The June Euro is trading inside of Wednesday’s range as traders await today’s European Central Bank interest rate announcement and ECB President Draghi’s press conference. Expectations are for the central bank to leave interest rates unchanged this time, but leave the door open for further cuts later in the year should the Euro Zone economy continue to weaken. Draghi may talk about the possibility of increasing its bond buying campaign in Spain. Traders are likely to react to his comments which should lead to periodic volatility early in the U.S. session.

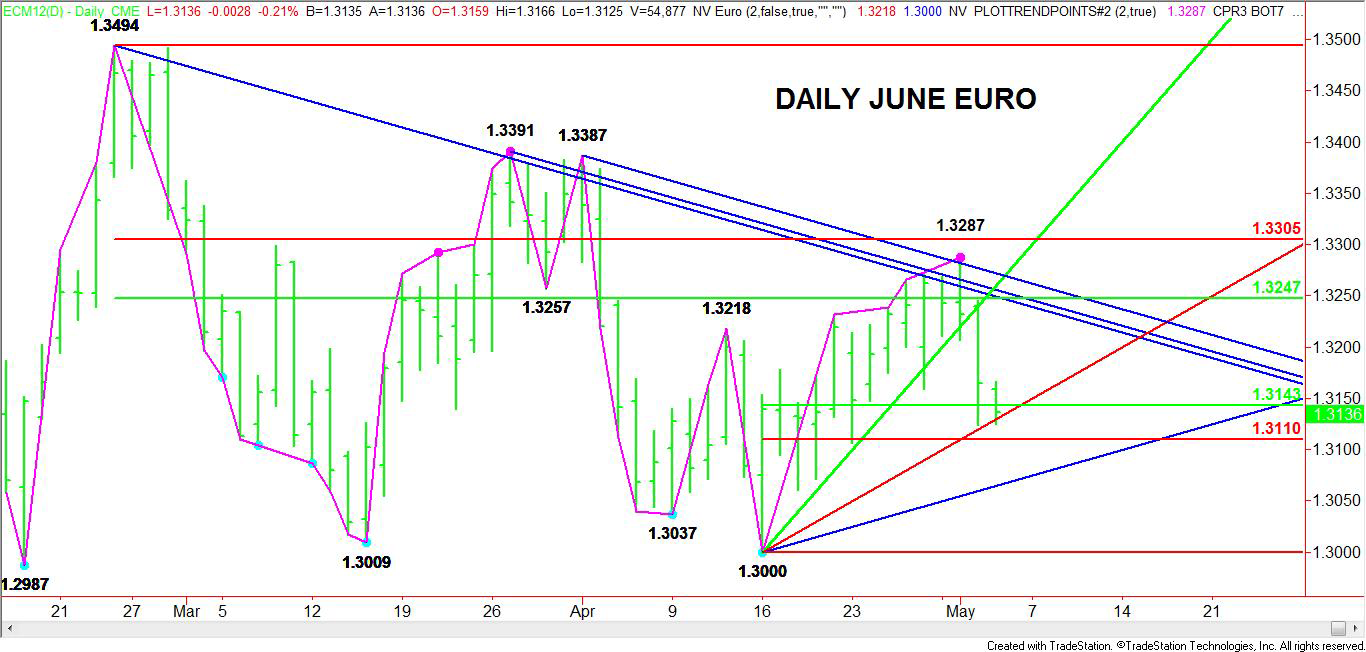

Technically, the June Euro futures contract is currently trading inside of the retracement zone created by the recent range of 1.3000 to 1.3287. This possible support area is 1.3143 to 1.3110. Additionally, the Euro tested and found support overnight on an uptrending Gann angle at 1.3130.

If traders interpret ECB President Draghi’s comments as bearish, then look for an immediate test of 1.3110. A failure to hold this level should trigger an acceleration down to the uptrending Gann angle at 1.3065. Holding the steeper Gann angle and the retracement zone could trigger a short-covering rally. There is plenty of room to the upside with downtrending Gann angle resistance coming in at 1.3249. The market is not likely to rally straight up to that area since a minor retracement zone at 1.3206 to 1.3225 has to be overcome first.

The June Euro is trading inside of a tricky price zone. Since the main trend is up on the daily chart, there is still a slight bias to the upside especially since the market is holding inside of the retracement zone. Traders should watch the volume and price action carefully because this type of set up can create a bear trap. If the market begins to break sharply, try to determine whether it is being triggered by heavy selling pressure or bids being pulled. Falling bids can sometimes create the trap that catches a trader selling weakness while chasing the bid.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

June Euro Futures Set Up for Bear Trap

Published 05/03/2012, 08:58 AM

Updated 05/14/2017, 06:45 AM

June Euro Futures Set Up for Bear Trap

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.