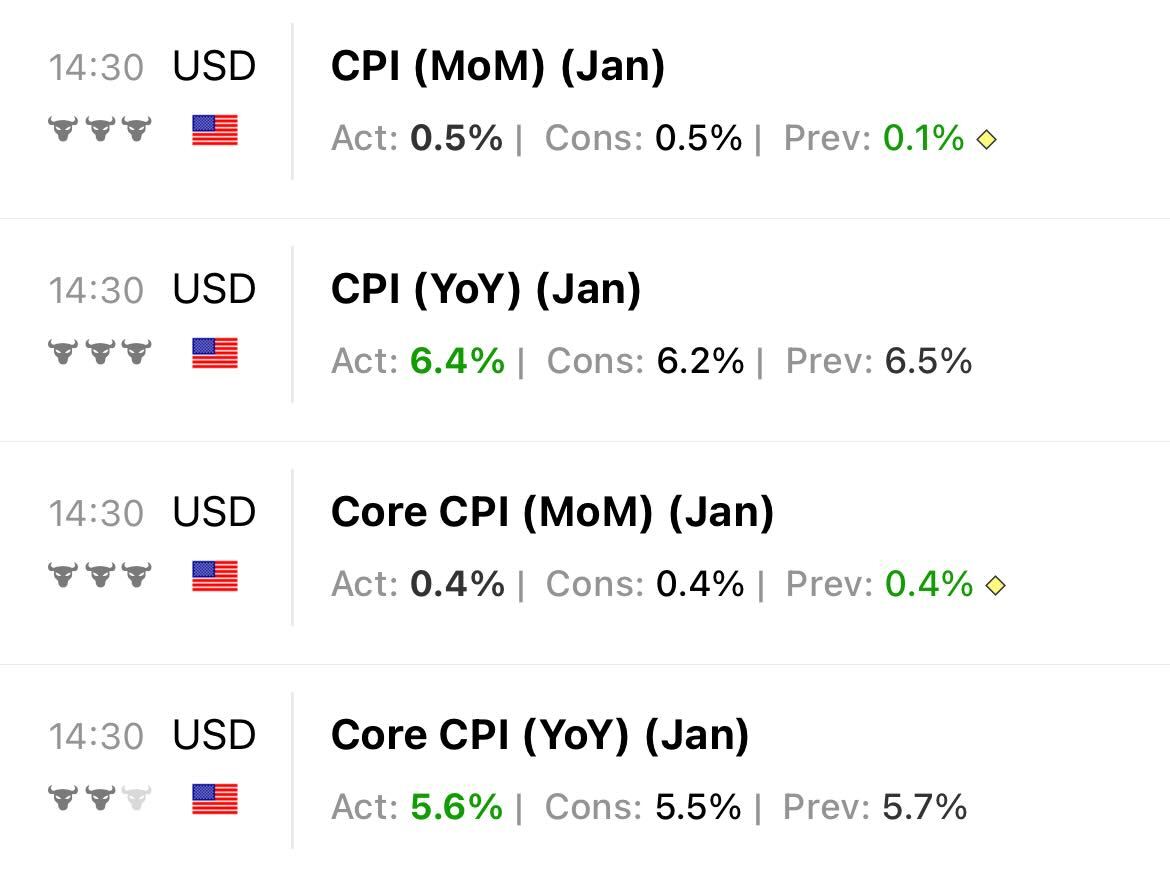

- Despite coming in below the previous reading, U.S. inflation data was slightly above expectations

- The initial market reaction was a mixed bag

- However, it is likely that inflation could fall sharply over the next two months due to the base effect

- March CPI change y/y= 6.4% + 0.4% -0.8% = +6%.

- CPI YoY change April=6%+0.4%-1.2%=+5.2%.

The highly-expected January U.S. inflation reading came out yesterday with figures below the previous month but slightly above expectations.

Source: Investing.com

Markets initially reacted relatively well to the news, with the NASDAQ Composite closing up +0.57% and the S&P 500 virtually flat (-0.03%).

Now, regardless of how the next few weeks go, I would like to explain in this analysis why inflation could fall sharply over the next 2 months into the 5% range.

Let's consider the 'base effect', i.e. comparing data from different periods for simplicity's sake. The photo below shows the seasonally adjusted CPI. The data observes the following order: Date and time first, Actual data, percentage change, and the previous number.

Source: Investing.com

*Note: This calculation obviously doesn't take into account major unforeseen events (in the sense it is only relevant if no new war breaks out or commodities do not double).

Think of it as an inflation index which, instead of tracking changes, directly tracks the reference value of the so-called seasonally adjusted CPI index.

Now, in the middle column, I have added some small numbers in white and red.

Without going into too much detail, the concept is quite simple. To each index value, based on the reference month, I add the new variation of the current month and remove the variation of the same month but of the previous year.

To simplify, if the last value was +6.4% in February (referring to January), the next month, we will add the new monthly variation of 2023 (March over February) and subtract the variation of the same period but of 2022.

