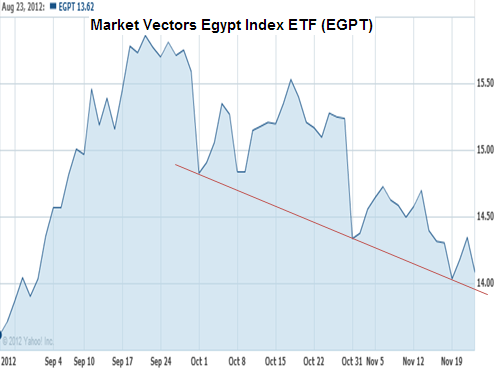

After a strong rally in late summer, Egypt's stock market has been on a steady decline. First, the correction has been driven by the recent tensions surrounding Israel and Hamas. Hamas jihadist groups have close ties with militants in the Egyptian Sinai and enjoy support throughout Egypt. If Israel were to take further military action, it could destabilize the region. But recently another alarming development has put pressure on Egypt's equity markets.

WSJ: The Egyptian revolution took another bad turn Thursday, as President Mohamed Morsi gave himself dictatorial powers over the legislature and courts. The world has feared that the Muslim Brotherhood would favor one-man, one-vote, once, and the Morsi coup is an ominous sign.

"The people wanted me to be the guardian of these steps in this phase," Reuters quoted Mr. Morsi as saying on Friday. "I don't like and don't want—and there is no need—to use exceptional measures. But those who are trying to gnaw the bones of the nation" must be "held accountable."

Nations with no history of democracy and lacking strong democratic institutions often end up in such situations. People forget that the ability to elect one's leader is only a step in building a democratic state (after all, Adolph Hitler was also democratically elected). In many cases people simply elect another dictator - which seems to be the situation in Egypt currently. Of course with food prices elevated, it doesn't take much to spark widespread social unrest.

In spite of being a promising emerging market and touted by some as a new post-Arab-Spring opportunity, Egypt has taken a turn for the worse.

As is often the case, Western leadership and intelligence sources remain one step behind the events in the Middle East.

WSJ: Mr. Morsi's coup is also awkward for the Obama Administration, which had been praising the Egyptian in media backgrounders for his role in brokering the cease-fire between Israel and Hamas. Mr. Morsi was hailed as a moderate statesman. Yet Secretary of State Hillary Clinton had barely left Cairo before Mr. Morsi made his move. He may have figured that all the praise made it easier for him to grab more power.

In a style typical of such regimes, the government is making an attempt to stabilize business conditions and buy time by injecting government capital into the economy. The money will be effectively used as a bribe but the effect is likely to be quite temporary in nature.

Egyptian Government (official statement): Prime Minister Dr. Hisham Qandeel said the government will pump in almost EGP 276 billion ($45bn) in investments at the business sector, and economic organizations with the participation of the private sector in the plan of the fiscal year 2012/2013.

The plan aimed at increasing growth rates and creasing more job opportunities.

The Prime Minister gave the statement during his meeting with the committee in charge of investments map which was attended by Investment Minister and representatives of finance, industry and domestic trade ministries.

Qandeel discussed means to attract more investments and foreign and Arab capital and Egyptians abroad investments.

With Egypt's implicit support for Hamas (an organization that has little interest in economic stability) and more civil unrest on the way, the hopes for near-term market recovery have now been dashed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Investors' Hopes For Egypt's Stock Market Recovery Have Been Dashed

Published 11/25/2012, 01:42 AM

Updated 07/09/2023, 06:31 AM

Investors' Hopes For Egypt's Stock Market Recovery Have Been Dashed

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.