America’s Independence Day holiday is over. Sadly, now it appears to be mostly about independence from gold…with macabre dependence on debt, fiat, and violent meddling in faraway lands.

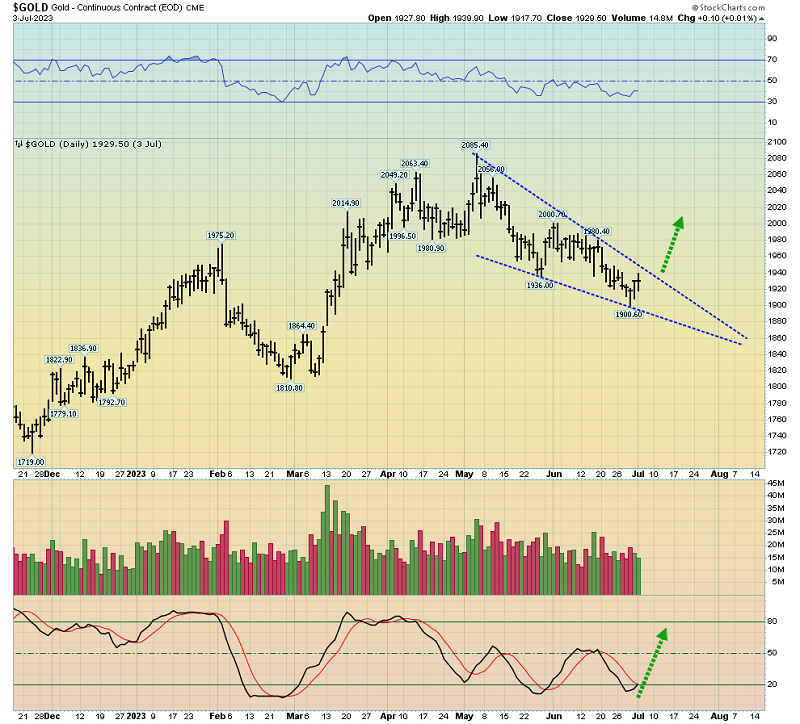

Regardless, there’s a potential bull wedge on this daily gold chart. There’s also an imminent crossover buy signal for the 14,7,7 series Stochastics oscillator (at the bottom of the chart).

John Wilder invented important technical indicators like RSI and Parabolic SAR. His moving averages are not as well-known. But I urge investors to consider using them as vital tweaking tools at key buy and sell zones for gold, silver, and the miners.

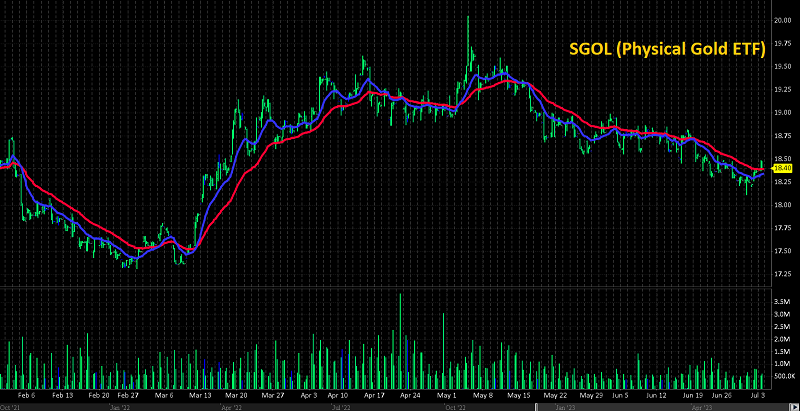

John passed away a couple of years ago, and his legacy stands tall; in addition to his market work, he was a war vet and mechanical engineer. I consider his revolutionary technical analysis to be some of the greatest work ever done in the field. The good news for investors is that if gold moves just $10 or $15 higher from here, a fresh Wilder moving averages buy signal will be triggered for SGOL, and of course for gold.

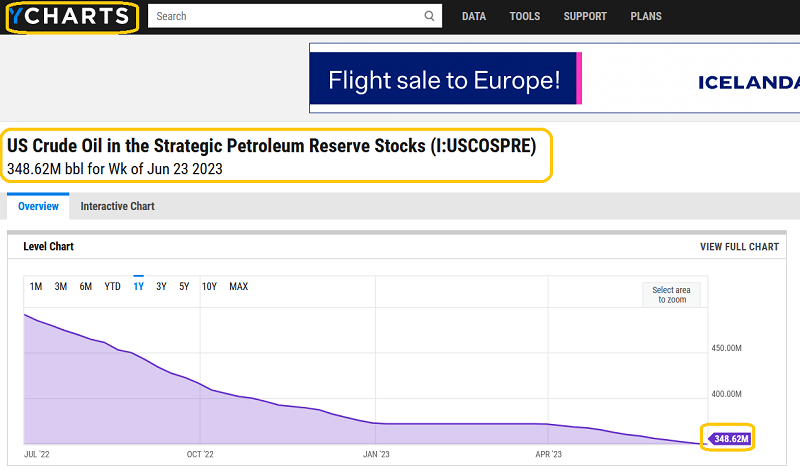

What about oil? Well, today is the first day of an important two-day OPEC meeting. Russia and Saudi Arabia have already announced additional cuts to supply, yet the price is stagnant.

It’s surreal that “The American Chickenhawk” (Biden) continues to keep the SPR spigot open, but he does.

If the price of oil rises significantly, US citizens will demand an end to his debt-funded war in Ukraine. By dumping 1-2 million barrels of SPR oil a week, the Chickenhawk counteracts the supply cuts from OPEC.

