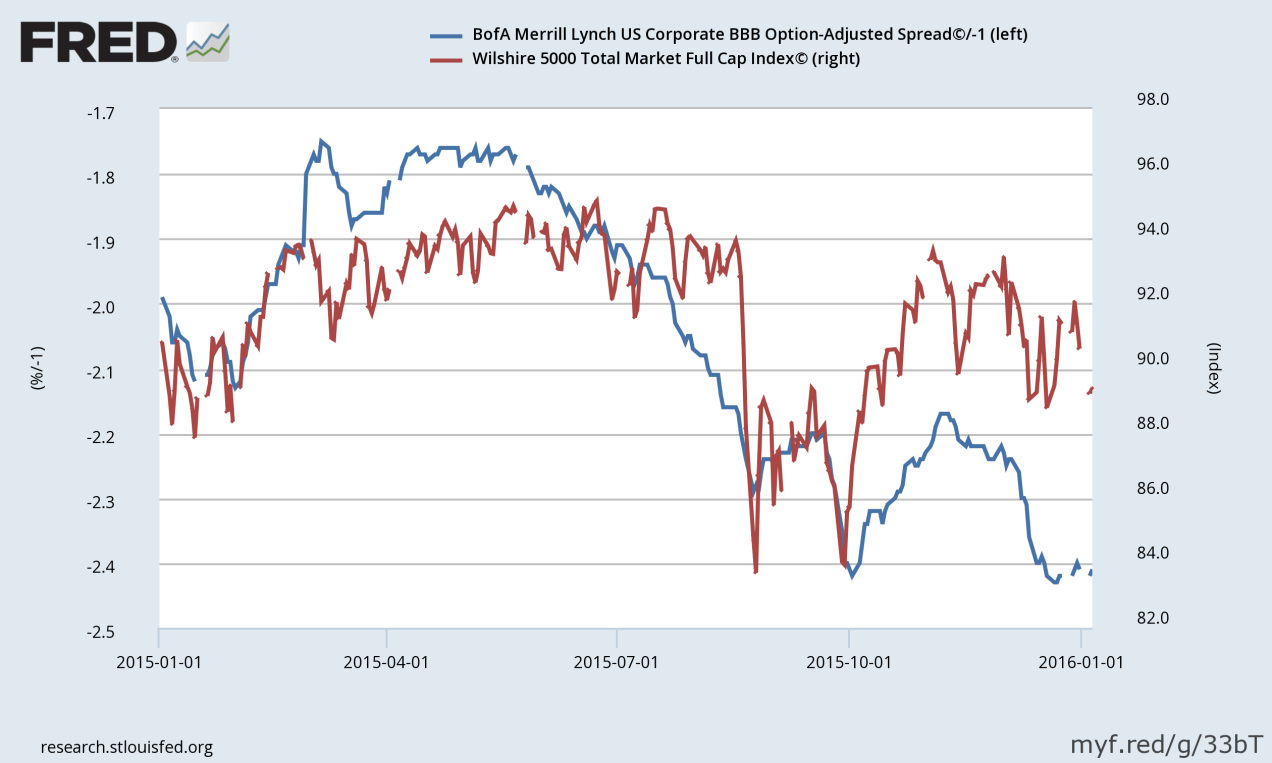

The chart above tracks the broad stock market against the spread of lowest-rated investment-grade corporate bond yields. They normally track each other very closely as they both reflect broad investor risk appetites.

When investors are hungry for risk stock prices move higher and corporate spreads get narrower. When risk aversion takes over, however, stock prices fall and spreads widen.

Another reason they closely track each other is corporations’ ability to access credit is very closely tied to the overall demand for equities. When it’s very cheap for companies to borrow, it’s very easy for them to fund stock buybacks and acquisitions of other companies.

Certainly, these two factors have been very important to the bull market of the past six years or so. Ray Dalio recently said he estimates that buybacks and M&A have roughly amounted to 70% of the total demand for equities.

As spreads widen, it becomes more expensive for companies to borrow and thus more difficult to fund stock buybacks and acquisitions. If Dalio is right then the phenomenon of widening spreads, which has been ongoing for about a year-and-a-half now, ultimately means stocks are gradually losing their single greatest source of demand.

Unless spreads reverse course and begin to narrow again as they did throughout the heart of the bull market, at best they represent a major headwind for stocks. At worst, it could mean that the bull market has lost its final, and most important, backstop.

The Fed has stopped supporting risk appetites via QE; margin debt looks to be reversing off of record-high levels; individual investors have already maxed out their equity exposure; profit margins and earnings have peaked and begun to roll over; corporate leverage is already off the chart and now spreads are widening, making it more difficult to sustain the current pace of buybacks and acquisitions.

Where then will the incremental demand come from to keep the bull market going?