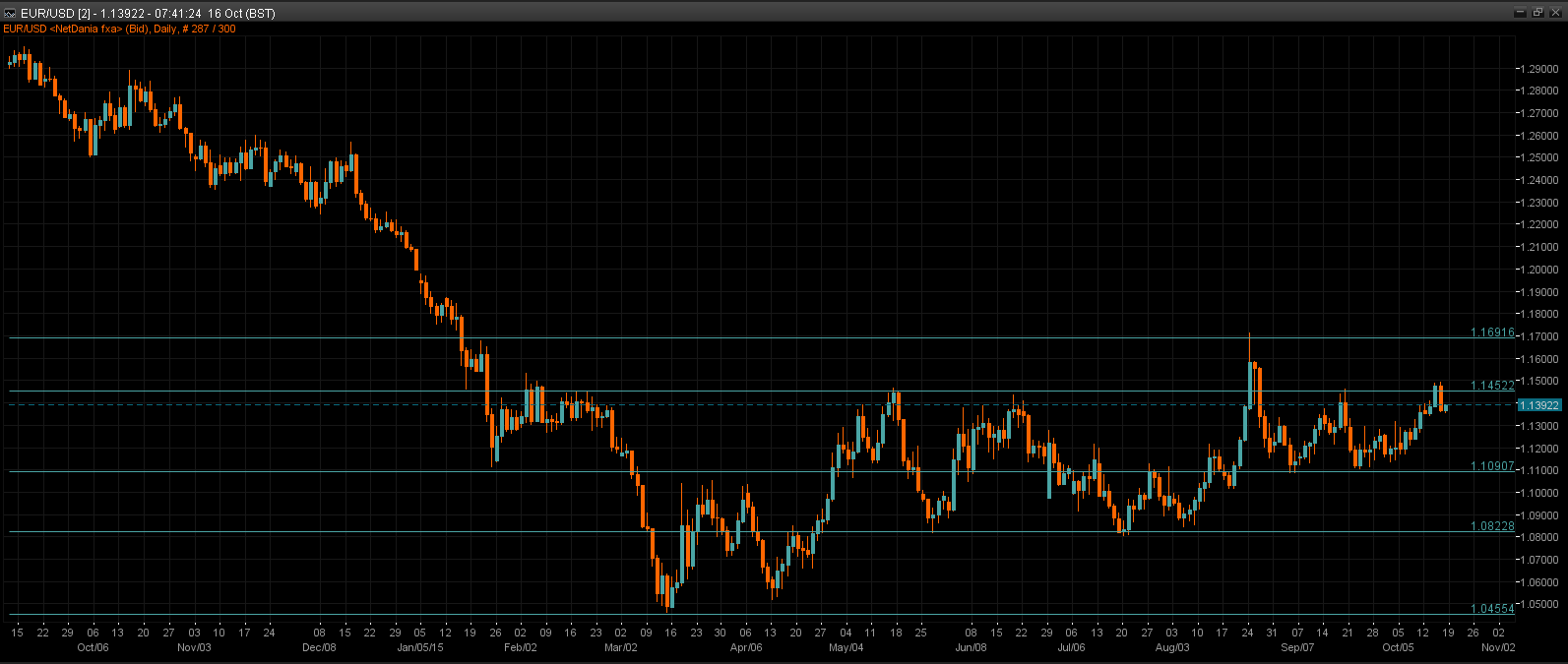

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR reached a high of 1.1495 and shot down to the 1.1400 level due to the upside surprises from US CPI data (1.9%, higher than prior 1.8%). Traders now await whether the ECB will expand the QE programme or not, despite the mixed views in which ECB’s Nowotny said “it is quite obvious that additional sets of instruments are necessary“ while Fed’s Dudley told the market that there will not be a Fed rate hike this year until

data improves

Technical: 1.1410/30 now a pivotal bull/bear battleground, while this area contains upside reactions expect further weakness and retest of 1.13 bids A breach of 1.1450 refocuses bull on the 1.1740 range highs

Interbank Flows: Bids 1.13 stops below. Offers 1.1520 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now

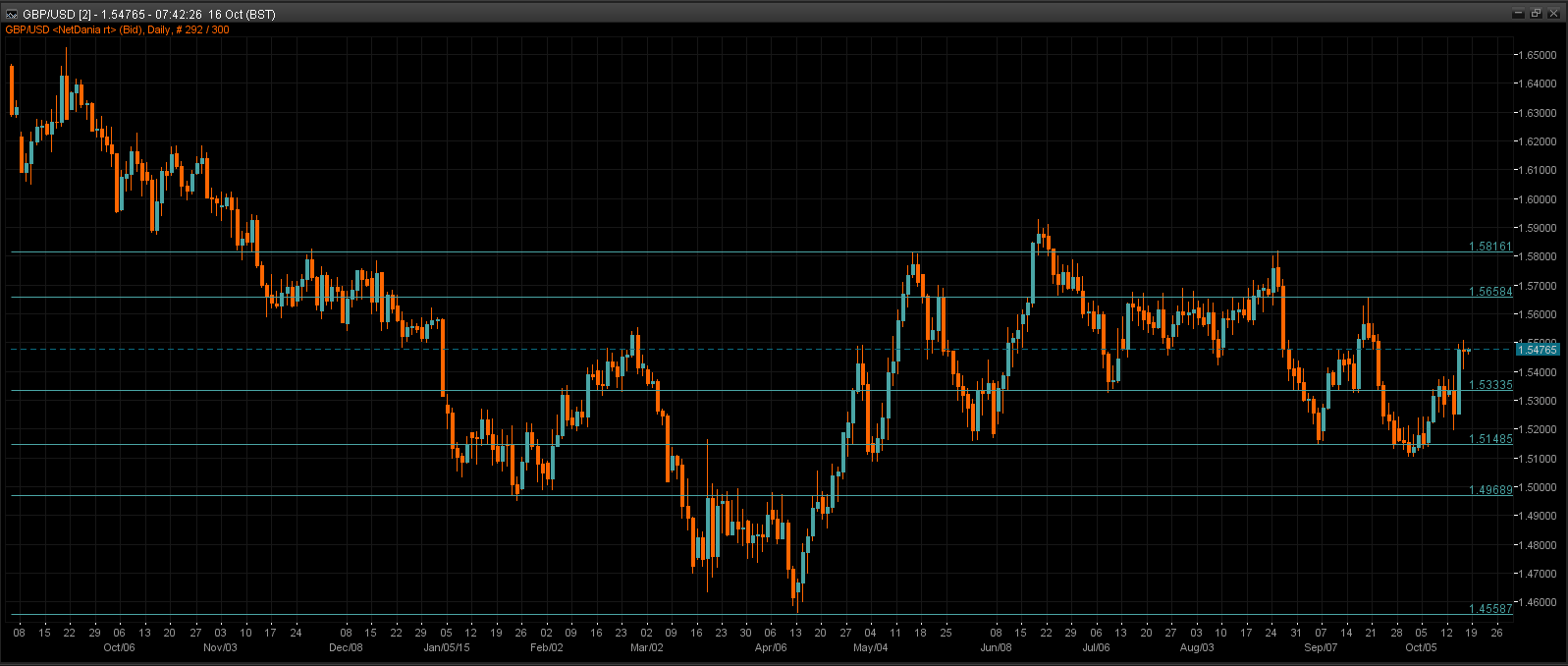

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP was flat, as there was no fresh data to guide. Separately, German Chancellor Merkel said she will work constructively with the UK on EU reforms but warns that some principles, such as the free movement of people, are non-negotiable.

Technical: While 1.5380 supports downside reactions expect a grind higher to test 1.56 symmetry objective.

