Global Macroeconomic Themes to Track in 2020

As 2019 draws to an end, we are seeing some positive traction on two key risk themes that have kept the global markets on tenterhooks over the last couple of years; US-China trade tensions and Brexit.

US-China phase one trade deal has finally seen the light of the day. In UK, Conservatives have emerged victorious in the general elections and with a majority in the parliament; it would be easier for PM Johnson to deliver on his core campaign promise i.e. to "Get Brexit Done". Unfortunately, given how complex both the underlying issues are, the way forward is likely to be convoluted and we expect developments on these themes to certainly drive the global risk sentiment in 2020 also. Below are the key themes to track in 2020 and our expectations under various scenarios:

2020 US Presidential Elections: A test of ‘Trumponomics’

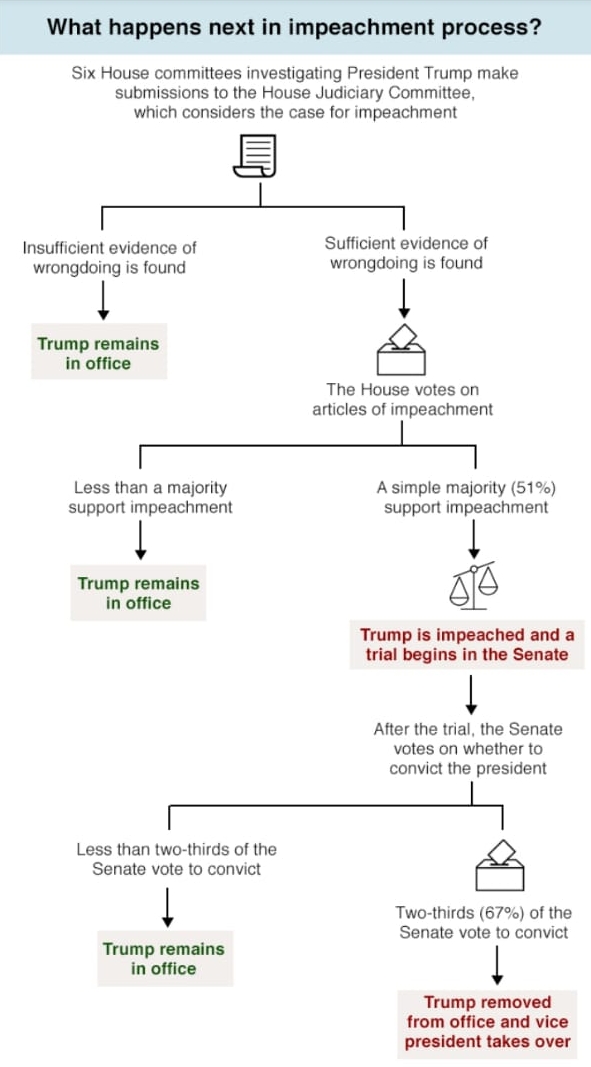

The central plot for 2020, where we expect a lot of drama to unfold is the US presidential elections. The Democrats are pressing charges for impeachment with the House of Representatives likely to vote soon (18th December). Even if the president is impeached he may not be removed from office as that would require a two-thirds majority in the Senate which at the moment is controlled by the Republicans. If the Democrats succeed in getting the allegations against the president to resonate with the voters, it would further lower Trump's approval ratings. President Trump,on the other hand, would want to showcase the health of the US economy, pointing to unemployment rate which is at a multi-decade low and stock indices which are at record highs as a testimony to his economic policies. Generally, no incumbent president has lost a re-election bid with the economy doing well. Also, no president has won a re-election bid with an approval rating below 50%. Both these statistics cannot hold and it will be interesting to see which one gives way.

Any development which tilts the scales in favor of President Trump would be Dollar positive and risk positive and vice versa. The top three Democrat contenders (in order of their current chances) are Joe Biden, Bernie Sanders, and Elizabeth Warren. Markets would keenly follow who emerges on top to challenge Trump in the race to become the next US president. If Warren turns out to be the one then one can expect a massive sell-off in US equities, bonds and the US dollar on account of her left-leaning ideology which is not seen as being business and market-friendly.

