Heliad Equity Partners KGAA (DE:HPBGn) is repositioning its portfolio following the management changes earlier this year. This involves the gradual disposal of holdings in listed companies (with stakes in DEAG Deutsche Entertainment and Cyan already entirely sold) and selected funding measures in non-listed companies (such as Springlane). The company also booked further write-downs on unlisted holdings in H119. The potential acquisition of flatex by a strategic investor at a price ahead of the market value remains Heliad’s key equity driver.

In the black due to higher flatex’s share price

Heliad’s H119 net profit reached a minor €0.4m (compared to a significant loss of €15.8m in H118), which was mainly assisted by the share price appreciation in its largest holding flatex (representing c 61% of NAV at end-June 2019). In contrast, it booked €2.4m write-downs on unlisted holdings (in particular Muume and Libify). Consequently, its net valuation gain reached €1.6m in H119 (vs a €12.3m loss in H118). At the same time, Heliad reported a minor net disposal loss at €0.2m vs a €0.6m gain in H118.

Shift away from listed holdings

Heliad intends to focus on investments in unlisted holdings across various industries, with a possible emphasis on the fintech, IT and security, blockchain and digital brands sectors. We note that this would represent some overlap with FinLab’s investment strategy, which is Heliad’s main shareholder and whose board members recently replaced the previous board at Heliad. As the company exits its listed holdings and redeploys the proceeds, we expect its portfolio may start to resemble FinLab’s at some stage, which may encourage the owners to merge the entities. We note that although Heliad may retain its stake in flatex in the short term, it may decide to sell it in the case of an offer from a strategic investor.

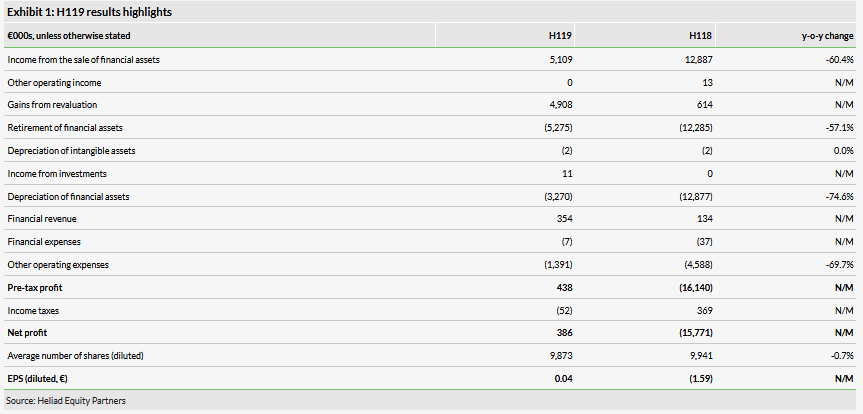

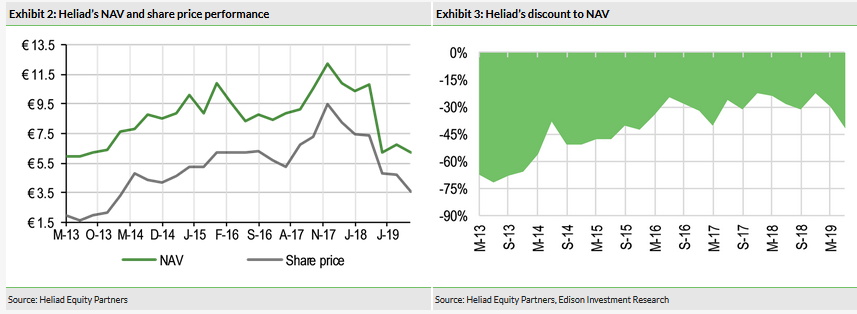

Valuation: Still trading at a sizeable discount to NAV

Heliad trades at a 23% discount to last reported NAV per share at end-June 2019 of €6.25. After the balance sheet date, the shares in its largest listed holding (flatex) went up by c 45%, driven by acquisition rumours and good financial results. Taking into account movements in Magforce and Elumeo shares after end-June 2019 and adjusting Heliad’s NAV for the change in the share price of all three listed holdings, we estimate Heliad is trading at a 39% discount to NAV.

Business description

Heliad Equity Partners is a Germany-based investment company that aims to invest in disruptive companies from the DACH region operating in the technology (fintech, IT security and blockchain) and digital brands sectors. The company is undergoing a restructuring of its legacy investment portfolio.

H119 results: Assisted by flatex revaluation

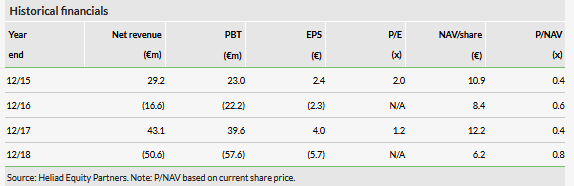

Heliad’s net income reached €0.4m in H119 compared with a net loss of €15.8m in H118. This was largely a function of the net revaluation gain, which stood at €1.6m in H119 versus a net loss of €12.3m in H118. Based on our estimates, we believe the main positive contributor was flatex (formerly Fintech Group), Heliad’s largest portfolio holding with a c 61% share in its NAV at end-June 2019 (54% at end-2018). flatex’s share price increased c 14% in H119, translating into a c €4.6m valuation impact. This was partially offset by the write-downs of non-listed holdings at €2.4m in H119 (none booked in H118). Based on our conversation with the company, we understand this was associated primarily with Muume and Libify. An additional minor negative contribution came from Elumeo’s share price decline of c 40% in H119. Last year, Heliad’s results were burdened by the fall in the share price of nearly all listed portfolio holdings, reflecting the broader conditions in equity markets.

