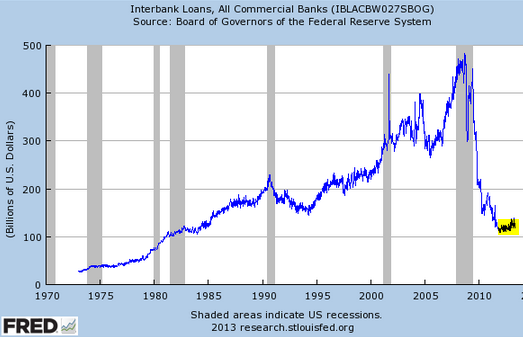

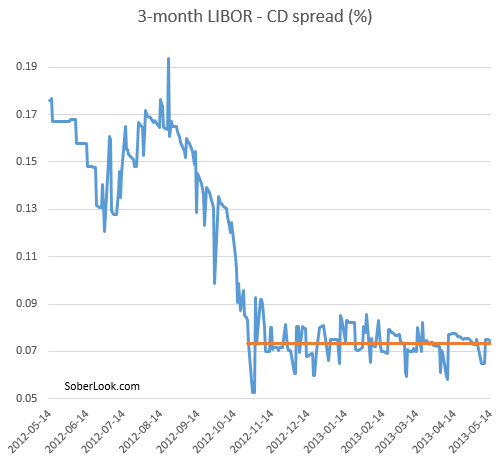

As predicted back in October, dollar LIBOR is now being priced (roughly) off certificate of deposit (CD) rates. Imagine being a bank's treasurer responsible for submitting LIBOR quotes to the BBA. If you can't justify how you obtained your rate and someone accuses you of LIBOR manipulation, it could cost you your job and more. The sources of LIBOR rates were supposed to be quotes on interbank loans. But unsecured interbank lending volumes have been suppressed since the financial crisis. In fact current levels are similar to what they were in the 80s (see chart below). And most of the activity is in the overnight markets with very little transacted at maturities of one month or greater. (Note: some confuse the sources of LIBOR rates, such as interbank lending, with products that price using LIBOR rates, such as interest rate swaps. Here we are discussing the sources.) With little to go by in the way of actual quotes, setting these rates becomes a real headache for banks. By pricing LIBOR off something that's highly transparent, like CD rates, makes the quotes easier to justify. After all, a CD rate is where a bank is willing to borrow money for a fixed term - which is what LIBOR is supposed to be. That's why LIBOR has been fixed at a fairly constant average spread to CD rates. The 3-month LIBOR is now roughly 7 basis points above the 3-month CD rate (note that the CD average here includes retail quotes - larger term deposits yield more and the spread of those large CDs to LIBOR is even tighter).

With little to go by in the way of actual quotes, setting these rates becomes a real headache for banks. By pricing LIBOR off something that's highly transparent, like CD rates, makes the quotes easier to justify. After all, a CD rate is where a bank is willing to borrow money for a fixed term - which is what LIBOR is supposed to be. That's why LIBOR has been fixed at a fairly constant average spread to CD rates. The 3-month LIBOR is now roughly 7 basis points above the 3-month CD rate (note that the CD average here includes retail quotes - larger term deposits yield more and the spread of those large CDs to LIBOR is even tighter).

Ironically CD volumes are declining as well. But as long as banks continue to openly quote the full CD term structure (across different maturities), banks will use the CD curve as a guide to set LIBOR rates.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

In An Attempt To Avoid More Controversy, Banks Are Pegging LIBOR To CD r

Published 05/21/2013, 04:09 AM

Updated 07/09/2023, 06:31 AM

In An Attempt To Avoid More Controversy, Banks Are Pegging LIBOR To CD r

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.