Interbank Flows: Bids 1.54 stops below. Offers 1.5550 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullback against 1.5380 targeting 1.56

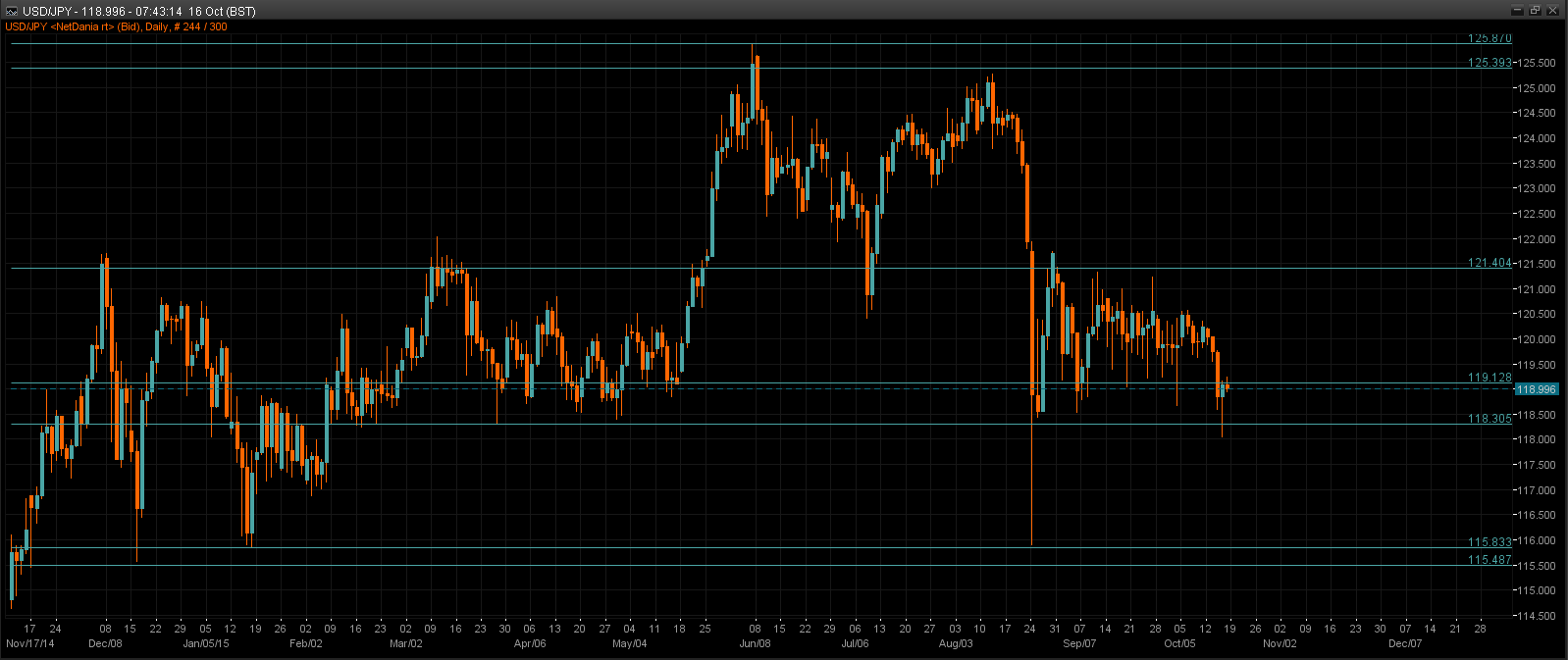

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY worked all the way down to 118.07, before getting support from stronger equities. The pair is back up above the 119.00-levels this morning. In Japan, industrial production declined for the second month in a row in August, proving that the

economy is still on a sluggish recovery path. Industrial output fell 1.2% over the month in August

Technical: Bids at 118.50 support again and the expected rotation back into range has developed while 119.50 caps upside expect further bearish price action and further exploration of stops sub 118.50, a failure at 118 emboldens bearish spirits and targets 116 next.

Interbank Flows: Bids 118.50/30 stops below. Offers 121.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines for now

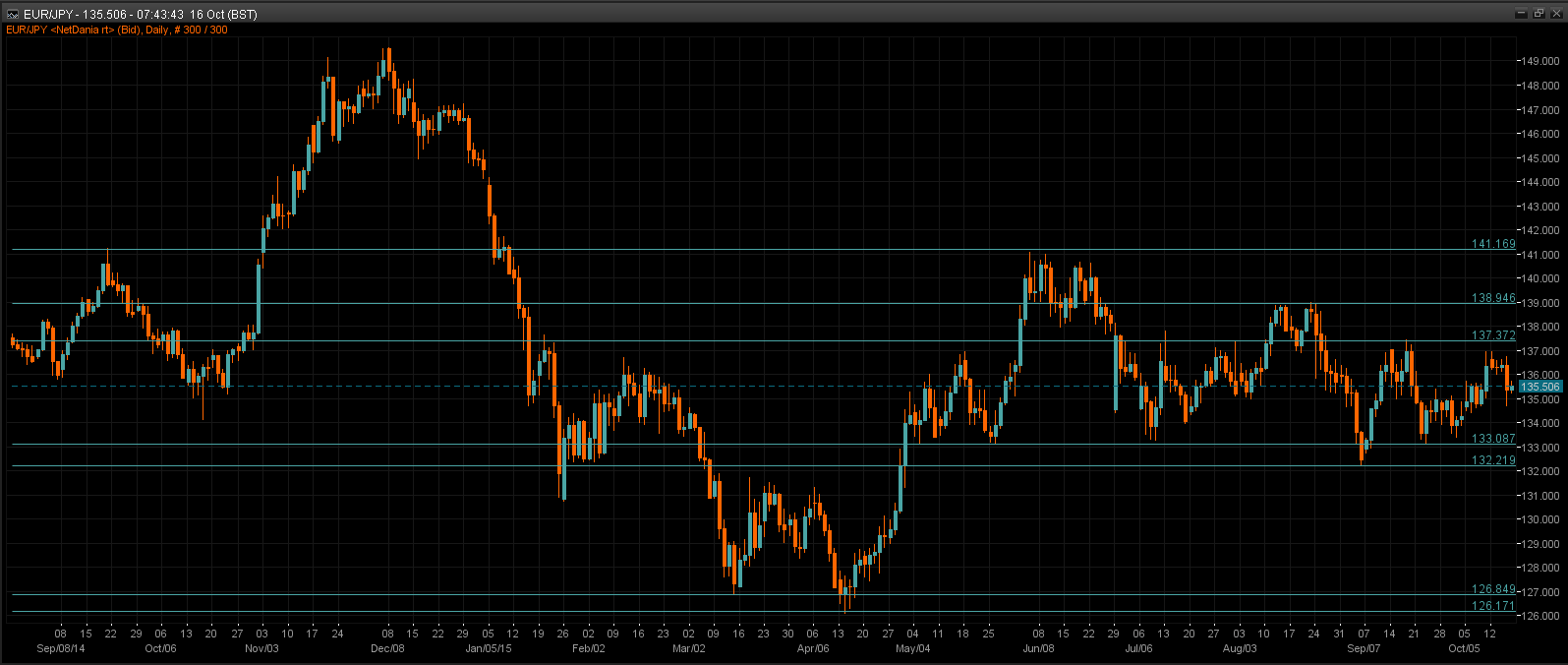

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Weighed yesterday by a sharp reversal in the EUR and the related cross flows. The result of Reuters Poll showed more than a half of Japan firms supported more BOJ easing while 66% of responded said Abe’s economic policies have been losing momentum. This may strengthen the confidence of BOJ to undertake further easing measures at the end of this month

Technical: While 136 caps upside reactions expect a retest of yesterdays low at 134.80 a failure here sets bearish tone targeting 133.40 next. A break back above 136.00 eases bearish pressure and sets a retest of 137.

