. That should chill those investing in the alternative energy sector as sunny, temperate weather is its ally. With individual stocks falling like the thermostat in China, exchange traded funds for alternative energy sectors such as Market Vectors Solar Energy (KWT) and ISE Global Wind Energy (FAN) are an ideal way to profit when the industry recovers, with protection from separate companies going bankrupt in the interim.

Corn Likes to Sun, too

China hopes to double its capacity to produce solar-powered energy this year. For this to happen in China (or anywhere), solar energy does not need heat to generate power, but it does require sunlight. If it rains or snows, there is much less sunlight. Wind is produced by heat from the sun as it strikes uneven surfaces. If there are fewer solar rays, the wind needed to turn the blades of wind turbines that create power will be weaker.

Rain or snow can also hamper the collecting capabilities of solar panels. Snow can also diminish the performance of the blades of wind turbines. As a general rule, any moisture is very bad for exposed machinery as it corrodes the metal and leads to rust and rot.

Biofuel operations also perform better when blessed with moderate weather with lots of sunshine. Harsh conditions could disperse the algae needed for biofuels, even if in contained environments. Cold weather also reduces the production rate of algae. Corn for ethanol needs lots of sunlight to grow as it is a tropical, annual grass. Switch grass, wheat, and other forms of biomass also do best in warm, sunny weather.

Extreme Weather is when Alternative Energy Shines

Scientists have claimed that climate change can result in extreme weather conditions, ranging from hurricanes to droughts. These types of weather result in alternative energy being more attractive. Alternative energy also becomes more appealing here as some desire to “move off the grid” into localized sources of power. This can range from home solar energy units to cogeneration facilities for commercial purposes.

The Higher the Temperature, the Higher the Price of Natural Gas

Due to record heat in the Midwest region of the United States last summer, natural gas prices jumped. The hotter it is, the more electricity is needed to run air conditioners. As most utilities in the United States run on natural gas that increases the demand for it. The higher need for power sends the price of natural gas higher.

To survive, least of all prosper, alternative energy needs for natural gas prices to be high. Natural gas prices have fared poorly in recent years due to fracking, which has produced so much more of it that its price has fallen dramatically. As a result, alternative energy cannot compete economically with low priced natural gas.

While there are many reasons that a stock falls in value, the plunge in the exchange traded fund for natural gas, United States Natural Gas (UNG), along with the collapse in the exchange traded funds for solar power, Market Vectors Solar Energy (KWT), and wind power, ISE Global Wind Energy (FAN) is evinced by the charts below:

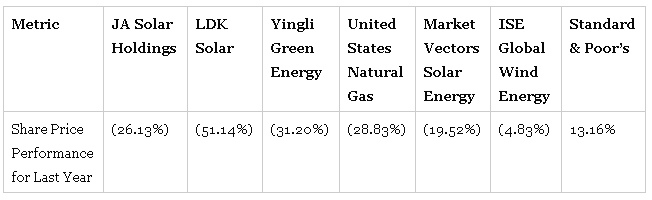

The table below shows how individual solar power stocks such as JA Solar Holdings (JASO), LDK Solar (LDK), and Yingli Green Energy (YGE) have fallen in price, along with the UNG, KWT, and FAN. These companies have suffered from a variety of factors. In the solar power sector, there has been an oversupply due to the Chinese Government subsidizing its companies that drove down prices and forced companies into bankruptcy. Cheaper natural gas has negatively impacted the entire alternative energy sector. During the same period these securities were declining, the Standard & Poor’s 500 Index (SPY) rose by double digits. That reveals the weakness of those areas of the energy sector.

Source: Finviz

The alternative energy sector is still very unstable. However, it is still attractive for the long term as its renewable, friendlier to the environment, reduces the need for energy imports, and sometimes cheaper than expensive foreign oil. The exchange-traded funds for solar power (KWT) and wind power (FAN) are more suitable as each offers exposure to the sector without the risk of an individual entity going bankrupt.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Good Alternative Energy ETFs Protect Against Bad Weather

Published 03/26/2013, 03:46 AM

Updated 07/09/2023, 06:31 AM

Good Alternative Energy ETFs Protect Against Bad Weather

China is enduring its coldest winter in decades

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.