Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

The market has been focused on the rising cost of inputs and labor and other supply chain issue for the last few months. There was tangible nervousness in the market ahead of the start of the Q3 earnings season that these headwinds will start weighing on corporate profits through compressed margins.

We saw some of that in the Q3 reporting cycle, with a number of companies struggling to effectively deal with higher input and labor costs. Even mighty Apple AAPL and Amazon AMZN came up short in their quarterly reports as a result of these developments. But many other companies have been able to pass on higher costs to the end consumer.

Higher expenses prompted Amazon to cut 2021 Q4 guidance, with the company outlining $6 billion in incremental higher outlays, of which $2 billion was on account of labor cost inflation. Supply-chain issues were behind Apple’s revenue miss, with the logistical challenge shaving an estimated $6 billion from the company’s Q3 top line.

While these unfavorable cost trends may not have had as much negative impact on earnings as many had feared ahead of the start of the Q3 reporting cycle, they still remain a risk to long-term earnings trends. In fact, a number of sectors where the margin cushion is already fairly thin, struggled with these trends.

A notable sector suffering such a margin squeeze in the ongoing Q3 reporting cycle is Consumer Staples whose Q3 earnings growth of +5.8% on +13.9% includes a 110 basis-point net margin contraction. The Utilities, Autos, Retail and Construction sectors are suffered margin squeezes, though relatively less pronounced compared to Consumer Staples.

Net margins for the index as a whole are expected to expand 81 basis points in 2021 Q4, though they are expected to be below the year-earlier level for 6 of the 16 Zacks sectors. These include Consumer Staples, Utilities, Industrials, Retail, Autos and Technology.

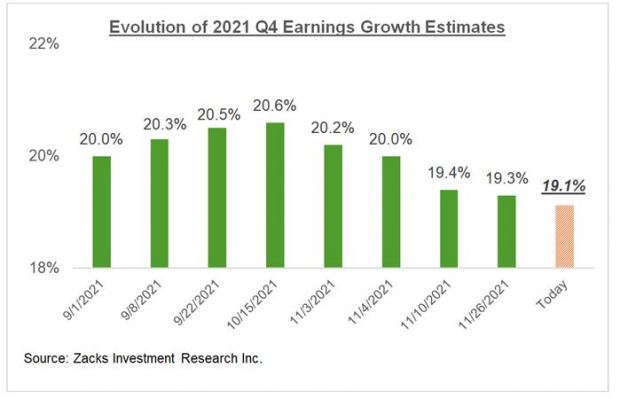

These margin pressures have been a big contributing factor to the recent negative shift in the revisions trend, which consistently remained positive since July 2020. You can see this in the revisions trend for 2021 Q4.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

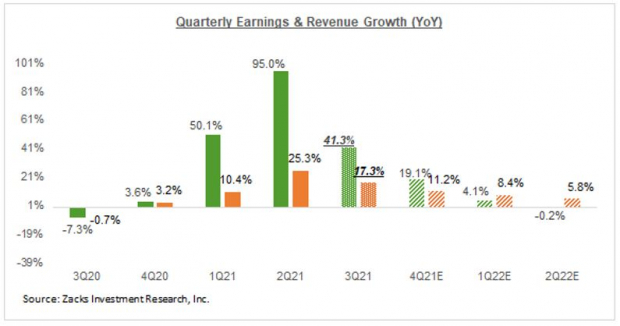

The chart below provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

We remain positive in our earnings outlook, as we see the overall growth picture steadily improving, as the near-term logistical issues get addressed.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it's poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in a little more than 9 months and Nvidia (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (NASDAQ:AMZN): Free Stock Analysis Report

Apple Inc. (NASDAQ:AAPL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research