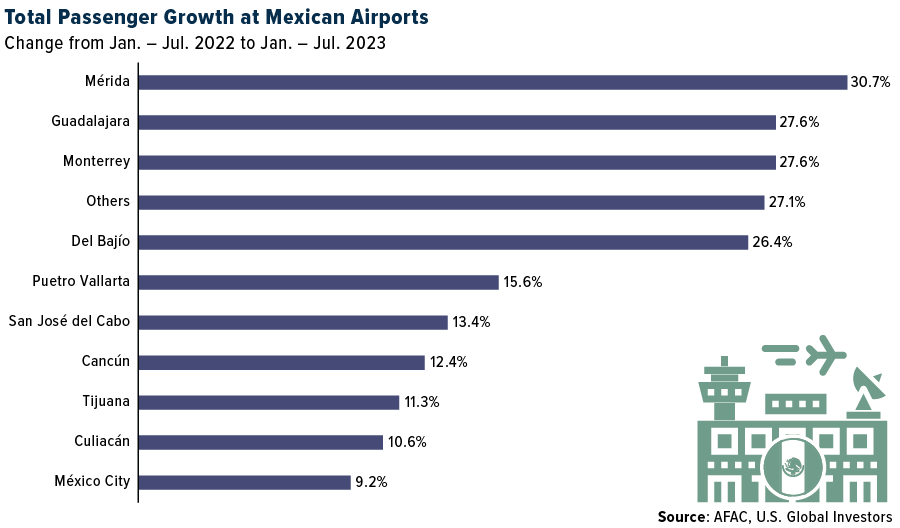

Despite an array of challenges ranging from safety issues to infrastructural vulnerabilities, Mexico's top three airlines—Aeroméxico, Viva Aerobus, and Volaris—registered a collective 16.5% increase in passenger numbers in the first half of 2023 compared to the same period last year.

This growth isn't that surprising, considering that air travel is increasingly replacing long-distance bus, car, and train journeys in Mexico, the number one overseas destination for Americans. Each airline has found its niche—Volaris caters to leisure routes, Aeroméxico targets business travelers and Viva focuses on converting bus passengers to airline customers.

Investment Opportunities in the Airline Sector

Investors have several compelling reasons to look closely at Mexican airlines. First, the reinstatement to Category 1 status makes these stocks an attractive proposition for market growth and increased revenue.

Even before the status upgrade, Aeroméxico was experiencing strong demand in European markets, capitalizing on its unique position as Mexico's only long-haul operator. According to data from the Centre for Aviation (CAPA) and the Official Airline Guide (OAG), 65% of the airline's available seat kilometers (ASKs) are from international operations.

Speaking of Europe, passenger volumes at airports were 97% of pre-pandemic levels in July, according to the latest report by Airports Council International (ACI). London Heathrow was the month’s busiest airport, serving over 7.7 million passengers, followed by Istanbul Airport (7.4 million passengers) and Paris Charles de Gaulle Airport (6.6 million).

For those considering diversified options, American partners of Mexican carriers also present investment opportunities. With global air traffic nearly returning to pre-pandemic levels and Latin American airlines experiencing a more than 25% increase in traffic between July 2022 and July 2023, the industry looks set for an upswing.

The Double-Edged Sword of Rising Oil Prices

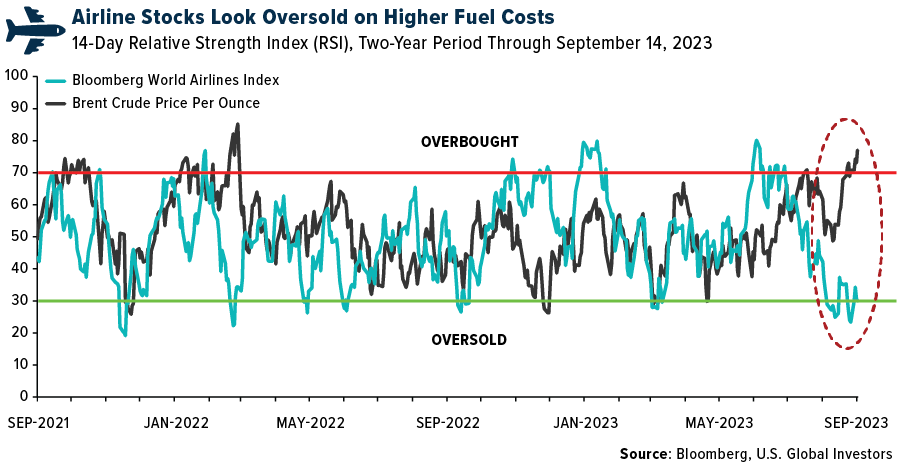

I would be remiss if I didn’t address rising oil prices in the context of airline stocks. Brent oil has climbed to over $94 per barrel for the first time since November 2022, with the rise attributed to supply cuts and rebounding demand.

In the past, the immediate market reaction to rising oil prices has included a selloff of aviation names. This could lead to overselling, providing an opportunity for investors to buy shares at a lower cost with the expectation that they will rebound—just as they did during the pandemic.

Indeed, global airline stocks look oversold right now, with the Bloomberg World Airlines Index below 30 on the 14-day relative strength index (RSI), compared to oil prices, which are safely in overbought territory. Now could be an attractive entry point for airlines as we await mean reversion to take place.

However, both the Organization of Petroleum Exporting Countries (OPEC), which turned 63 years old last week, and the International Energy Agency (IEA) predict continued supply shortages. Starting this month, “the loss of OPEC+ production, led by Saudi Arabia, will drive a significant supply shortfall through the fourth quarter,” the IEA writes, adding that a rollback to the cuts at the beginning of next year “would shift the balance to a surplus,” which would be good news for airlines.

Discover the top-performing airline stocks in 2023 so far!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate for every investor. By clicking the link(s) above, you will be directed to a third-party website(s). US Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Bloomberg World Airlines Index is a capitalization-weighted index of the leading airline stocks in the World. The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. Mean reversion is a financial term for the assumption that an asset’s price will tend to converge to the average price over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by US Global Investors as of (06/30/2023): Allegiant Travel Co., Delta Air Lines Inc.