In a normal review of the US, the IMF recently called on the Federal Reserve to drop its dot-plot tool and replace it with a single staff forecast, like the ECB. We too have been critical of the individual macroeconomic forecasts and appropriate level of Fed funds. We think it is a particularly noisy channel of Fed communication.

There seems to be more salient issues for the IMF to focus on than the Fed's communication. When everything is said and done, the Fed's communication seems fairly clear. There would be a period of time between the completion of its asset purchases (QE) and the first hike in the Fed funds target range. It has gradually shifted from date-specific to data-dependent policy. It has warned anyone who wishes to listen that it intends to raise rates this year provided that the slack in the labor market continues to be absorbed, and that officials can be "reasonably" confident that the inflation target will be met in medium term.

The Federal Reserve has not surprised the market. It has telegraphed its major step months in advance. Last month's dot plots showed that a majority of the Fed still think that two rate hikes this year may be appropriate. Surely few can really claim surprise if the Fed were to hike rates in September. The market understands what the Fed is signaling but is skeptical. The pricing of Fed funds futures market suggest a single hike at the December meeting is the odds on favorite scenario in the market (as opposed to surveys, which continue to show a majority of economists expect a September move)

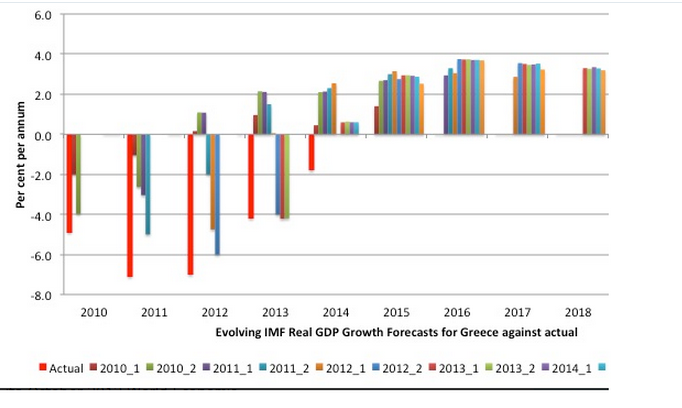

The IMF suggests that a single staff forecast should be introduced to replace the dot-plots. Is this such a good idea? Look at this Great Graphic from Billy Mitchell -- billy blog. It shows the evolving IMF forecasts for Greek GDP for the last several years. It is habitually more optimistic that the actual performance (red bar). This is true even after it admitted ( circa 2012) that it under-estimated the fiscal multiplier (how much austerity would depress the economy).

While Federal Reserve officials under-estimated the pace that the unemployment rate has fallen, it has over-estimated US growth (using the central tendency of the Fed's forecasts, an average after high and low forecasts are excluded). At the end of 2012, when the Fed first offered growth forecasts for 2015, it expected 3.0%-3.7%. Even as of the middle of last year, the central tendency was 3.0%-3.2%. Last month it was cut to 1.8%-2.0%, after incorporating for new economic data, including the near-stagnation in the Q1.

The fact of the matter is that monetary policy needs to be conducted without perfect (complete information). Even the models struggle predicting growth of a large dynamic economy, which makes it all the more amazing how fast China reports its quarterly growth numbers.

One staff forecast, like what the IMF has provided on Greece, suggests greater confidence than it deserves. Showing the range of views, as the Fed does, unsettles that air of confidence. It helps remove the veneer of precision and exactitude by demonstrating that reasonable people differ. The one staff forecast adds to the rigidity of something that by its very nature must be flexibly accepted. It is a small signal that it does not suffer from hubris as much as its critics may say

In both the IMF and Fed approaches, the forecasts are adjusted. The IMF staff does this twice a year, and as the chart illustrates for Greece, the updates tends to be relatively small. The Fed's forecasts are updated quarterly and sometimes the forecasts are sharp, especially the current year forecast. Over the last four quarters, the lower end Fed's 2015 GDP central tendency has fallen from 3.0% to 1.8%, while the upper end has been cut from 3.2% to 2.0%. There is also information contained in the magnitude of the range. In June it fell to 0.2% from 0.4% in Q1, suggesting a greater convergence of views.

The IMF puts more stock into its GDP forecasts. It evaluates countries such as Greece based on metrics that use its own forecasts for GDP, such as debt-to-GDP ratios. The IMF's approach leads to a rigid acceptance of something that it objectively cannot do well -- forecast GDP. This does not necessarily mean that anyone can. The point that is not to pretend otherwise but accept this as given. This leads to less rules-for-the-sake-of-rules inflexibility which was a problem in the 1997-1998 Asian Financial Crisis, and now in Greece as well.