A “slow-growth trap.” That’s how the Organization for Economic Cooperation and Development (OECD) described the global economy last week in its latest Global Economic Outlook. The group sees world GDP advancing only 3 percent in 2016, the same as last year, with a slight bump up to 3.3 percent in 2017.

Catherine Mann, the OECD’s chief economist, urged policymakers around the world to prioritize structural reforms that “enhance market competition, innovation and dynamism,” as monetary policy has been used alone as the main tool for far too long. The longer the global economy remains in this “slow-growth trap,” Mann said, the harder it will become to revive market forces.

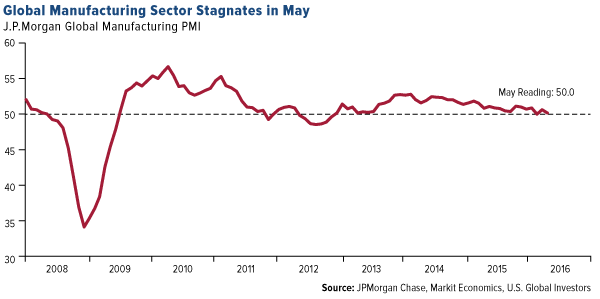

This is precisely in-line with what I, and many of my colleagues, have stressed for months now. To push the economy on a high-growth path, we need structural fiscal reforms, both here and abroad. One need only look at the global purchasing managers’ index (PMI) to see that manufacturing conditions have been slowing for the past several years since the financial crisis. The PMI in May registered a 50.0, which Markit Economics describes as “lethargic” and “low gear.”

U.S. manufacturing also saw further weakness in May, with its PMI reading falling to 50.7, more than a six-year low. The eurozone’s PMI fell to 51.5, a three-month low. Meanwhile, the Caixin China General Manufacturing PMI came in at 49.2, still below the neutral 50 threshold.

It’s clear that policymakers need to address slow growth with smarter fiscal policies, lower taxes and streamlined regulations. Zero and negative interest rate policies are taking their final gasp as far as what they can accomplish.

One of the bright spots continues to be India, whose own manufacturing sector expanded for the fifth straight month in May. The country’s GDP advanced an impressive 7.9 percent in the first quarter, following 7.3 percent year-over-year growth in 2015. This helps it retain its position as the world’s fastest growing major economy. Credit Suisse ranked India first in April’s Emerging Consumer Survey 2016, noting that:

“Indian consumers stand out among their emerging market peers with higher confidence about their current and future finances and relatively lower inflation expectations.”

Many analysts are referring to this as the “Modi effect,” in honor of Prime Minister Narendra Modi, elected two years ago on promises to reinvigorate business growth by cutting red tape and increasing infrastructure spending. Modi, who is scheduled to visit Washington this week, has had limited success at this point. But to be fair, India’s challenges run deep, and it will take quite a bit longer to make substantial changes to the country’s notorious regulations and corruption.

India’s Oil Demand Ready for Takeoff

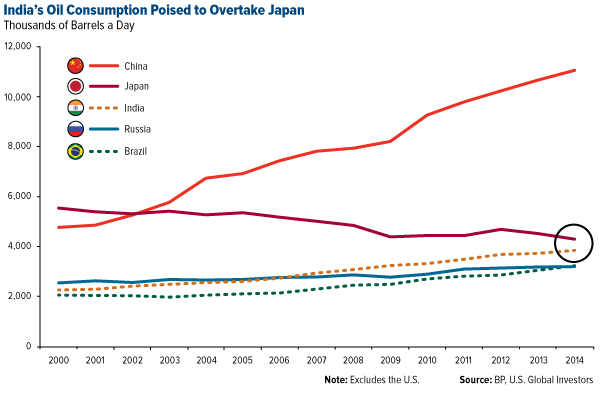

Make no mistake, China’s oil demand is still massive, second only to the U.S. But it has begun to contract in recent months, and there to offset the difference is India, which is expected to have the fastest growing demand for crude between now and 2040, according to the International Energy Agency (IEA). India’s consumption stood at 4.5 million barrels a day in March, which is up considerably from an average of 4 million barrels a day in 2015. The Asian country represented a whopping 30 percent of total global consumption growth in the first quarter. This makes it the world’s “star performer” growth market, a role occupied until recently by China. India is now poised to overtake Japan as the second largest oil consumer in Asia, if this hasn’t already happened.

