Today the London Bullion Market is closed for a national holiday.

Friday’s AM fix was USD 1,666.50, EUR 1,329.16 and GBP 1,051.88 per ounce.

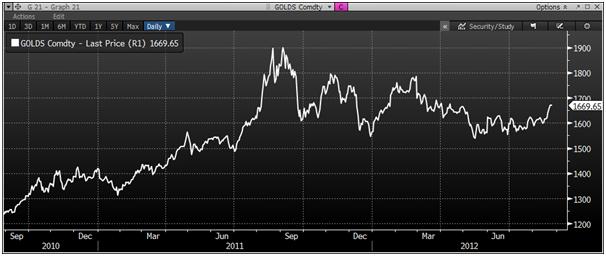

Gold climbed $0.80 or 0.05% in New York on Friday and closed at $1,669.80. Silver surged to as high of $30.71 and finished with a gain of 0.52%. On the week, gold climbed 3.3% and silver gained a whopping 9.3%.

Cross Currency Table – (Bloomberg)

Gold hit a high not seen since mid April on Monday, continuing the momentum from last week’s gains as investors expect further monetary stimulus from central banks and become increasingly concerned about inflation.

Consumer price inflation data in the US is due Friday and is expected to move higher on higher fuel and food costs.

There may be more hints of further cheap money from the Jackson Hole Symposium later this week as finance chiefs gather to discuss economic policy behind closed doors.

Monetary risk remains high especially in the euro zone after Jens Weidmann, head of the Bundesbank, sent a shot across the bows of the ECB’s Draghi and likened the mooted ECB bond-buying plans to a dangerous drug.

Merkel praised Weidmann for speaking out about his doubts and said she saw strong Bundesbank influence within the ECB as positive. But she took care not to voice any support for his criticism of Draghi's policies. Weidmann rejected suggestions that he was isolated on the ECB Governing Council in having such reservations. "I hardly believe that I am the only one to get a stomach ache over this," he said.

Alexander Dobrindt, a senior German politician who has been the Executive Secretary of the Christian Social Union of Bavaria since 2009, was more direct, saying Draghi risked passing into the history books as the "currency forger of Europe." A conservative ally of Merkel, Dobrindy echoed Bundesbank’s Weidmann that Greece should leave the currency bloc by next year.

The comments show the huge divisions in Germany over the debt crisis now in its 3rd year and the understandable concerns of inflation and even hyperinflation. The Bundebank and senior politicians and allies of Merkel may thwart Mario Draghi’s big plans to do “whatever it takes” to solve Europe’s financial collapse.

One way or another, the euro is certain to fall in value in the long-term.

Gold USD Daily – (Bloomberg)

As was pointed out by Merryn Somerset Webb at the weekend (see commentary) the euro has defied negative commentary but the question is for how much longer.

The fundamentals of the euro are appalling – just to keep eurozone broad money supply from contracting alone will take a whopping €3 trillion. “The euro is clearly a bad currency by any definition.” While some fund managers advocate shorting the euro, we believe this is a high risk strategy for investors as in the short term the euro could stage a strong rally – should for example Grexit happen. A "core euro" could and would likely become stronger.

Therefore, investors' and savers' best way to protect against a fall in the value of the euro and indeed other fiat currencies is to have an allocation in physical gold.

US economic data published this week follows. Today is the Chicago Midwest manufacturing index for July at 1230 GMT. Tuesday is the Case-Shiller 20-city Index and Consumer Confidence. Wednesday is GDP, Pending Home Sales, and the Fed’s Beige Book. Thursday is Initial Jobless Claims, Personal Income & Spending, and Core PCE Prices. Friday is Chicago PMI, Michigan Sentiment, and Factory Orders.

NEWSWIRE

(Bloomberg) -- Platinum to Trade at Premium to Gold

Platinum may trade at a premium over gold within six months as a lower supply of the white metal boosts prices, according to Jeffrey Rhodes, global head of precious metals at INTL FCStone Inc. Platinum may climb to $2,000 an ounce by December, while gold advances to a record $1,975 an ounce, Rhodes said at a conference in Hyderabad, India today. Spot platinum ended at $1,549.75 yesterday after rallying on supply disruptions in largest producer South Africa. Gold was at $1,670.55.

G10 and Precious Metals Currency Ranked Returns – (Bloomberg)

(Bloomberg) -- Platinum Prices More Bullish Next Year, Standard Chartered Says

Platinum prices may climb next year on less supply from mines in South Africa, the biggest producer, Jeremy East, global head of metals trading at Standard Chartered Bank, said.

Platinum is more bullish next year because many mines in South Africa will be closing, so supply will be reduced and the market will be more balanced, East said at a gold conference in Hyderabad. “Tighter regulations and problems at trade unions have created a lot of challenges at the production side,” he said.

Gold may climb to $1,750 an ounce by December because of problems in Europe and a possibility of further stimulus programs to boost economies, he said.

(Bloomberg) -- Gold Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended August 21, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets prices will rise, outnumbered short positions by 130,684 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 16,380 contracts, or 14 percent, from a week earlier.

(Bloomberg) -- Silver Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York silver futures in the week ended August 21, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets prices will rise, outnumbered short positions by 21,200 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 5,613 contracts, or 36 percent, from a week earlier.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

History May View ECB’s Draghi As 'Currency Forger Of Europe'

Published 08/27/2012, 08:41 AM

Updated 07/09/2023, 06:31 AM

History May View ECB’s Draghi As 'Currency Forger Of Europe'

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.