A moment's insight is sometimes worth a life's experience.

-- Oliver Wendell Holmes

This Bull started off as the most hated bull market in history and is now metamorphosing into the most insane of all Bull Markets. By any measure, this market needs to let out some steam as it is trading in the extreme of the extremely overbought ranges. Historically, the crowd is almost always in the bullish camp at this stage of the game, but that does not appear to be the case. In fact, what stands out is that the masses are as anxious as ever and yet markets are trading close to their highs.

When you look at the sentiment data, one thing becomes apparent; the masses are uncertain. They do not know whether they should embrace the bullish or bearish camp. Most of the actions seem to be limited to the Neutral camp; in other words, individuals keep moving from the bullish or bearish camps into the neutral camp.

The masses are uncertain and uncertainty is just a milder form of fear as they do not know what to expect, so they keep populating the neutral camp. The past five readings below starting from the 17th of March illustrate that the number of individuals in the bullish camp has never traded past the 48% mark — hardly something you would expect at this stage of the game

Still Nervous

- 17th of March total number of neutral and bears: 74%

- 24th of March total number of neutral and bears: 67%

- 28th of March Total combined score of Neutral and bears: 64%

- 2nd of April total combined score of Neutrals and Bears: 70%

Emotions are driving this market to such a degree that traders would do well to pay close attention to the psychological state of the masses than to technical indicators. At this point, all we have is the technical factor, which means that a sharp correction (something that we would fully embrace) might not occur as the fear factor is already rising.

After all these years of looking at the markets, we cannot help but note that we have an extremely unusual situation developing. The markets are begging for a reason to correct, but the very reason they need is entirely lacking. Before a correction, the masses are usually optimistic and bullish, but this is not the case. From being the most hated it is moving into the most insane bull market as all the standard rules that apply to a Bull Market are being flung out of the window one at a time.

When markets are trading in record territory, the crowd is almost always bullish and complacent to some degree; all you are trying to do is measure the level of bullishness or complacency. However, as stated before this market is not following that guideline; it will be interesting to see what path the markets take; will the market's pullback sharply even though the crowd is already anxious?

So Is It Time To Panic?

Fear in our books is a useless emotion that is abused by almost every media outlet, both financial and non-financial in nature. We believe in being aware of what is going so that we have the opportunity to act in a calm and collected manner. At this point, we favour a sharp correction, but our opinion is of little value; markets take the utmost delight in trying to punish those who have firms views. We have never witnessed a market pullback sharply no matter how overbought it is when the fear factor is high. However, there is always a first time or the possibility of something different occurring; hence, the need to always be ready and willing to adapt to change. If the market pulls back strongly while the crowd is still anxious, then we are moving into a new paradigm, and we will adjust accordingly. We are not going to think about it, or try to fight it; if the trend change occurs; there is only one option, accept and adapt to the new trend or resist and be run over.

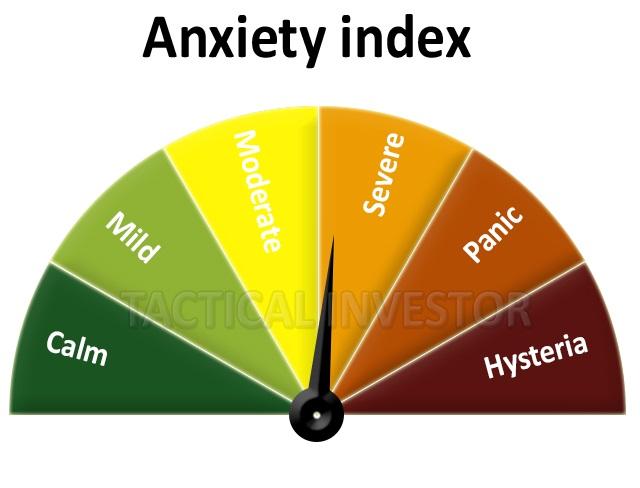

Surprise, surprise, the crowd has become even more anxious this week as indicated by our proprietary “Anxiety Index.”

Even, we after looking at the markets for so many years have to shake our head and marvel and the huge dichotomy taking place in the markets right now. A few years ago, if someone told us we would be facing this situation we might have attempted to put up an argument as such a concept would seem almost incredulous, but today we should be ready and willing to deal with every possibility.

Conclusion

At this point, it is all about being patient and observant; the markets are trading in the extremely overbought ranges, and therefore prudence is warranted. Our plan is to wait for our indicators to pullback to the oversold ranges and in the interim to only open positions in stocks that are trading in the extremely oversold ranges to minimize our downside risk. If you are a conservative trader, the suggested game plan would be to sit on the sidelines or scale back on your long positions and to tighten your stops.

If you are not a conservative player then taking on some calculated risk is fine but aim for quality stocks that have pulled back or trading in the extremely oversold ranges and have your stops in place. Uncertainty and mystery are energies of life.

Don't let them scare you unduly, for they keep boredom at bay and spark creativity.

—R. I. Fitzhenry

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Trends: Are Stocks Headed For A Crash?

Published 04/04/2017, 12:34 PM

Updated 07/09/2023, 06:31 AM

Market Trends: Are Stocks Headed For A Crash?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.