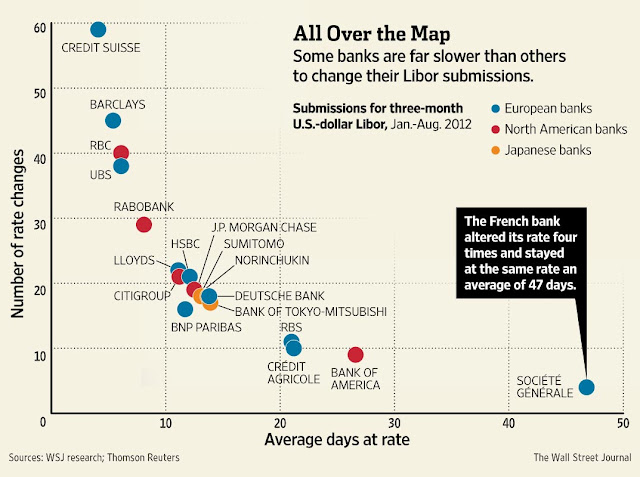

The media outfits these days love to scrutinize bank submissions of LIBOR, looking for some sort of a pattern. The chart below from the WSJ shows how frequently banks change their rate. What are those sneaky bankers up to? Naughty SocGen, so slow in updating those rates. And why is CS constantly changing theirs? The answer of course depends on who is running that department (usually within the corporate treasury) and what "methodology" is used to cook the numbers.

It's a thankless job because the scrutiny is high, the risks of getting it "wrong" and ending up in court are even higher (since there is no "right" answer), and there is no money to be made by submitting. Now that the regulators are taking over this process, the incentives to submit LIBOR on a daily basis will be even lower. The FSA will soon require proof of actual borrowing costs to justify the submission values.

Reuters: An expansion of the panel of banks that submit rates to Libor, a three-month blackout on the disclosure of individual bank's lending rates and a requirement to back submissions with evidence of borrowing costs in other markets are among reforms designed to reduce attempts to manipulate the rate.

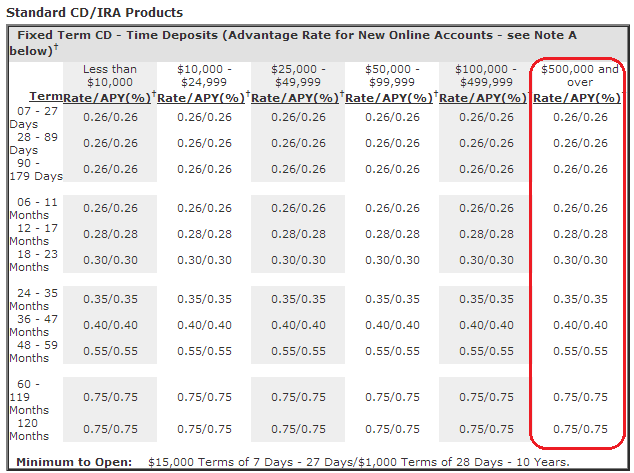

But banks generally don't borrow from other banks for 3 months - so where is this proof going to come from? Some think LIBOR submission will simply converge to certificate of deposit (CD) rates. That's right, retail CD rates. After all the full CD curve for each bank is generally publicly available and is effectively how a bank borrows money from the public for a period of time.

JPMorgan: We expect that requiring a formal process for Libor submissions, together with the explicit requirement to reference a broad set of short term markets, is likely to produce convergence towards observable rates such as bank CD rates.

Of course it would be the rates for "jumbo" CDs in order to avoid the FDIC protection effect for CDs under $250,000 (FDIC protected amounts tend to have lower rates). The BofA CD rates for example (below) don't seem to distinguish the account types, but the curve is available on their website daily.

That means that the 3-month LIBOR rate should start approaching the 3-month CD average as the LIBOR regulation nears. It appears that convergence has already been taking place recently (possibly for other reasons). Hopefully it should make LIBOR submission process much easier. Rather than calling their basis swap desk for "guidance" on LIBOR, treasurers will start calling their retail banker for CD rates.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

LIBOR May Converge With CD Rates

Published 10/02/2012, 01:49 AM

Updated 07/09/2023, 06:31 AM

LIBOR May Converge With CD Rates

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.