US-China Trade Tensions: Patches of agreement, swathes of disagreement

The phase one US-China trade deal is more like the tip of the iceberg. What we have got now seems like a temporary truce. Both sides were desperate to show some progress and closure to their constituents. While the deal may benefit a section of Trump's voter base and help him lift his approval ratings, more contentious issues continue to remain unresolved. Even the commitment on the part of China to purchase USD 40-50Bn of US farm goods seems too ambitious given that prior to the start of the trade war China had bought USD 24bn of US farm goods in 2017 and the most it has ever bought so far was USD 29Bn worth in 2013.

President Trump has said phase 2 negotiations would commence immediately but has not specified any timeline on the same. Phase 2 negotiations are expected to cover issues such as Chinese government subsidies to state-owned enterprises, digital trade, data localization, cross border data flows and cyber intrusions. The extent of hardball president Trump plays in phase 2 would depend on the state of the economy and markets heading into the elections, his approval ratings and on who the Democrat challenger is. Just like in 2019 we expect a lot of comments and statements coming in from both sides. We expect some patches of an agreement but large swathes of disagreement.

Brexit: A tumultuous transition period lies ahead

With a majority, Conservatives will be able to push through the Withdrawal Agreement Bill (agreed by Boris Johnson with the EU) through the UK parliament, legally taking the UK out of the EU. Thereafter there shall be a short window of 11 months until 31st Dec 2020 by when the UK and EU would have to hammer out a trade deal that would establish the future trading relationship between them. This could be a tall order especially if UK wants to differ significantly from current EU standards and tariffs. The more closely aligned the UK is with European standards, the smoother the transition would be.

Given the health of the UK economy, there is a possibility the BoE could cut rates in Q2 after considering the progress made on future trading relations during the transition period

We expect the Pound to trade 1.2750-1.40 during 2020 with a risk of breaking lower if downside risks to the UK economy emerge from a tumultuous transition period.

Health of the Chinese Economy: Dragon on its knees

The global engine of growth has been slowing. Deleveraging has taken its toll on the Chinese economy. China’s auto sales have contracted in 17 out of the past 18 months. The third-quarter GDP growth at 6% was the lowest in nearly three decades. Growth in Q4 is expected to slow down further. While the government has taken small steps to boost infrastructure growth, no large scale stimulus measures have been announced so far. The PBoC’s response has also been measured. It has cut the loan prime rate by merely 5bps to 4.15% from 4.20%. This indicates that China wants to tread cautiously, striking a balance between debt and growth. Considering that China has accounted for one-third of global growth in recent years, lack of immediate revival in Chinese demand could keep global growth suppressed.

EUR/USD and USD/JPY 3M (NYSE:MMM) ATM vols

The question on everybody’s mind is whether we will see the low volatility environment of 2019 continue into 2020. The volatility in EUR/USD and USD/JPY is at or close to historic lows. This does not come as a surprise given that there is little policy divergence between major global central banks; the Fed, the ECB and the BoJ. All three are accommodative and stand ready to ease more if their respective economies worsen. All three are currently engaged in some kind of asset purchases (Though the Fed is doing more so to manage liquidity). For volatility to return we need policy divergence to reappear. Therefore it would be very important to track the incoming data, especially from the US and Eurozone. The Fed is better placed than the ECB, and the BoJ as the US economy is relatively stronger. The median dot plot indicates that the next action of the Fed could be a hike (though far ahead in 2021). The Fed is expected to pause and watch the effects of its midcycle policy adjustment play out. We expect the Fed to remain on hold through 2020. However, the pillar holding the US economy so far is consumption and if that falters we could be looking at an even more dovish Fed and that could be negative for the US dollar. We see EUR/USD trading in 1.07-1.16 and USD/JPY in 104.50-112.50 during 2020.

On the geopolitical front, anti-government protests in Hong Kong, France, South America, and Iran need to be monitored closely. Other outside risks could emanate from Impact of negative rates on European banks, impact of a quick turnaround in yields on fund portfolios having sizeable exposure to negative-yielding debt, overstretched valuations of Fintech unicorns, prolonged phase of low growth resulting in earnings not meeting expectations, making current valuations unsustainable and resulting in a steep equity market correction.