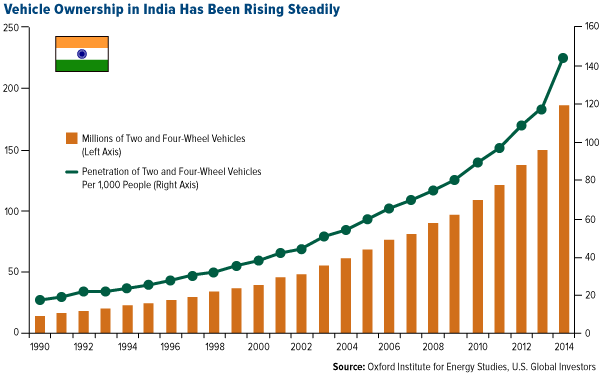

Contributing to India’s oil binge are policy changes that make its economy resemble China’s in the late 1990s, soon before its industrial boom. Compared to other major economies, India’s per capita consumption of oil is relatively low, as ownership of automobiles and motorcycles—many Indians’ preferred mode of personal transportation—is still developing, with penetration at merely 144 per 1,000 people. If we look just at passenger cars, the rate is closer to 17 per 1,000 people. (In the U.S., the figure is 850 per 1,000 people.)

This is the exciting part, of course. A couple of months ago I shared with you a factoid from my friend Gianni Kovacevic’s book “My Electrician Drives a Porsche?”, that in 1979 there were only 60 privately-owned automobiles in China. Today, it’s the world’s largest auto market.

India’s rise appears to be similarly dramatic. In the chart above, courtesy of a March report from the Oxford Institute for Energy Studies, you can see that the number of vehicles driving on Indian roads doubled between 2007 and 2014, thanks not only to an exploding population but also the rise of India’s “spending class,” as Gianni calls it. More than 600 million Indians are under the age of 25, based on 2014 data, and many in this cohort aspire to have social mobility and the American Dream. The country is now on track to become the third largest auto market by 2020, behind China and the U.S., and obviously this has huge implications for oil consumption.

Oil at $60 by the End of Summer?

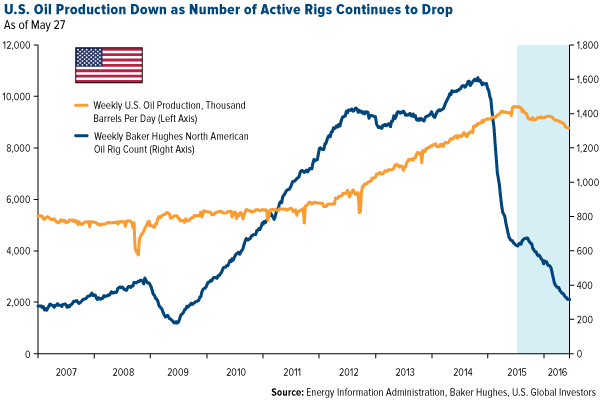

Despite OPEC’s failure to agree on a production cap, global oil markets are rebalancing faster than expected. U.S. producers, reacting to low prices, continue to trim exploration and production spending, leading to fewer active rigs and, consequently, less output over the past 12 months.

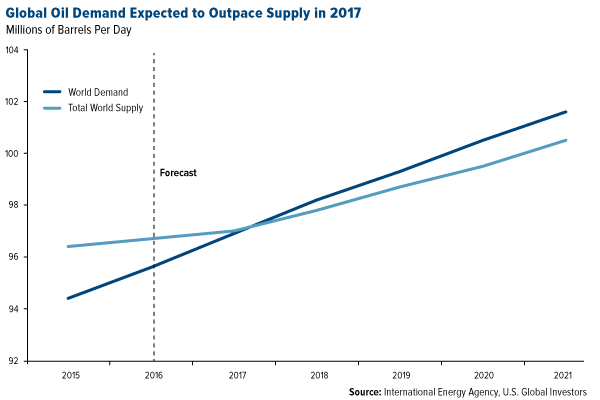

Meanwhile, demand remains strong, not only in India but around the world. The IEA, in fact, expects global demand to outpace supply in mid to late 2017. What’s more, analysts with Bank of America Merrill Lynch believe that oil demand will peak sometime after 2050, “as long as we remain in a relatively low oil price environment of $55-75 per barrel in real terms.”

Many prominent analysts, including British financials firm Standard Chartered’s chief economist, now see oil climbing above $60 by the end of the summer. Goldman Sachs (NYSE:GS) also appears to have turned bullish, noting that global storage levels are heading into a deficit “much earlier than we expected.”

Helping to turn sentiment around is the arrival of the busy summer travel season, as I told CNBC’s Pauline Chiou last week. This year in particular is expected to be one for the history books—not just on roads but also by air. With fares down throughout 2015 and the first half of 2016, industry trade group Airlines for America estimates 231.1 million passengers will fly on U.S. airlines during the months of June, July and August. This would mark a record high, up from the 222.3 million that flew over the same period last year.

All Eyes on Gold

I’d like to thank Verizon union members for the strong pop in gold prices on Friday last week. As you might already know, thousands of Verizon workers were on strike during the month of May and consequently were counted as unemployed. This contributed to the weakest jobs report since 2010—only 38,000 new jobs were created in May, a dramatic dive from March’s 180,000—adding to speculation that an interest rate hike this month will once again be delayed. This bodes well for gold, which had its strongest daily gain since March Friday, soaring up more than $33 an ounce.

More than that, though, gold is up on Fear Trade worries, with negative interest rates draining yield around the world.

Disclosure: This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.