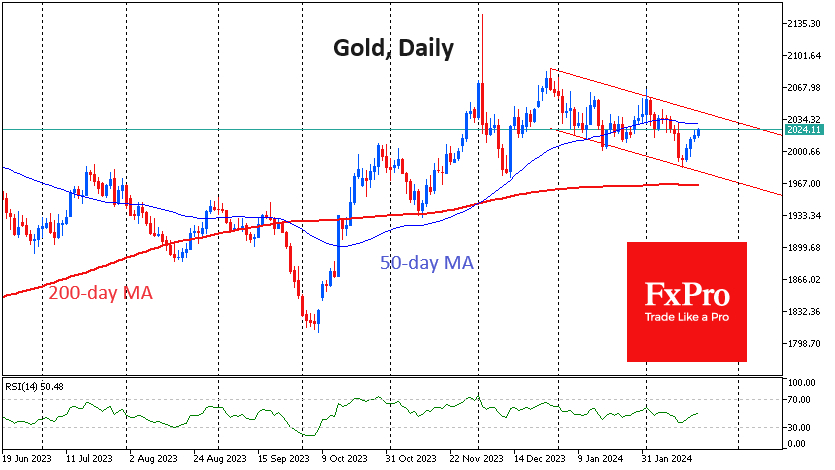

Gold rallied for the fourth consecutive session to reach $2023, recovering almost all the losses suffered the week before on the back of the inflation report. Gold's ability to rally suggests continued domestic demand, as some investors are clearly rushing to buy back any losses.

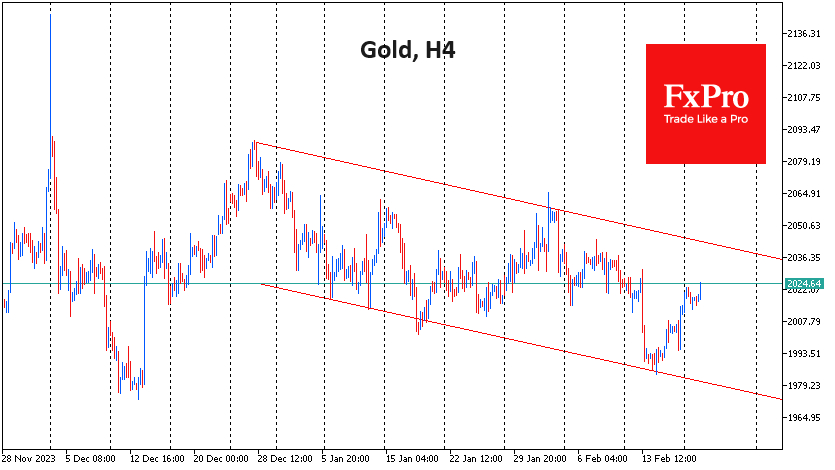

At the same time, however, we note that since the beginning of the year, gold has been characterized by solid selloffs on the news, forming a smooth downtrend. In the context of this downtrend, a rise to $2040-2045, which is the upper boundary of the bearish range, looks quite acceptable.

The area around $2035 - the highs of two weeks ago - also appears to be a crucial intermediate level. Confident buying from this level would be the first important signal that the recent correction is over and that gold is ready to make a fresh assault on the highs.

Much more important, however, will be the behavior of gold as it approaches the $2050 level, where the reversal of the decline in late January took place. Consolidation at this level would confirm the breakdown of the downtrend and set the stage for a move towards $2100 and the subsequent renewal of historic highs.

However, as long as gold is trading within the downtrend, there is a greater chance of a breakdown or even an acceleration of the downtrend.

Among the fundamental factors, the potential for growth could be provided by the fall in the dollar if Fed officials show a softening of their position, bringing the start of interest rate cuts closer.

On the bearish side, equities could come under pressure following the optimistic rally in the tech giants and the news of a sharp slowdown in economic activity. We also do not rule out the possibility that the recent support measures for the Chinese stock market and property sector will cool demand for gold as a safe-haven for investors from that part of the world.

The FxPro Analyst Team