Barrick Gold (ABX), the largest gold miner in the world, came out with earnings that were better than most analysts expected. The market was obviously happy as the large gold miner says it may suspend its high cost projects in questionable jurisdictions. Instead, I have suggested in many articles that Barrick should focus on their Nevada projects which are continuing to support the company with a large amount of positive cash flow. Nevada is the jurisdiction, which made them successful.

On the other hand their $8.5 billion Pascua Lama Project has been a disaster with soaring costs and jurisdictional disagreements. It is an albatross and Barrick must cut their losses. They should look to invest in Nevada where their properties especially in the Cortez Trend have some of the highest margins in the business. Over the past year, Barrick’s risky moves into questionable projects and jurisdictions have hammered down its share price. Sometimes well managed juniors may actually be safer than some of the majors.

Remember there are smaller but more efficient junior producers who could compete with the clumsy larger players in terms of its ability to expand their gold and silver production and at the same time reduce costs. Comstock Mining (LODE) is one of the few junior gold miners that is producing gold and generating positive cash flow in a very turbulent and volatile marketplace.

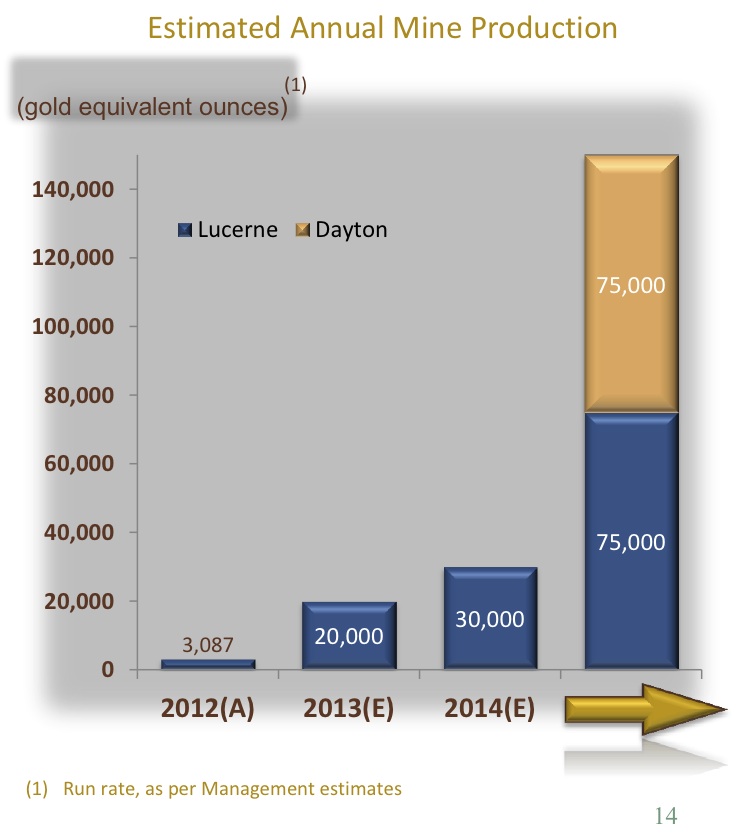

The company is well capitalized to explore and expand the resource around the historic Comstock Lode. In a recent technical report, Comstock Mining announced the discovery of the “Chute Zone” which is similar to the historical bonanza grades found by the old time miners over a 100 years ago. This discovery is very exciting as it could really boost the growth of Comstock Mining, which has been producing gold now for about 8 months. They hope to eventually produce 150,000 ounces of gold per year in 2015.

Comstock is comparing the Chute Zone to the Woodville Bonananza which was mined in the 1870′s. Having a strong management team, shareholder base and positive cash flow to explore the eastern slope of the Virginia Range near Reno, Nevada is very exciting.

Comstock Mining has expanded the resource to 2.7 million ounces of gold and close to 27 million ounces of silver. Still, the company believes they are just scratching the surface of the potential in this historic mining district. It is still trading near multi-year lows.

Current production and positive cash flow could internally fund exploration operations providing less dilution risk to current shareholders. The company has recently stated a near term target of 20k ounces of gold and is looking to expand that over the next few years as additional deposits come online.

Finding a growing gold and silver producer that could internally fund resource growth, in a mining friendly jurisdiction, with quality management and strong shareholder support, with the potential to make bonanza style discoveries is not easy to find in today’s market environment.

Listen to my recent interview with CEO Corrado DeGasperis from Comstock Mining (LODE). Corrado has over 25 years of manufacturing, mining and capital markets experience. He was the CEO of Barzel Industries and CFO of Graftech International, a global manufacturer of industrial graphite.

Disclosure: Author and interviewer owns Comstock Mining and the company is a sponsor on my website.

Below you may find the video.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Junior Gold Producers May Be Safer Than The Senior Miners

Published 04/26/2013, 03:35 AM

Updated 07/09/2023, 06:31 AM

Junior Gold Producers May Be Safer Than The Senior Miners

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.