A glimpse at what could be next, the daily chart for oil. When oil was trading at $130 I urged investors to focus on key buy zones rather than price predictions, and the $65 buy zone was the one I focused on. The next 48 hours of OPEC action likely determine whether the sideways action of the past few months is a base pattern launch pad or a pitstop en route to my next buy zone at $40.

What is known is that oil is close to $65 now, and investors who haven’t bought should consider doing so. If oil does begin to rally, will Biden open the SPR spigot even wider? He could, but he would draw significant heat if the number of SPR barrels drops too low… heat from even his own voters who have so far stayed quiet while he happily lords over the mindboggling devastation in Ukraine.

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape.

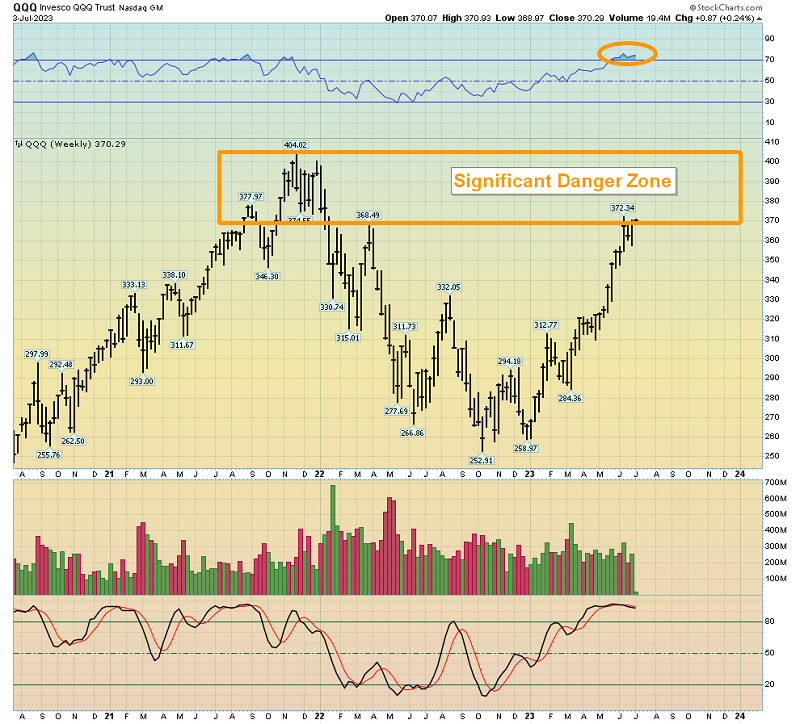

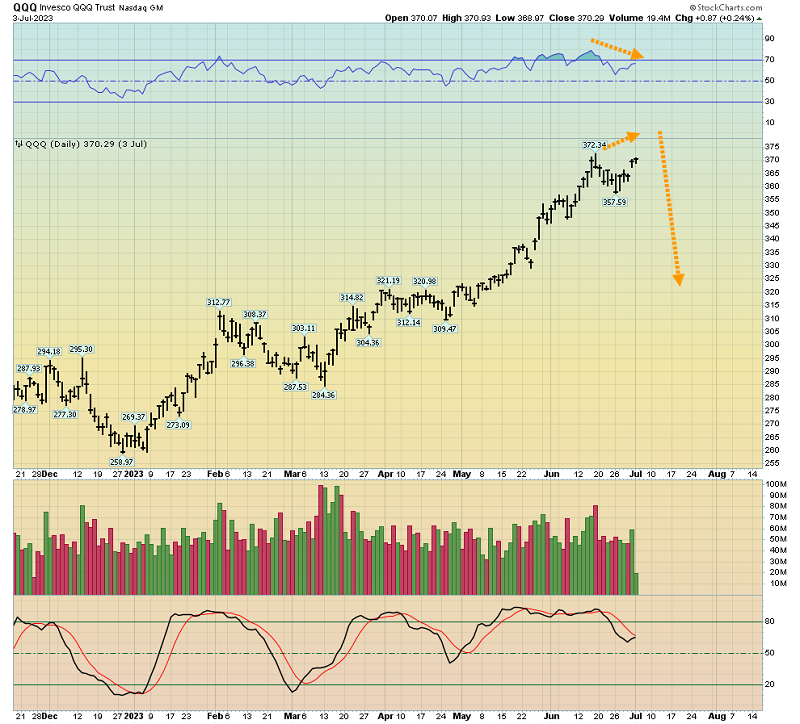

What about the stock market? The QQQ chart. I highlight some Wilder moving averages and while there’s no crossover sell signal, the buy signal is very “long in the tooth.”

In the QQQ weekly chart, note the overbought Wilder RSI and the huge resistance zone, which is a significant danger zone for gullible investors who are buying now.

Also, in the daily chart, there’s a developing bear divergence of RSI with the price. It certainly “bears” watching. A sell signal on the Wilder moving averages that happens with the QQQ ETF in the danger zone could be followed by a very violent decline in the price. Investor caution is highly recommended.

What about the miners? The short-term GDX (NYSE:GDX) chart. A Wilder moving average buy signal is in play.

On the daily chart, there’s a potential bull wedge for gold. On this magnificent GDX chart, it’s fully formed and functioning like a champ. While the overbought US stock market flashes a possible bear divergence with RSI and price, there’s a bull divergence in play for GDX… and for many miners too.

The US jobs report is Friday, and some consolidation is likely for the miners after the surge of the past few days, but the technical green shoots are getting greener. If Johnny Wilder was here with us today, I’ll dare to suggest he would be impressed.