Has the market crossed the Rubicon again? In early May of this year, right about the time the stock market usually lies down for a while and takes its usual breather from the April rally, two back-to-back events poured gasoline on the rally’s fire. First, European Central Bank chairman Mario Draghi cut interest rates. The next day, an April jobs report came out that was not only above consensus (not by much, really), but more importantly completely wrong-footed a market expecting a swing in the other direction after a weak ADP payroll report had come out two days earlier.

Traders are creatures of habit. They expect markets to behave a certain way, and when they don’t, there is often an explosive move as everyone tries to position for the new trend. If the market starts to go down when it’s supposed to go up, it can start a bout of panic selling. The same is true in reverse, which happens more often – after all, stock markets have an inherently upward bias.

The stock market took off like a rocket with that May counter-move. People were talking about prices going parabolic until Fed chairman Ben Bernanke stepped in a few weeks later and ended the party by broaching the possibility that the police might be coming – or in other words, the Fed might start tapering soon.

We may now be repeating that move. Though the previous week was essentially sideways, ordinarily the markets would be taking another post-earnings season breather right now. The fact that they are not, partly inspired by Fed chair nominee Janet Yellen’s vagueness about ever wanting to end quantitative easing, has gotten the market euphoric. We are back in the all-news-is-good-news mode again. Either the news keeps the Fed in the game, or the economy is really getting better after all. Most of all, the trend is your friend.

There is no shortage of signs that we have entered the giddy stage. The website Minyanville listed some of them: record prices at art auctions, the all-is-for-the-best syndrome, hugely optimistic investor sentiment readings. Margin debt at an all-time record, the price-to-sales ratio on the S&P the highest it’s been since the tech bubble, the value of the Wilshire 5000 index is apparently more than GDP.

In the very short term, that is, the next week or so, the markets are apt to either go sideways or move up for a day or two at most before retreating. They are close to becoming too overbought over every time horizon. That doesn’t mean that prices have to retreat, but professional traders do watch technicals and are ready to step aside. The fear of selling, though, which helped fuel last week, could allow the most rabid bulls to take control for a time.

Over the short term period that makes up the remaining six and a half weeks of 2013, many are eying a stampede as one possibility, a phenomenon of running like crazy because everyone else is. Two of the shibboleths passed around the faithful even now are that there is some untold number of managers chasing performance, and that the calendar favors the last six weeks of the year: December is historically the second-best month of the year. Ergo, markets must keep going up.

That is also the perfect setup for a painful reversal, but the latter would need some kind of catalyst. The fact that runaway buying has ended disastrously the last dozen years does not stop people from believing that they can get it right this time – as Caesar himself is said to have remarked, men are quick to believe that which they wish is true. There are potential triggers for selling – Europe, China, Iran, electronic trading flaws, a concentration of data points that are simply too weak – but whether any of them will metastasize into a problem isn’t knowable at the moment.

One thing is knowable – we are building a bubble, whatever Janet Yellen may think or say. Like every Fed or Treasury chieftain, she’s constrained from saying anything sensational – it would be irresponsible for such a personage to go up to Capitol Hill and start with an imitation of Cassandra. That said, she doesn’t appear to give off any indication that she’s concerned about the possibility. She rather sounds just like Ben Bernanke saying, “the sub-prime mortgage problem appears to be contained” (which he said not once, but over and over).

Yet we are constructing a bubble. If we don’t get into a decently long period of consolidation in the very near future, the market is going to disappear into one of those brain-destroying vortex moves upwards – the notorious “blow-off top” – that ends in a crash. Right now, the odds are starting to favor the latter, though not before we get a pullback. Shorter term, everyone is so convinced that the market can’t do anything but go up that one would think it is surely about to go down, even if not very far or for very long. But this year even a few days is treated like some strange anomaly. Caveat emptor.

The Economic Beat

The economic data was largely in the opposite direction of the market this week, beginning with the small business confidence index. It fell about 2.5 points, rather large for this particular index, with some negative employment readings. It was followed by the Chicago Fed’s national activity index, which printed a positive reading of 0.14 but has the three-month moving average negative for the seventh month in a row. That’s quite a streak.

Weekly claims remain elevated at 339,000 (since the previous week was revised up a hefty 5,000, this was proclaimed in news services as “claims fall again”), and international trade data continue to paint a picture of weakening global trade. Import-export prices took a dip and now stand at (-2.0%) and (-2.1%) respectively over the last twelve months. This is weak data.