So to understand: +6.4% +monthly variation March (for February) 2023-monthly variation March (for February) 2022. On the basis of the numbers in the columns, we can conclude that a further fall in inflation in the next two months is likely.

In 2022, the increases in March and April were +0.8% and +1.2%, respectively.

Since these two figures have to be removed from the equation above, it is easy to see (intuitively) that if the changes in the next 2 months are in the range of +0.4% or +0.5%, then the overall figure must necessarily fall.

And the smaller the changes over the next 2 months, the smaller the final figure will be.

So let us assume that the changes over the next 2 months will follow the trend seen in February (an increase of +0.4%). In other words, we would arrive at the following numbers:

So within a couple of months, or at least within the next 2 surveys, we could end up with a CPI of around 5%. This will happen as the Fed sets rates to 5% and above. This is the famous pivot point that I keep telling you about.

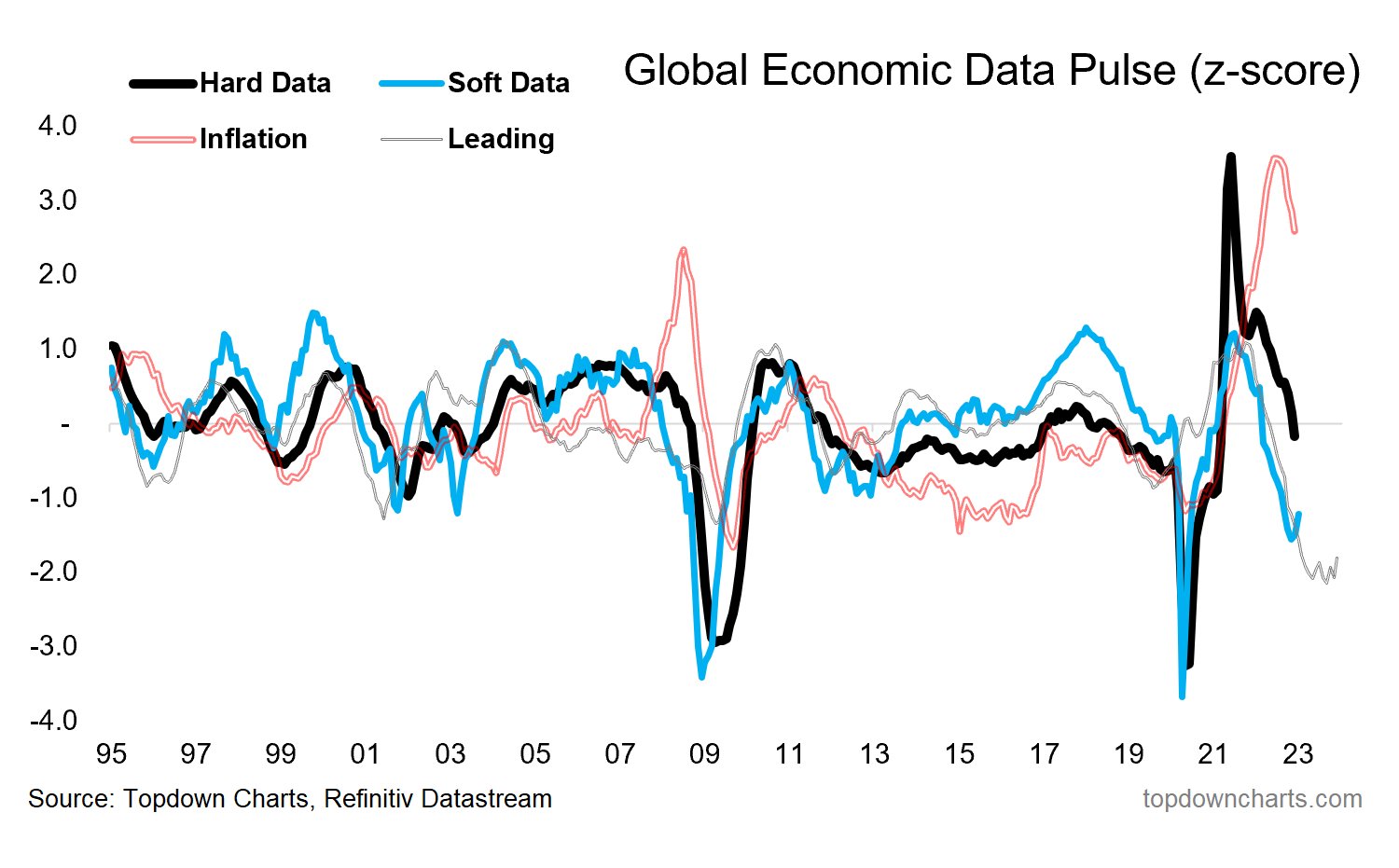

Inflation in the business cycle follows leading indicators and economic data. See the chart below (only the pink line is missing in the general decline).

Source: Topdown Charts

Once again, nobody can predict the future, but at least we have a probable scenario to consider.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such and is not intended to encourage the purchase of assets in any way. I would like to remind you that any type of asset is valued from many points of view and is highly risky and; therefore, any investment decision and the associated risk remain with the investor.