Itron, Inc. (NASDAQ:ITRI) , one of the leading technology and services companies that is committed to the resourceful use of energy and water, inked a deal with Brazilian utility, Aguas de Matao to help the latter cut down on water losses and improve revenues.

The utility caters to nearly 27,000 customers in the City of Matao in Sao Paulo. The utility will upgrade its distribution system with Itron’s smart water solution, including software-as-a-service for analytics and meter data management.

The utility has been facing non-revenues water levels of up to 50%. With the help of Itron’s solution, Matao can use water judiciously as well as with the detailed meter data Aguas de Matao can monitor the system performance and improve water efficiency. The deal will also allow Águas de Matao to detect leaks, meter blockages, backflow, excessive consumption or significant pressure drop.

The water solution includes residential and commercial & industrial (C&I) water metering automation and monitoring technologies. Itron Temetra’s advanced data collection and data management software will help Aguas de Matao to collect and process advanced data and generate insights from across the utility’s distribution network.

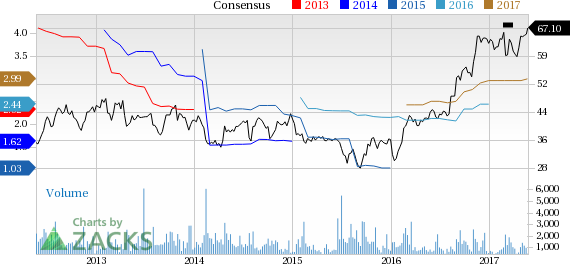

Itron has outperformed the Zacks categorized Electrical Test Equipment industry over the past one year. The stock has gained 53.4%, while the industry recorded 48.4% of growth during the same time frame.

Itron is likely to benefit from consistent focus on restructuring strategy, product development, and strong backlog position. The company anticipates that its investment in the OpenWay Riva IoT solution, and differentiated software and services offerings, combined with ongoing operational discipline, will drive financial results. Further, strong cash flow position and new projects will prove conducive to growth.

Fluctuation in currency rates, higher expenses and increased competition are likely to pose challenges for the company in the near term.

Itron, Inc. Price and Consensus

Zacks Rank & Key Picks

Itron carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the computer and technology space include Teradyne, Inc. (NYSE:TER) , Axcelis Technologies, Inc. (NASDAQ:ACLS) and Agilent Technologies, Inc. (NYSE:A) .

Teradyne has expected long-term growth of 10% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axcelis Technologies has expected long-term growth of 20% and flaunts a Zacks Rank #1.

Agilent Technologies has expected long term growth of 9.7% and carries a Zacka Rank #2 (Buy).

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

Agilent Technologies, Inc. (A): Free Stock Analysis Report

Itron, Inc. (ITRI): Free Stock Analysis Report

Teradyne, Inc. (TER): Free Stock Analysis Report

Original post

Zacks Investment Research