Former Fed Chairman Alan Greenspan just provided a sound reason to expect a recession sooner rather than later.

Wrong Way Greenspan

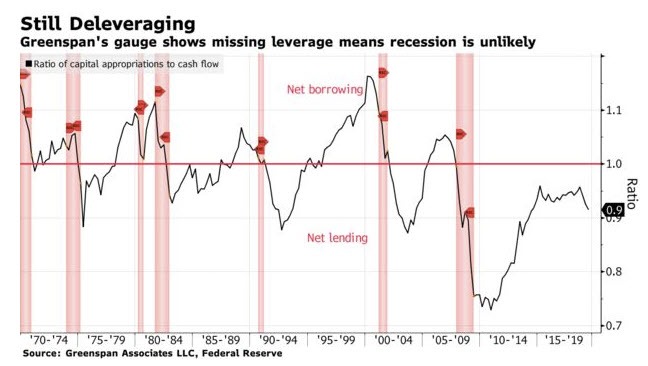

If you weren't worrying about recession before, former Fed Chair "Wrong Way" maestro Alan Greenspan just provided one: Greenspan Sees No Recession as Post-Crisis Deleveraging Endures.“The economy has been weakening, but we’re still in a period of deleveraging,” Greenspan said in a recent interview. His office reaffirmed his outlook on Wednesday. “No recession in the last half century, at least, began from a period of deleveraging.”Spectacular Contrarian HistoryGreenspan has a spectacular history of being wrong.Interest Rate Flashback July 31, 2017Alan Greenspan told Bloomberg TV :

"By any measure, real long-term interest rates are much too low and therefore unsustainable. When they move higher they are likely to move reasonably fast. We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.”

Bond Bubble Flashback August 4, 2017

Please consider Bubblicious Debate: Greenspan Says “Bond Bubble About to Break”, No Stock Market BubbleIn a CNBC interview, the longtime central bank chief said the prolonged period of low interest rates is about to end and, with it, a bull market in fixed income that has lasted more than three decades.“The current level of interest rates is abnormally low and there’s only one direction in which they can go, and when they start they will be rather rapid,” Greenspan said on “Squawk Box.”Alan Greenspan on "Irrational Exuberance"On December 5, 1996 the Maestro warned of "Irrational Exuberance". Click on the link for an amusing video.By the year 2000 Alan Greenspan embraced the "productivity miracle" of technology and no longer saw any bubbles. That's precisely when the technology bust started.

Negative Yields "No Big Deal"

On August 13, 2019, Greenspan said No Barriers to Prevent Negative Treasury Yields.

Former Federal Reserve Chairman Alan Greenspan says he wouldn’t be surprised if U.S. bond yields turn negative. And if they do, it’s not that big of a deal.

Curiously, we had a bubble with interest rates well north of 2% but now 0% would not be surprising.

Negative Interest Rates Are Social Political Poison

Greenspan's timing on negative rates is particularly noteworthy.

Effective Lower Bound

For discussion of why the effective lower bound of interest rates may be much higher than zero, please see In Search of the Effective Lower Bound.

Just as Sweden and others are questioning negative rates, Greenspan embraced them.

Well done Maestro!

And thanks for the heads up on a recession.