Every economic decision made has a good side and a bad side. Government deficit spending has both good sides and bad sides. Interest rate changes have good and bad sides also. Added to this dilemma is that each decision affects the dynamics of the other decisions made - making the outcome of the sum of the decisions unpredictable.

Follow up:

I see the economic world (actually might better be called the political economic world) in shades of gray. The road to failure is paved with litmus test opinion - austerity, deficit spending, exceptionalism, credit, consumerism, socialism, trickle up, trickle down .... Every week I try to focus on an economic subject where I know some readers have strong beliefs - and shoot some holes in it. Admittedly, I sometimes have penned posts which I believe the opposite of what I wrote. My objective is to try to explore the opposite side - and challenge the logic of conventional wisdom.

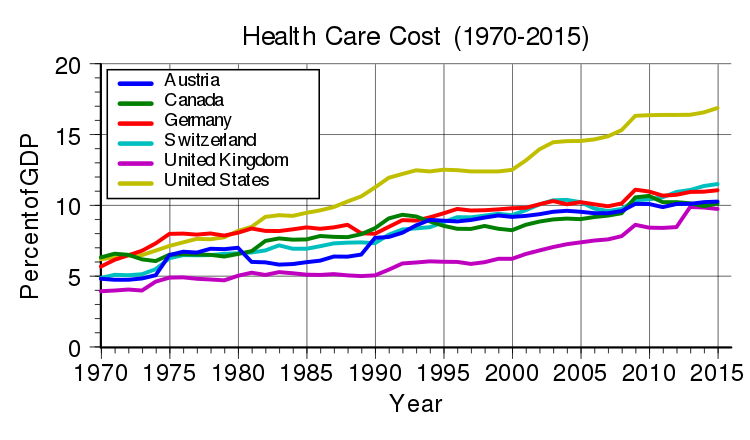

Could it be that the most likely cause of the slowing USA growth is health care?

This could be true if you consider that GDP measures money movements for essentials of life.

And the more you spend to survive, the more GDP grows. The average human spends survival money for:

- food,

- the place where you sleep at night,

- clothes you wear,

- the cost to get to work,

- education,

- and health care costs.

It can be argued that it is a big difference between eating hot dogs vs. steak, or a 500 square foot tiny home and a mansion on a 20 acre estate. With few exceptions, a consumer does not spend money on health care unless that consumer believes it is necessary. Of course, if one can afford it, more money is paid for the best possible health solution - but for the vast majority, expenditures are limited to the least cost possible.

Health Care consumes more of GDP than other countries.

Source: WikiBasti - Own work, Public Domain,

The USA is spending at least 5% more of its GDP on health care than most other economies - and the sad result is that the USA is in 31st position on life expectancy. Excessive spending is not translating into better results.

What is the economic multiplier of health care? Is it less than for other consumption? As the vast majority of consumers spend ALL of their income, is spending money on medical care causing some or all the softening of GDP seen over the recent years?

One cannot do precise calculations on the effects of health care on an economy - but logic dictates spending money which does not need to be spent is little better than burning money.

GDP includes and excludes many elements.

All economic activity is not equal. GDP excludes used items such as used cars and resold houses. GDP excludes imported items even though the consumer spends good money on them. (Of course, GDP includes exports which have no domestic consumption, and with a perfectly even balance of trade imports and exports cancel each other.)

GDP excludes any illegal activity - say buying drugs or spending for sexual service persons. On the other hand, GDP includes much of the military spending, even for munitions and military equipment actually used outside of the states.

GDP made sense when the world's major activity was building things - but I would suggest it no longer tells the complete story in a service economy.

What makes more sense to me is having the primary economic metric be growth of income per capita in various forms (inflation adjusted and unadjusted, median, etc.).

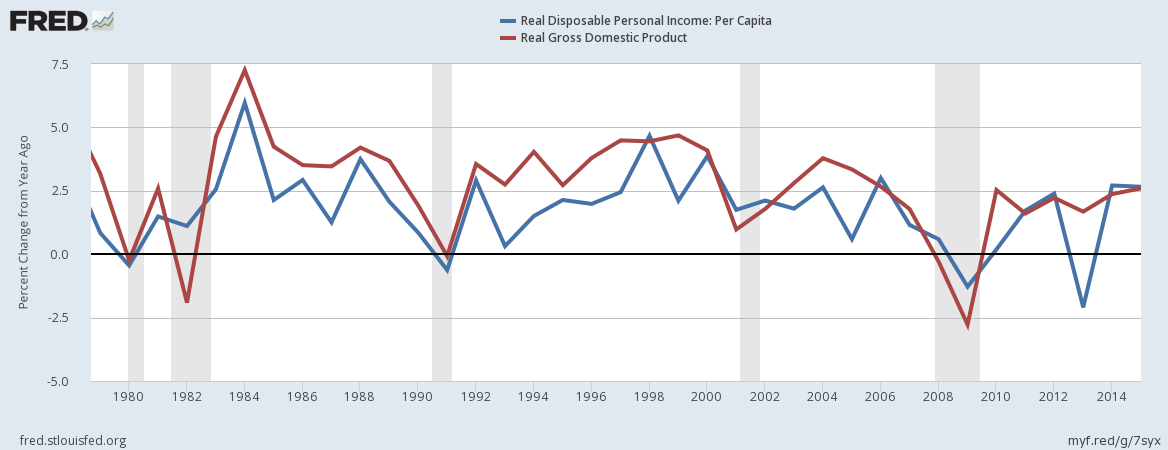

Disposable personal income tells more about what is going on in an economy than consumption. Using this metric, there was no recession in 1982 or 2003 - but there was one in 2013. I would like to use median incomes - but there currently is no real-time method to compile this data. Tracking the economy with data that is released 6-12 months ex-post facto doesn't really make sense.

And, one more thing - the next time a politician stands up and wants to raise your taxes - this may turn out to be recessionary. It is definitely a headwind for the economy because it removes money from the real economy. And if taxes are raised to reduce the federal deficit, that is even worse in times of low inflation and slow growth. That's when the economy needs more money.

Other Economic News this Week:

The Econintersect Economic Index for October 2016 insignificantly declined with the economic outlook remaining weak. The index remains near the lowest value since the end of the Great Recession. Some sectors of the economy continue to give recession warning flags. Employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week: Privately-held Garden Fresh Restaurants (dba Souplantation, Sweet Tomatoes), Privately-held Hanson Permanente Cement (f/k/a Kaiser Cement), Multimedia Platforms Worldwide.

Disposable personal income tells more about what is going on in an economy than consumption. Using this metric, there was no recession in 1982 or 2003 - but there was one in 2013. I would like to use median incomes - but there currently is no real-time method to compile this data. Tracking the economy with data that is released 6-12 months ex-post facto doesn't really make sense.

And, one more thing - the next time a politician stands up and wants to raise your taxes - this may turn out to be recessionary. It is definitely a headwind for the economy because it removes money from the real economy. And if taxes are raised to reduce the federal deficit, that is even worse in times of low inflation and slow growth. That's when the economy needs more money.

Other Economic News this Week:

The Econintersect Economic Index for October 2016 insignificantly declined with the economic outlook remaining weak. The index remains near the lowest value since the end of the Great Recession. Some sectors of the economy continue to give recession warning flags. Employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week: Privately-held Garden Fresh Restaurants (dba Souplantation, Sweet Tomatoes), Privately-held Hanson Permanente Cement (f/k/a Kaiser Cement), Multimedia Platforms Worldwide.

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: