Stocks and ETFs shook off European gloom and doom amid positive economic reports last week to climb higher into resistance and severely overbought levels, levels from which, typically, measurable and meaningful corrections occur.

On My Wall Street Radar

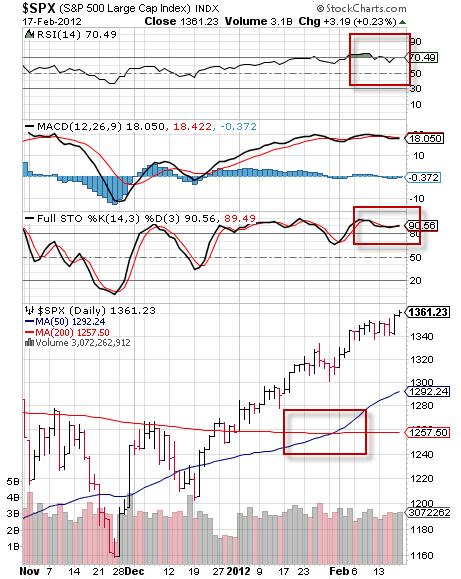

In the chart of the S&P 500 (NYSEARCA:SPY) above, you can see how RSI is above 70 which is overbought, Stochastic is above 90, also overbought, and the index itself is more than 100 points, or 8%, above its 200 day moving average which is also an overextended state.

ETFs Overbought

All major ETFs and indexes are in or near significantly overbought territory:

SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) RSI: 65.6, Stochastic: 84.6, 4% above 200 day moving average 4%

iShares Russell 2000 Index ETF (NYSEARCA:IWM) RSI: 64.6, Stochastic 80.61, 7% above 200 day moving average 7%

PowerShares QQQ Trust Series 1 (NYSEARCA:QQQ) RSI: 72.92, Stochastic 85.55, 11.9% above 200 day moving average 11.9%

SPDR S&P 500 ETF (NYSEARCA:SPY) RSI: 70.5, Stochastic 90.5, 8.3% above 200 day moving average

Furthermore, all major indexes are currently at long term resistance lines and have MACD readings that are “rolling over” or already have moved to “sell” signals. On the bullish side, the index has formed the “golden crossover,” which is a bullish indicator in which the 50 day moving average has moved above the 200 day moving average.

The combination of overbought conditions, prices at significant resistance and declining momentum points to the high likelihood of a correction coming sometime in our near future.

The Economic View from 35,000 Feet

The economic news was mostly positive last week as Greek limped towards yet another settlement with Europe and that story will be told on February 20th at the next summit meeting in Brussels.

Weekly unemployment claims continued to fall and stayed below the all important 400,000 level and continuing claims over a four week average also declined. Federal Reserve surveys from New York (Empire State) and Philadelphia showed continued strength in the manufacturing sector and housing starts beat expectations.

On the downside, a recession in Europe appears to be more certain than ever and Europe continues ratcheting up the heat on Greece with the outcome of this latest round of negotiations still in doubt. Retail sales missed expectations and quarterly profits for the S&P 500 declined.

This coming week we see reports from the Federal Reserve, weekly employment, home sales and consumer sentiment.

The big action will be in Brussels today, Monday at the Finance Ministers’ meeting.

Bottom line for stock and ETF investors:

Global markets are extremely overbought and subject to a measurable correction within the context of a longer term uptrend. Headline news from Greece (and, later, Portugal,) will continue driving global markets. Central banks will remain active to prop up ailing sovereigns.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets, ETFs, Vastly Overbought on Global Optimism

Published 02/19/2012, 11:06 PM

Updated 05/14/2017, 06:45 AM

Markets, ETFs, Vastly Overbought on Global Optimism

Major U.S. stock indexes and ETFs vastly overbought on global optimism.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.