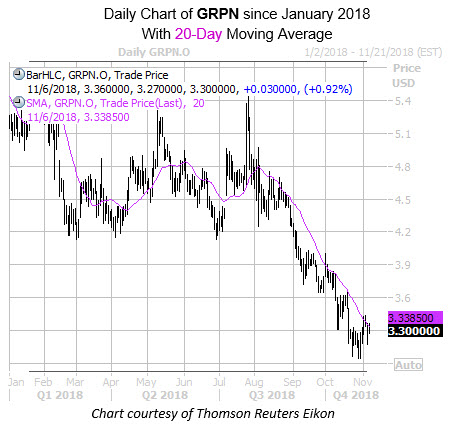

Shares of Groupon Inc (NASDAQ:GRPN) are trading slightly higher this afternoon, last seen up 0.9% at $3.30. The coupon concern is expected to report its third-quarter earnings before the market opens tomorrow, Nov. 7. Below, we will take a look at what the options market has priced in for the stock's post-earnings moves, and dive into the shares' long-term performance on the charts.

GRPN has been underperforming of late, stuck in rapid a downtrend since its late-July highs. Aiding its steady decline has been the 20-day moving average, which has been a ceiling of resistance for the shares since early August. What's more, the security has shed over 35% year-to-date.

Digging into its earnings history, GRPN closed higher the day after reporting in five of the last eight quarters, including the past two in a row. Looking broader, the shares have averaged a 10.9% move the day after earnings over the last two years, regardless of direction. This time around, GRPN options are pricing in a 21.5% swing -- roughly double the norm -- for Thursday's trading.

As far as the expected direction, Groupon options buyers are loading up on bearish bets. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows GRPN sporting a 2.00 10-day put/call volume ratio, ranking in the 99th annual percentile. This lofty ranking indicates puts have been purchased over calls at a much faster-than-usual pace ahead of earnings.

Covering analysts also seem to be sporting a pessimistic outlook. Of the 14 covering Groupon stock, 11 sport tepid "hold" or worse ratings. Lastly, short interest on GRPN has risen 16% during the past two reporting periods, and now represents 12.5% of the stock's total available float. At the equity's average pace of daily trading, it would take shorts nearly seven days to cover their bearish bets.