Yesterday marked an important day, the day the Dow Jones Industrial Average broke the 13,000 mark since the outset of the Great Recession. The Nasdaq 100 was also close to the 3000 mark, so the bulls have every reason to celebrate for just a few minutes. The bulls can celebrate for only a few minutes however, because it is unclear if and how long the bulls can keep their charge and sustain us above these awesome levels.

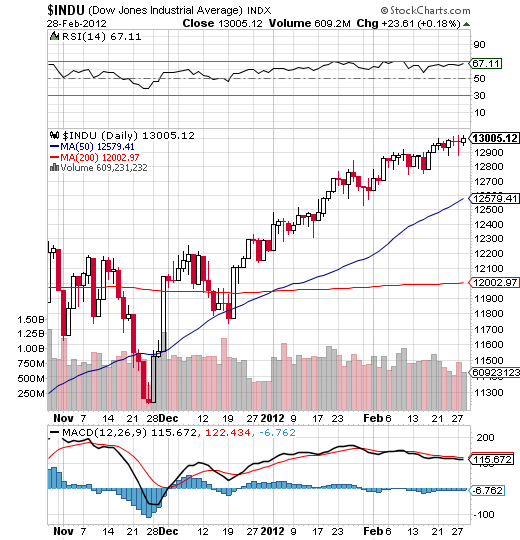

By looking at the chart below of the DJIA, a few things are clear from the outset. We have been in a steady incline since the beginning of the New Year, as especially indicated by the “Golden Cross” formed by the 50 day moving average (blue line) crossing over the 200 day moving average (red line). Two factors, however, suggest that the market still faces significant resistance: the MACD and RSI indicators.

To start with the MACD indicator: as one can see, the MACD (blue bars) have been near zero in the negative direction for the last 10 days. Currently the MACD reads -6.762, which means that it is only 6 points off from hitting zero and tipping positive. MACD is a great indicator for overall market momentum, and as as of right now it looks like the momemtum is the same it has been for the last few days: flat. With no real spike in momentum in an upward or downwards direction, it is hard to say if or for how long the bulls will stay in control and keep DJIA above the 13,000 mark.

The same holds true for RSI, or Relative Strength Indicator. Right now the DJIA’s RSI closed at 67.11, less than three points away from the “70″ mark, or the “overbought mark.” As soon as the RSI reaches and passes the 70 mark, the DJIA is formally “overbought” and a sell off might be eminent.

So, with a negative to near zero MACD and a near 70 RSI, I would suggest that the DJIA still faces severe headwinds and the bulls will have to mount a serious offensive to gain full control of markets and push above annd beyond the 13,000 level for a longer period of time. Since our growth this week and last week has consisted of flat, sideways, piecemeal movements of less than .2% per day on average (.18% for today), it is hard to imagine the bulls making a significant offensive move, although it could happen. Keep in mind however that the last ten days or so are also evidence enough that markets are indeed facing significant resistance and it will take alot more energy than .2% increases to keep the DJIA above the 13,000 mark for any period of time.

With all of the talk about DJIA, it is easy to forget about the other major indexes, which also mounted more bullish efforts. The S&P 500 mounted a piecemeal bullish effort with a gain of .34%, the NASDAQ Composite mounted a real bullish effort and grew .69% today, and the Russell Index 2000 lost .35% today. Index ETFs followed suit as the SPDR S&P 500 ETF (NYSEARCA:SPY) added .29% while the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) added .15% (really that’s it for a 13,000 day?). The PowerShares QQQ Trust Series 1 ETF (NASDAQ:QQQ) added 1.01% on the other hand, while the iShares Russell 2000 Index Fund ETF (NYSEARCA:IWM) lost .27% (talk about a sideways index right here).

If any index has the potential to keep its bullish attitude, its the NASDAQ 100, as the Nasdaq’s poster child Apple Computers (NASDAQ:AAPL) is slated to release the iPad 3 next week. Be aware however, I have said it before and I will say it again: what goes up must eventually come down, the same applies for the DJIA and the Nasdaq and yes, our precious red-hot Apple.

Markets and ETFs were also perhaps motivated by positive Consumer Confidence reports, however yesterday’s Case-Shiller report real estate report nothing to write home about. Europe for now has also started to recover as Greece has been placed in the rear view mirror and all of their problems have magically been solved. At least that’s how it seems and that’s how investors feel today.

Bottom Line: Yesterday was a big day in that the Dow reached the 13,000 mark for the first time since the onset of the Great Recession. Although 13,000 is a good number, I am weary about sustained levels above 13,000, given the current conditions in Europe and the sideways, piecemeal growth over the last few days. At any rate, we will have to wait and see if the bulls really do still have the reigns and can mount a serious enough offensive to break through the now cracked ceiling and keep us riding high.

Disclaimer: Wall Street Sector Selector trades a wide variety of ETFs and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets and ETFs Punch Through, But for How Long?

Published 02/29/2012, 01:26 AM

Updated 05/14/2017, 06:45 AM

Markets and ETFs Punch Through, But for How Long?

The Dow punched through 13,000 today, but how long will it last?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.