Key Points:

- Price action trading near key reversal zone.

- RSI Oscillator close to overbought.

- FOMC rate hikes likely to start a significant slide in the gold price.

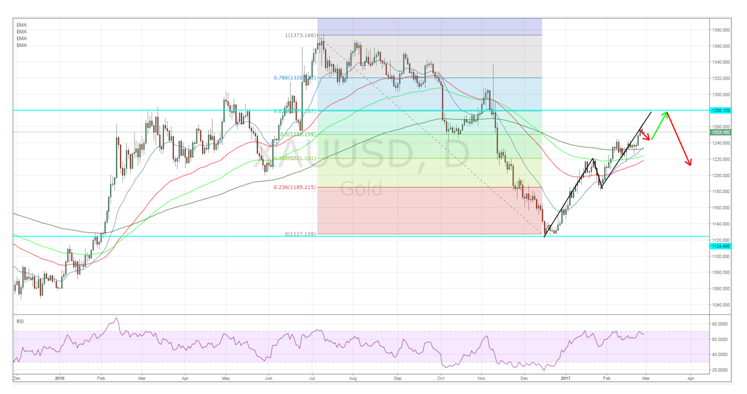

Gold has seen a resurgence over the past few months as the metal has seemingly rallied from the December $1122.75 low as it clawed its way back above the key $1200 handle. Subsequently, price action has proved fairly robust as it has climbed higher in a relatively clear ABCD pattern that looks close to completing around the 61.8% Fibonacci level. However, the momentum has started to stall and we could be seeing the first stages in a retreat back towards the key $1200 handle.

In fact, a cursory review of the underlying technical indicators provides some illuminating information. In particular, the RSI Oscillator is currently flirting with overbought levels and has been for some time despite price action having continued to climb. In addition, price action is nearing a key reversal point at the 61.8% Fibonacci level at $1280.10. This level also happens to coincide with the end of the potential ABCD pattern. Subsequently, the pressures are building for a significant pullback.

Additionally, gold faces another important battle as the FOMC continues to ratchet up the rhetoric for a March interest rate hike. The last decade has seen a relatively impressive correlation between the price of gold and interest rates (Treasury Yields). The seemingly depressed rates of return, due to economic malaise, has seen capital flood into the precious metal. However, with a new cycle of tightening ahead of us the spectre of looming falls could be very real indeed.

Subsequently, the medium term is likely to see the precious metal fall further to form new lows well below the $1046 mark. In the short run, the most likely scenario involves price action continuing to rise back towards the $1280 mark before a breakout failure sends the metal sharply lower towards the key $1200 handle over a period of weeks.

Ultimately, the upside is likely to be relatively limited for the precious metal by a range of fundamental factors. Subsequently, the most likely contention is the bearish one which may explain some of the current short side positioning that has been evident. Regardless, gold is in for a rough few weeks given the mounting risk of short term interest rate hikes.