I've got to say, with a mere two trading days left in the year, and the utterly bizarre-o, Lewis Carroll-esque house of mirrors the market now inhabits, I wonder if there's even a point of offering conjecture about what's next for the market. After all, just look at what very recent history has given us:

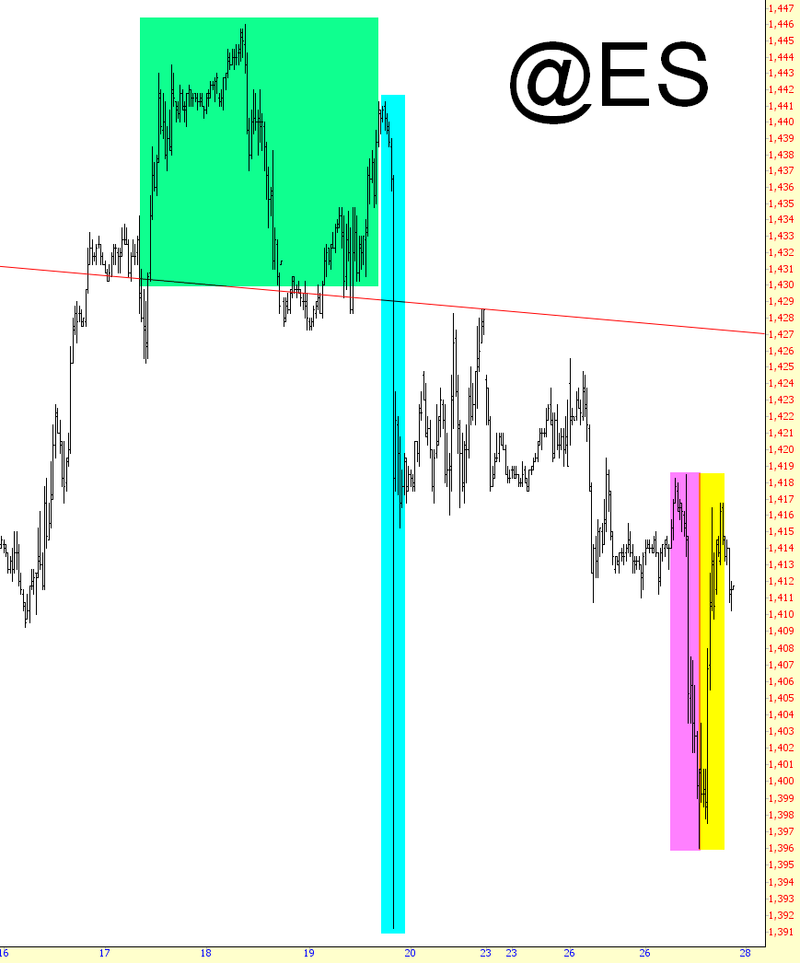

In green, a pointless "overshoot" of the former resistance level, followed in cyan by a flash-crash out of nowhere, followed in turn by countless ups and downs with every single press conference, Facebook posting, and tweet by a member of Congress, then, in magenta, a brief return to reality (this morning) and, just as quick, in yellow, an explosive rally based upon the fact that Congress is going to be in freaking session.

Jesus, Mary, and Joseph on a biscuit.

I pride myself on a preternatural ability to blast through charts at blinding speed and find meaningful patterns, support and resistance levels, breakouts, and breakdowns. It's one of the few things I'm seriously good at. But in this market, until our nitwit legislature pushes the farce that is the United States down to the next little milestone in our road to ruin, I have to wonder if the charts even matter anymore.

This whole fiscal cliff thing is a joke. Why? Uhh, simple:

(a) The United States is hopelessly in debt;

(b) It can only continue funding its bloated, groteseque bureaucracy with trillions more of unpayable debt until the end of time;

(c) Social Security and Medicare are both insolvent and will eventually be brought to ruin;

(d) Our politicians lack the will to do what needs to be done to wrench the country off its course of destruction

We could really use a dictator right about now, but those don't tend to work out really well in the end either, do they?

I imagine what's going to happen Sunday night is one of two things:

(1) A deal won't be had, and the e-mini markets are going to go absolutely ape-shit; we may end this crappy year of 2012 with the nice crash that it so richly deserves, or, more likely;

(2) The feckless and spineless inhabitants of Capital Hill will, for the five billionth time, kick the can down the road with some pussified miniature "down payment" type of "solution" that gives them a few more weeks to get their collective act together (at which time no act will be gotten together, and yet another chapter of this agonizingly endless novel will begin).

Do I sound bitter? I hope not. I intend to sound a combination of frustrated, cynical, and a touch hopeless.

Half of my portfolio remains in safe, boring, unprofitable cash. The other half remains in an array of sixty-one different short positions, all obviously on the small side. In a normal market, these carefully-selected shorts would shine as hallmarks of superb bearish stock-picking. In this market, however, they are at the mercy of the insanity in which we all reside, and I shall wish each of my sixty-one soldiers the very best of fortune, although they may find themselves draped over razor wire come Monday, the last day of this utterly retarded year named twenty-twelve.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is There A Point?

Published 12/28/2012, 12:54 AM

Updated 07/09/2023, 06:31 AM

Is There A Point?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.