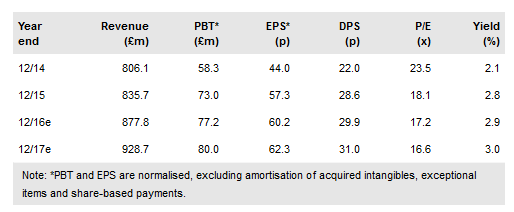

Greggs' (LON:GRG) trading update confirmed that it delivered a stronger than expected finish to FY16, leaving it well placed to face the margin pressures that will affect the entire industry in FY17. We expect only modest changes to FY17 estimates when FY16 results are released and therefore continue to value the shares at 1,189p.

Greggs has reported a strong end to FY16. For the 52 weeks ended 31 December 2016, total sales grew by 7.0% and company-managed shop l-f-l sales grew by 4.2%. Sales over the Christmas period were particularly strong, aided by a favourable trading pattern and, as a result, Q416 company-managed shop l-f-l sales grew by 6.4%. Excluding the final two weeks of the year, Q416 l-f-l sales growth was 4.1%.

However, Greggs also highlights some industry-wide cost pressures in 2017 that are likely to have a modest impact on margins in the short term. Ingredient costs are already increasing and Greggs expects the rate of inflation to accelerate in the next few months and remain positive for around 18 months.

To read the entire report Please click on the pdf File Below