Interbank Flows: Bids 134.80/60 stops below. Offers 137 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now

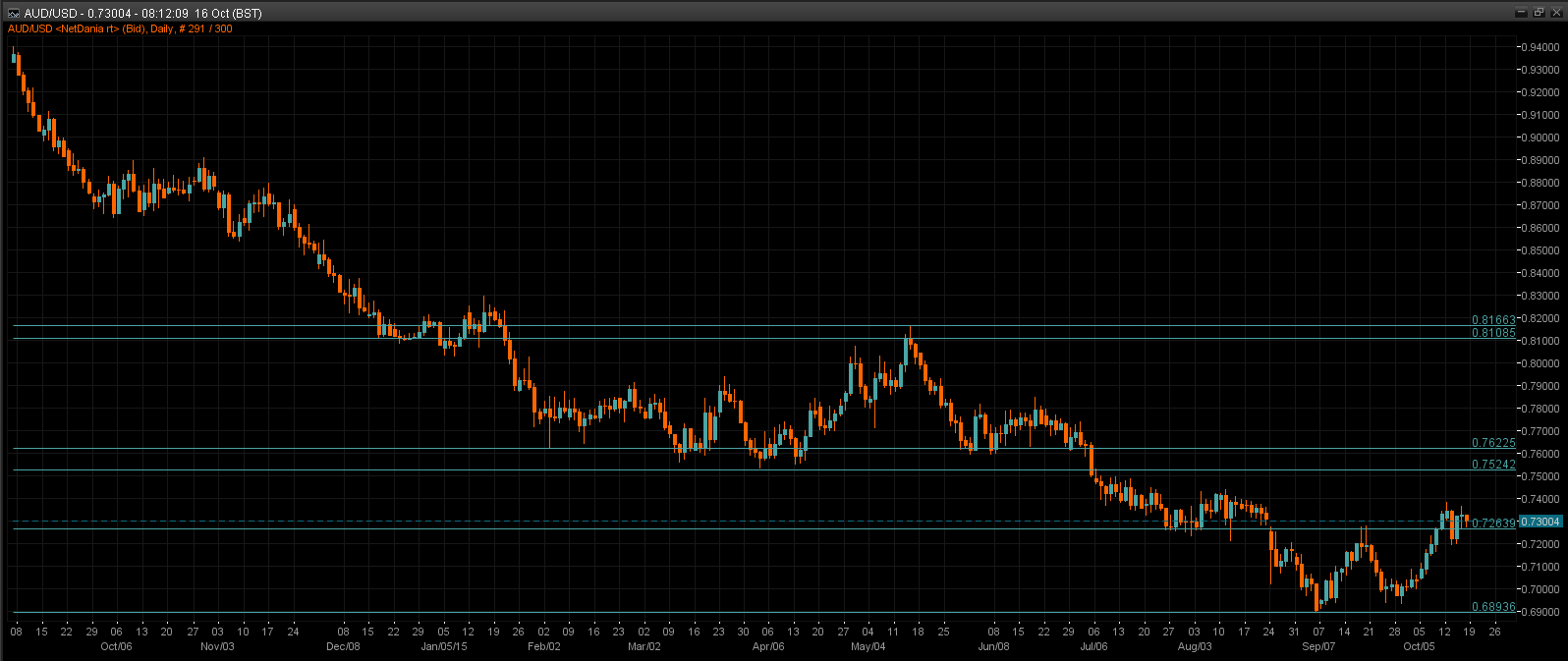

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Australian job-market data prompted a fall in the AUD, which is now seen flirting around the 0.7300-mark. Expect less aggressive positioning today as positions are likely pared ahead of China’s 3Q GDP on Mon

Technical: The snap back breach of .7300 targets a retest of .7400 offers. Another breach of .7300 against overnight highs targets .7160 equality corrective objective.

Interbank Flows: Bids .7200 stops below. Offers .7400 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now

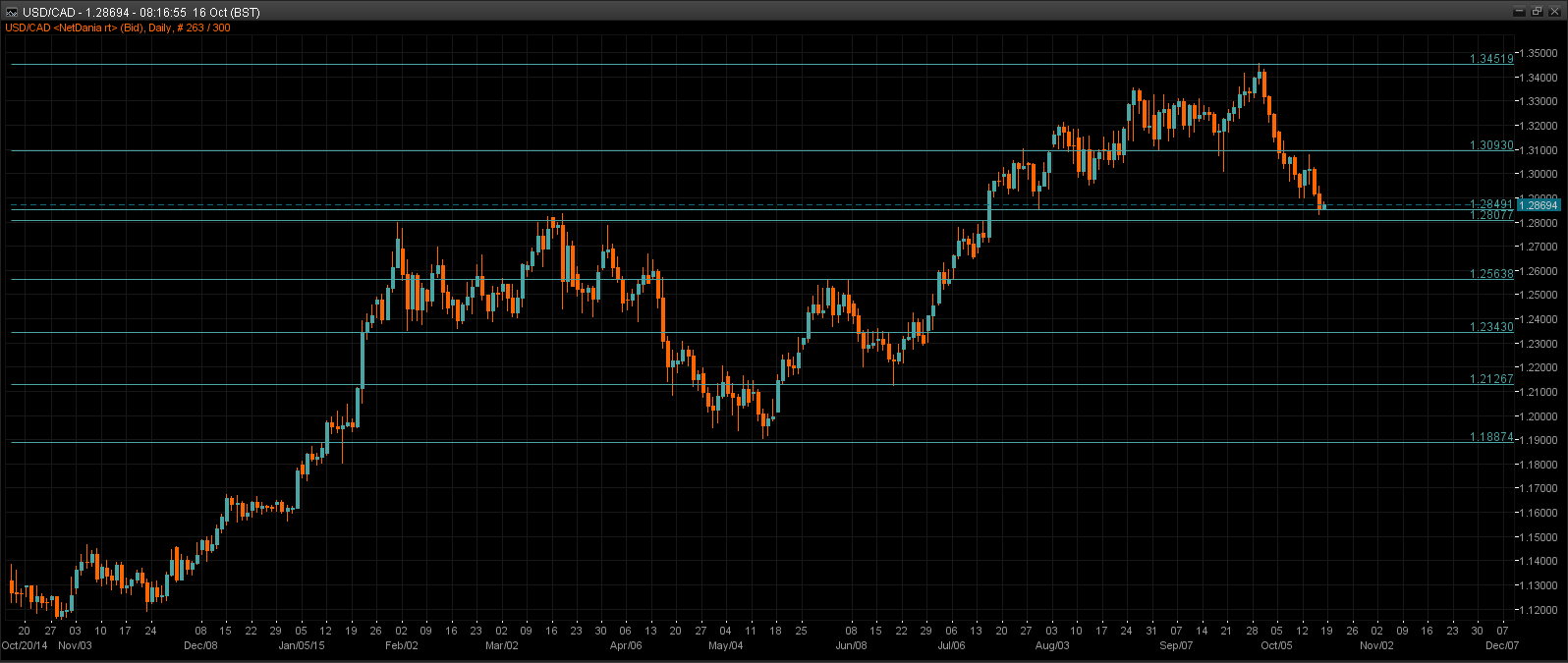

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD hit its strongest level against the US dollar in three months, powered by expectations that the Federal Reserve could delay raising US interest rates until next year. The stabilization in the price of oil also helped the loonie gain ground. The currency has been greatly sensitive to the fall in world oil prices over the past year.

Technical: Near term bearish tend remains intact as intraday resistance at 1.2950 contains intraday upside reactions bears target a retest of bids below 1.2850. A breach of 1.2950 opens test of 1.3060 offers next.

Interbank Flows: Bids 1.2850 stops below. Offers 1.3060 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines for now