The world is fixed. Or at least you would think that it is, following a good day of data and the news that the Dow Jones closed at a record nominal (not accounting for inflation) level yesterday, with room to spare.

Services data also came in a broadly better level, with the Eurozone, UK and US measures all beating expectations. Germany continued to show off its economic prowess by putting in a number 10pts better than the likes of France and Italy – which suffered its sharpest drop in 7 months. This divergence is key to our thoughts around a revival for GBPEUR in Q2. The Eurozone problems persist, and they are very likely to come back into focus sooner rather than later.

Here in the UK the better than expected services PMI figure makes up slightly for the frankly horrific manufacturing and construction numbers we’ve had recently. The overall macroeconomic picture does remain a significant concern. Inflation issues, alongside weak consumer and business confidence, suggest that the path of the UK economy will remain one of stagnant and slight improvements, mixed with oscillation around the zero growth mark.

The big questions is; will the better than expected number and the expectation that we are indeed growing in Q1 now prevent the Bank of England’s from adding more quantitative easing (QE) at tomorrow’s meeting? I reckon that the members of the MPC that voted for the increase in QE last month will once again vote for one this month, and the question now remains has the data got materially worse since?

The answer to that is ‘no’, but the publication of this week’s Funding for Lending scheme numbers that showed a £2.4bn drop in lending by banks may just be the thing that tips the balance in favour of further easing.

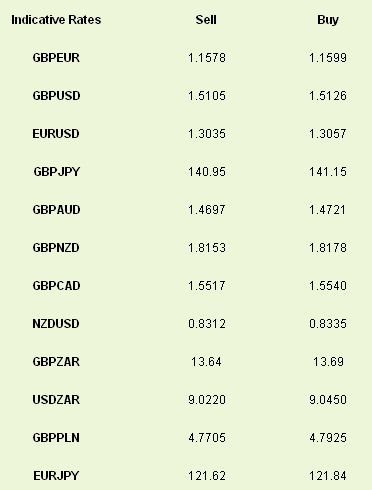

Sterling ran higher in the minutes before and after the PMI announcement and got as high as 1.52 against the USD before the US release stiffened the greenback.

Today’s revision to Eurozone GDP for Q4 should be confirmed at the -0.6% mark we had seen previously. With tomorrow’s ECB meeting now in investors’ mind-sets, the euro should remain pinned around these levels until Mario Draghi decides to pipe up again.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Good Day Of Figures Fails To Mask Ongoing Concerns

Published 03/06/2013, 04:58 AM

Updated 07/09/2023, 06:31 AM

Good Day Of Figures Fails To Mask Ongoing Concerns

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.