The impact of the coming change will be dramatic both in terms of its impact on Europe (China’s single largest trade partner) and the US with whom China is fast developing a trade war.

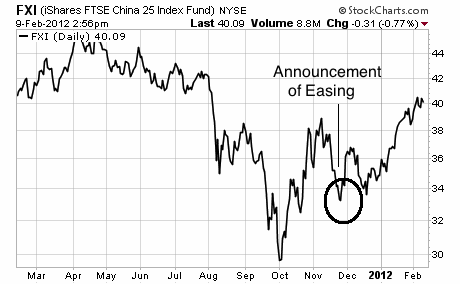

Most of the rally in China’s markets over the last few months stemmed from the belief that China was going to begin monetary easing again in order to soften its economic slowdown.

Risk Of Hard Landing Rises As China Begins Monetary Easing (From Forbes 11/18/11)

"Chinese policymakers have begun to selectively ease macroeconomic policy to support growth, according to Barclays’ analysts. While full on easing won’t come until 2012, China will face a significant economic slowdown as the export sector feels the impact of a fragile global economy, and residential investment, which makes up 12% of GDP, falls drastically as the People’s Bank of China (PBoC) seeks to control a real estate bubble.

In their attempt to execute a “soft landing,” China’s leaders have engineered a slowdown by tightening policy over the last several quarters. This was a response to unwanted consequences of prior stimulative policy. "

Note the effect this view had on the Chinese market’s action:

China cannot risk a severe economic slowdown. There are already over 30 million Chinese who have lost their jobs, left the coastal cities, and are moving back to the countryside.

Moreover, during times of economic turmoil, civil unrest grows. Since 2006, China has averaged 90,000+ “mass incidents” (riots and protests) per year. In 1993, during the boom years, this number was less than 10,000.

Suffice to say, an economic slowdown is a MAJOR problem for China’s Government.

This is most recently clear in the village of Wukan, which in September began a series of protests based on the fact that the Government took away the villagers’ farmland and fishing rights (thereby removing their primary means of earning a living).

Wukan began a mass sit-in/ protest. The tiny village of 13,000 has since become such a headache (thanks to the international press) that China’s Government actually let the villagers vote on who should be their local officials.

This is absolutely unbelievable. China…letting a village vote on its leadership. And it gives us some idea of just how tenuous the Chinese Government’s control over the general population is.

However, while unemployment is a big problem for the Chinese Government, inflation is a HUGE problem. Over one third of China’s population lives off less than $2 a day. If the price of food rises in China… those “mass incidents” will explode into outright widespread rioting and civil unrest.

Well, thanks to China’s aggressive easing since November, inflation is back in a big way (it had been in decline since July 2011 before this).

China’s inflation rebounds in January, renewing pressure to control living costs

(From Washington Post 2/8/12)

China’s inflation rebounded in January as food prices soared, renewing pressure on Beijing to control surging living costs as it tries to boost slowing growth in the world’s second-largest economy amid warnings of a global downturn.

Consumer prices rose by an unexpectedly strong 4.5 percent over a year earlier, up from December’s 4.1 percent, data showed Thursday. Food prices jumped 10.5 percent, accelerating from the previous month’s 9.1 percent.