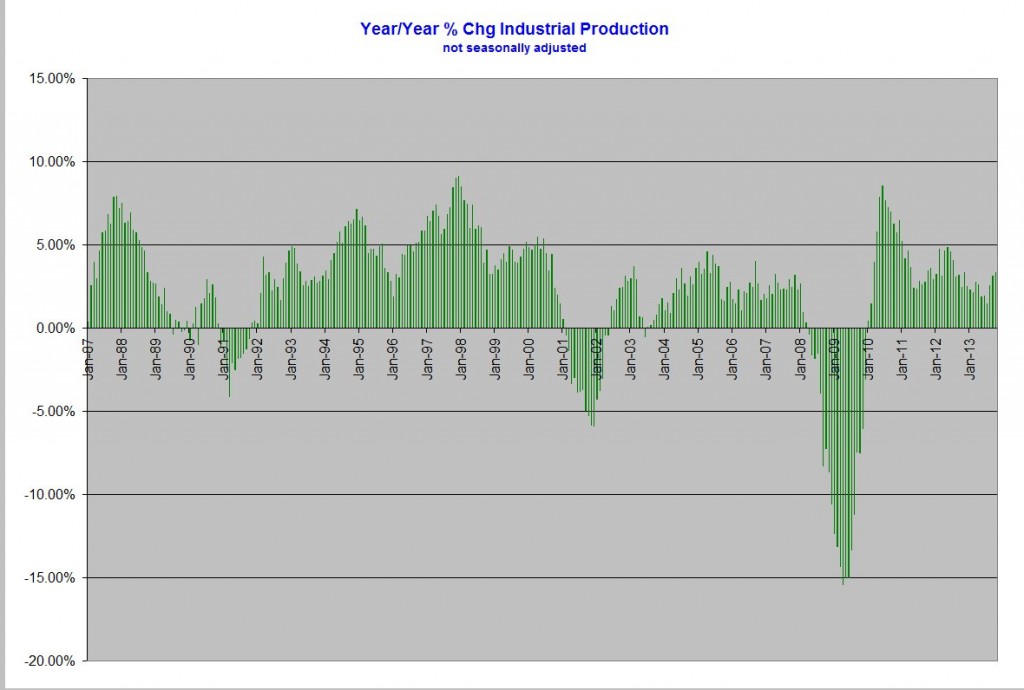

The New York Fed reported a contraction in its monthly manufacturing activity reading of (-2.2), lower than estimates and greeted by the market as another positive for continued quantitative easing. A little later, industrial production was revealed to have fallen (-0.1%) in October, and that was greeted as another positive for continued quantitative easing, especially with capacity utilization declining a couple of ticks. The year-on-year rate rose from 3.1% to 3.3%, and that was greeted as signaling an improving economy.

The chart below reveals that year-on-year production has indeed rebounded the last couple of months. The question is whether this in another lower peak, followed by another dip to a lower low. It’s difficult to say of course, and the current data is probably benefiting to some extent from 2012′s fourth quarter slowdown in the face of the impending budget-tax-sequester trifecta.

The business capital goods category is most likely to benefit from last year’s soft conditions, but we have a wait of another dozen days or so to see what the next durable goods report might reveal. The comparison might also partly show in the wholesale sales and inventory report, which reported a larger than expected increase in inventories for September. This too was hailed as boosting the next revision to third quarter GDP, but inventories have been a two-edged sword for years – when they start to run down again, as they probably will this quarter (and did last year), the next quarterly GDP print suffers. In the meantime, if the latest year-on-year increase in inventories of 2.56% stands up, it will be the lowest since July 2010.

Next Wednesday ought to be the most important day next week, barring any surprises, as it will have October retail sales in the morning, followed by existing home sales, and then the afternoon release of the minutes from the last Fed meeting. Naturally traders will be scouring the latter for signs that the magic formula will be served longer than expected. As for retail sales, the consensus is for a very modest increase of 0.1% after last month’s decline of (-0.1%), so it’s reasonable to expect that the actual number will be better.

The homebuilder sentiment index comes out on Monday, and is usually followed by the latest housing starts number the next day. However, the former comes from the private sector and the latter from the government, which is still catching up from the shutdown. The result is that starts will come out eight days later this time. I wouldn’t be surprised to see the index come in a point or three, given some of the restraint I’ve seen and heard in recent homebuilder results, and while the consensus calls for no change, I suspect the Street would call that a victory.

In another unusual departure, the consumer price index (CPI) is scheduled to come out Wednesday, one day before the producer price index (PPI) that usually precedes it by one to two days. If they are as weak as the import-export results imply, then that will also be good news. The closely watched Philadelphia Fed manufacturing survey comes out on Thursday, and whatever news it reveals should be good for the markets. The Labor Department has a couple of reports out, the quarterly cost index on Tuesday and the monthly JOLTS (labor turnover) survey on Friday, and they are also expected to be positive for stocks. It just stands to reason.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

It’s All Good: The Market Enters The Giddy Stage

Published 11/17/2013, 03:46 AM

Updated 07/09/2023, 06:31 AM

It’s All Good: The Market Enters The Giddy Stage

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.