The company reported a minor net disposal loss of €0.2m in H119 compared with an €0.6m gain in H118. During the period, the company reduced its holdings in all listed companies (except Elumeo), including flatex, MagForce, Cyan, Max21 and DEAG Deutsche Entertainment. We understand this is part of Heliad’s repositioning process, as it intends to focus on private investments (see our discussion below). We understand the stakes in Cyan and DEAG were sold completely in H119. At the same time, Heliad’s holding in flatex was reduced to 9.9% at end-June 2019 from 10.9% at end-2018. Consequently, Heliad held stakes in three listed companies at end-June 2019: flatex, MagForce and Elumeo.

Other operating expenses declined visibly to €1.4m from €4.6m in H118, largely supported by lower costs of management and liability at €0.9m vs €2.6m in H118 associated with fees paid to Heliad Asset Management (Heliad’s investment manager), as well as reduced expenses for bad debt allowances (€0.1m vs €1.4m in H118). As a result, diluted EPS was €0.04 after a loss per share of €1.59 was recorded in H118.

Heliad’s NAV per share decreased c 40% to €6.25 at end-June 2019 vs end-June 2018 (€10.38) as a result of negative valuation effects related to both listed and unlisted holdings (for more details see our previous two update notes). That said, it remained broadly stable compared to end-2018 NAV at €6.20 per share due to the factors described above.

Reorientation to focus on innovative private companies

Following management changes in April 2019 associated with Heliad’s weak FY18 results, the company has been in restructuring mode. Stefan Schütze and Juan Rodriguez (two board members of Heliad’s largest shareholder, FinLab, who replaced the previous CEO) will remain on Heliad’s management board and will focus on maximising the value of the existing portfolio while exploring opportunistic investments across different industries, with a potential stronger emphasis on the fintech, IT security, blockchain and digital brand sectors. We understand that Heliad will seek new private investments rather than invest in listed holdings (which are easily accessible directly for Heliad’s investors at a lower cost).

Although we believe Heliad may retain its c 9.9% stake in flatex (at least in the short term), we also acknowledge that flatex recently initiated a review of strategic options, including a potential sale of the business and onboarding of new investors. This could potentially represent an exit route for Heliad and (depending on the attractiveness of the actual exit price) might translate into a significant disposal gain. In the longer term, Heliad’s investment activity should become more aligned with FinLab’s approach and, in our opinion, it is possible the two entities might be merged at some stage.

Recent portfolio developments

Heliad’s current portfolio is a combination of holdings in listed companies and privately held investments. The former includes flatex (an integrated online brokerage business), MagForce (a biotech player with approved nanotechnology-based therapy to treat brain cancer) and Elumeo (an online jewellery retailer with relatively weak recent performance). Heliad holds stakes in six non-listed companies: Springlane, Spaze, Alphapet, Libify, Muume and Tiani Spirit.

We note that Heliad’s NAV per share and financial results are mainly dependent on the share price development of flatex. Following this holding’s c 45% share price appreciation since end-June 2019 (triggered by the strategic review and H119 results), Heliad’s 9.9% stake in the company is worth c €54.4m compared with €37.4m at end-June 2019. In addition, flatex raised its FY19 EBITDA margin target in July 2019 to 31% from 29% on the back of solid preliminary H119 figures and the ongoing product rollout in the Netherlands. In H119, the company posted a c 10% y-o-y increase in sales to €64.3m and EBITDA at €19.7m, up c 7% y-o-y. flatex states that lower market volatility in H119 was more than offset by a dynamic expansion of its customer base. As announced in August 2019, the company attracted c 32k new customers in the year to date (including almost 10k in the Netherlands), which is already in line with the whole of 2018. It also reiterated its plan of attracting 60,000 new customers in 2019.

Magforce is making progress with its strategy to drive the uptake of its thermal ablation treatment, NanoTherm. It recently announced it has completed treatment of the first 10-patient cohort in the pivotal prostate cancer study required by the US FDA for approval. It has indicated that the initial findings from this first cohort indicate treatment side effects have been minimal and in line with that of biopsies. See our recent notes for more details.

With respect to Heliad’s unlisted holdings, we note that Springlane (a retailer of kitchenware) closed a €10m financing round in August 2019. The funds received from Apeiron Investment Group, S-UBG Group and existing shareholders will be used to finance the company’s growth. Following the funding round, Heliad continues to be Springlane’s largest shareholder with a 26.5% stake.

Valuation

Heliad assesses its own NAV per share on the basis of the market valuation of listed holdings and valuation of unlisted holdings based on new funding rounds or secondary transactions. The company is trading at a 23% discount to the last published NAV per share of €6.25. Movements in the discount between publication of the quarterly NAV tend to reflect the valuation of listed holdings, which we estimate made up c 70% of NAV (c 61% for flatex alone) at end-June 2019. We estimate that flatex’s c 45% share price increase since end-June 2019 translates into an incremental NAV per share improvement of c 28% (or c €1.72 per Heliad share). The net negative impact of share price changes in Heliad’s remaining two listed holdings (Magforce and Elumeo) might have resulted in an NAV deterioration of c €0.05 per Heliad share, according to our estimates. Adding the net figure (c €1.67) to Heliad’s last reported NAV per share suggests the underlying discount may now be closer to 39%. This means Heliad’s current market capitalisation is below the market value of its stake in flatex. However, we believe the discount to NAV might partially reflect Heliad’s recent poor performance.