The euro is tanking again, as the ECB starts buying bonds for its long-promised “whatever it takes” QE program. Yesterday’s exchange rate move was dramatic enough to generate headlines like this, from Forbes: Euro Nears Parity With U.S. Dollar

And the decline is accelerating:

What we’re seeing here is a brilliantly-fought currency war battle, i.e., an aggressive devaluation that will, in the coming year, give the incoherent mess that is the eurozone some much needed-breathing room in which to try to get its financial house in order.

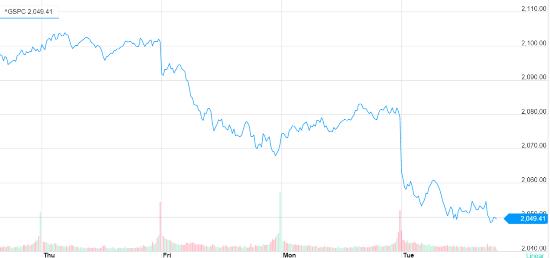

But a victory by definition has another side. Someone has to lose, and in this case the loser is emphatically the US. While the euro is falling and European exporters are happily undercutting their American competitors, financial analysts are calculating the impact on the profitability of US multinationals. And they’re not liking the result. Here’s the S&P 500 over the past five days:

US stocks are now down for the year, which means a couple of things. First, the corporations that borrowed tens of billions of dollars in the first quarter to buy back their shares are now under water. Share repurchases are a kind of carry trade in which the company generates positive cash flow as long as the dividend yield on the stock it buys and retires is higher than the interest on the bonds it issues to do the deal.

But if the share price goes down, the deal generates a capital loss. Corporate CEOs who have been “earning” huge year-end bonuses by pushing their share prices up with borrowed money are now wondering how they’ll explain spending billions on their own stock at the very top of a long bull market. Annual meetings are about to get a lot more entertaining.

Meanwhile, other than lots of people getting part-time jobs, the latest batch of economic statistics are already pretty grim. Just yesterday morning:

US wholesale stockpiles increase 0.3 percent in January while sales plunge 3.1 percent

WASHINGTON (AP) — U.S. wholesale businesses increased their stockpiles by a modest amount in January as sales plunged by the largest amount in six years.Stockpiles held by wholesale businesses rose 0.3 percent in January after no change in December and a 0.8 percent November increase, the Commerce Department reported Tuesday.

Sales dropped 3.1 percent in January following a 0.9 percent December decline. The January decline was the largest setback since sales fell 3.6 percent in March 2009 when the country was mired in the Great Recession. January marked the fourth consecutive month that sales have fallen.

The other interesting consequence of a soaring dollar is that the Fed officials who allowed it to happen are now wondering what they were thinking when they promised to raise interest rates. After all, a soaring currency is functionally the same thing as higher rates in that both raise the price of money and restrain economic growth.

With money suddenly very expensive and growth seeming to fall off a cliff, some sort of “mission accomplished” language is no doubt being worked up for the next Fed meeting, in which the strong dollar will be a rationale for walking back the rate hike rhetoric.

So the real question isn’t how low the euro can go but how high the dollar can go before the US economy has a nervous breakdown.

And then there’s gold. While it’s getting trashed in dollar terms (leaving US gold bugs curled into fetal positions waiting for the torture to stop), it’s up nicely ineuros. The next chart certainly looks like an incipient bull market.