The June Euro futures contract is posting a slight gain this morning. The gains are being attributed to the favorable Spanish auction. Talk of possible aid from the European Central Bank and a favorable nod from the U.S. Federal Reserve regarding additional stimulus has been providing support for the Euro over the past four days.

Fear Factor

Whether the rumors are true or not, they have put a little fear in the hearts of short-traders who were looking for an excuse to lighten up on their open positions. Fundamentally, nothing has really changed in Europe except for trader psychology. Instead of selling short and asking questions later, the bears are demonstrating that they are at least willing to listen to the stories floating around out there. The fear of giving back profits seems to be the driving force at this time.

I don’t believe there is enough valid information available to encourage buying at current levels, but from a short-trader's perspective, there are enough rumors to warrant taking cover at this time, which is why the June Euro has reached a balance point on the chart.

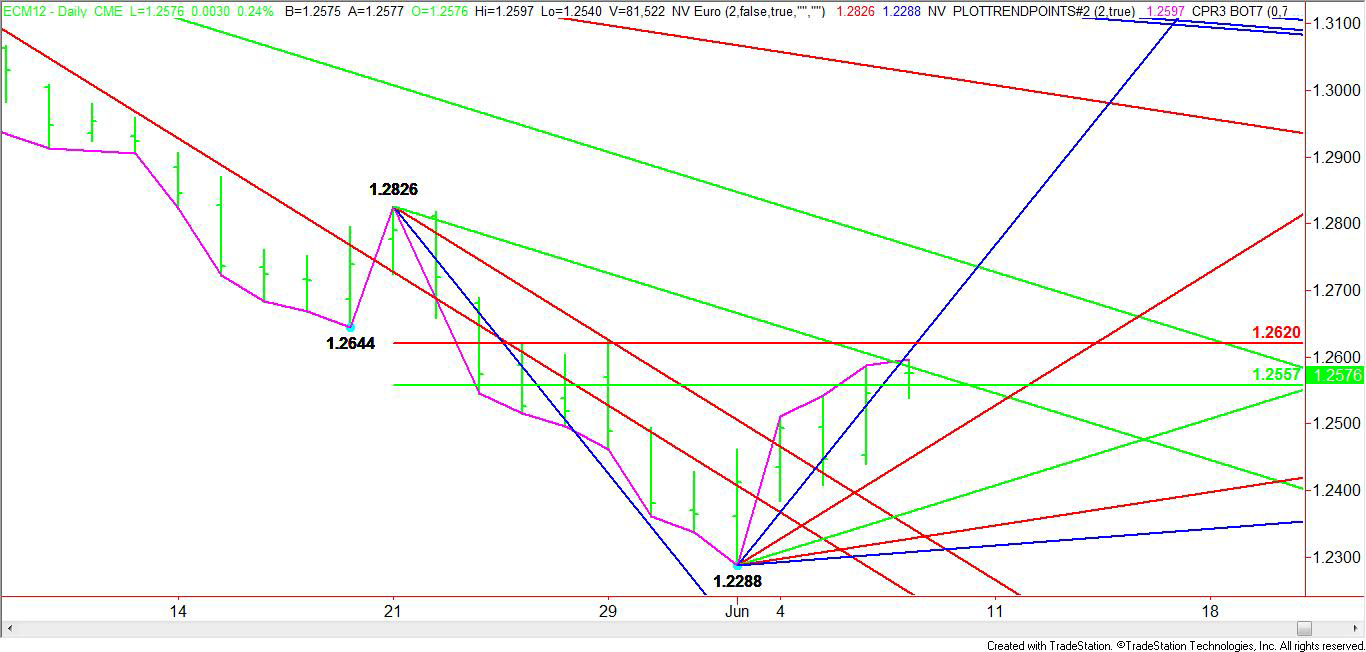

Technically, the June Euro is currently behaving like any market would following a closing price reversal bottom on the daily chart as it did on June 1. Based on this pattern, a market typically retraces 50 to 61.8 percent of the last down swing. Since the last move down was 1.2826 to 1.2288, the first upside target zone was identified as 1.2587 to 1.2620. Currently the market is trading inside this retracement zone so a move to the downside will not be a complete surprise. In addition to the potential resistance zone, a downtrending Gann angle at 1.2586 could encourage some profit-taking selling.

Needless to say, the Euro has reached a critical area on the charts. The current set-up has created a key area of interest, which should create higher volume and perhaps greater volatility.

Lack Of Support Base

The main trend is still down and that will not change until the swing-top at 1.2826 is violated. In the meantime, the major concern for traders should be the lack of a support base. Technicians often say that the height of the market is determined by the length of the base and at this time, I don’t see a support base, I see a closing price reversal bottom.

This means that in order to gain credibility with bullish traders and to scare a few more shorts out of the market, the June Euro has to form a secondary higher-bottom. This can only happen if the market retraces its short-term rally from the recent bottom. Once this move is made, new buyers are going to have to step in to prevent a new low. If this occurs then I can build a case for a possible change in trend, but right now this looks like a rally in a bear market. Stay tuned for further developments.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

June Euro: Bears Drive Action

Published 06/07/2012, 12:01 PM

Updated 05/14/2017, 06:45 AM

June Euro: Bears Drive Action

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.