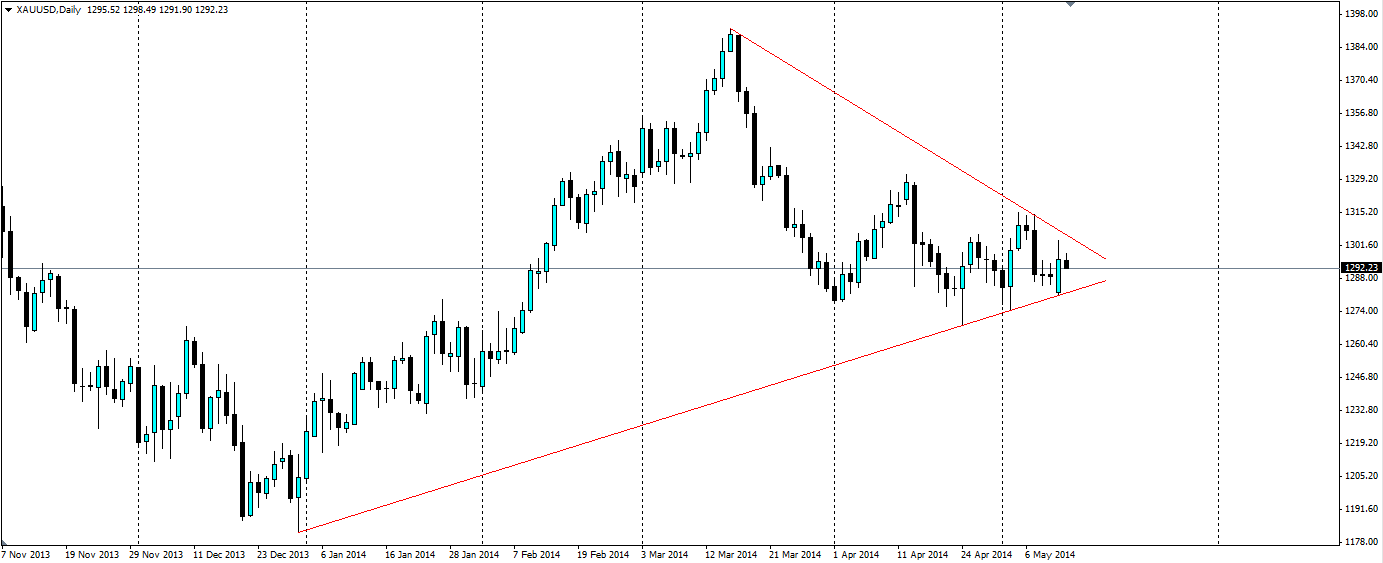

The Gold price is currently consolidating between a bullish and a bearish trend, forming a pennant shape. Price volatility and the stochastic indicator are also converging meaning either of these linesis likely to be breached in the next few days leading to a sharp movement in the price.

The Price of Gold saw a nice bullish run for the first quarter of the year with a peak at $1,392.14 an ounce. The beginning of tensions in the Ukraine between Russia and the west drove the price to these heights. When the US Fed began hinting at possible rate rises towards the beginning of next year, demand for gold reversed and the bears took over. The price was driven down below the $1,300.00 level, eventually finding support at 1,277.48. The price has since bounced along this support line, testing it on several occasions, and on each bounce posting a lower high, forming a bearish trend. There have been several false breakouts of the support, but each of these has resulted in a higher low, forming a bullish trend line.

Source: Blackwell Trader

The tensions in the east of Ukraine, where several regions have held referendums on independence that have been deemed illegal by the UN, are an ever increasing threat to the stability of the whole region. As Germany sends a top diplomat to the region to try and work out a solution to the issues, the gold markets watch with keen interest. Any threat that this crisis could turn into a full blown war will send gold markets into panic buying as investors park their money in the safety of gold. The bearish trend will not stand a chance in this instance.

Also of interest in gold markets, is the (likely) new Indian Government. The polls have only just closed, but the exit polls show a probable win for the Bharatiya Janata Party (BJP). The BJP is seen as much more open to investments and may ease import restrictions on the precious metal as Indian housewives are the world’s largest consumers of gold. Currently there is an import duty payable on gold, and any change in policy will push gold higher as the current 800 tonnes of imports a year will no doubt expand.

Overall the sentiment on gold has been bearish. As the US FED looks to wind up its enormous asset buying programme, it will turn to raising interest rates as a way to finally end the stimulus enacted to bring the global economy back from the brink of ruin. This is certainly a while off, but we are seeing more signs the US economy is improving, and each slight improvement raises the prospect of higher interest rates. Gold will no longer be the attractive safe haven it has been for the past five years, so keep an eye on US economic data.

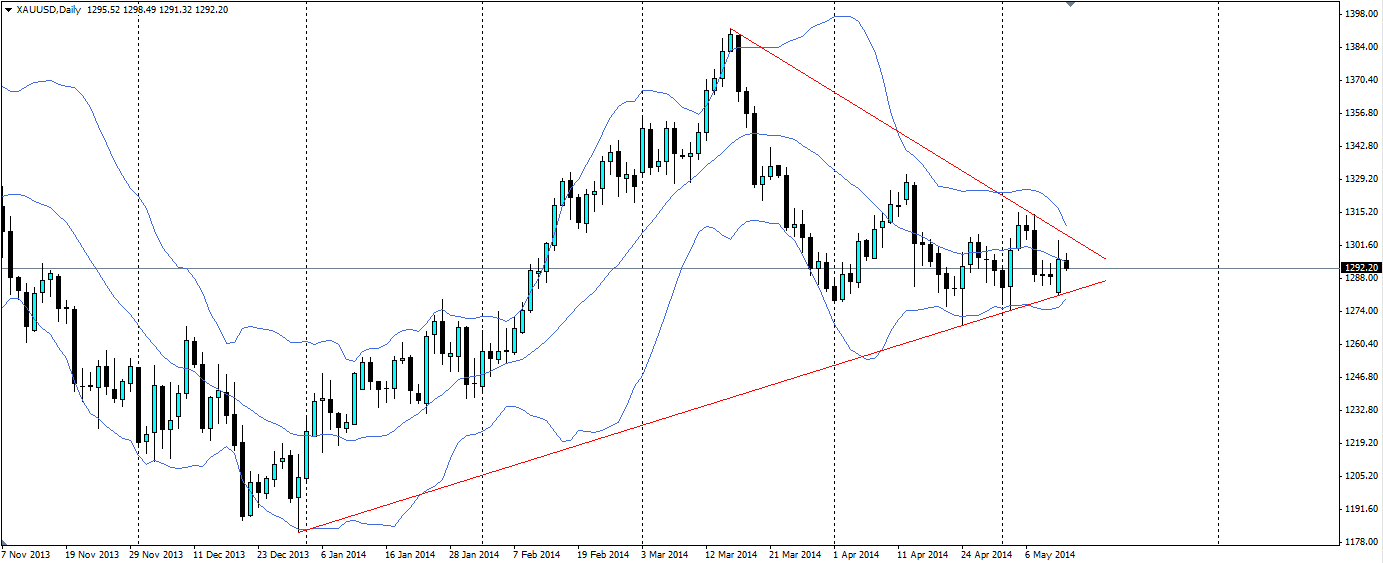

Looking at the Bollinger bands for the D1 chart for gold, we can see a clear consolidation of volatility. As the price has been squeezed between the bullish and bearish trend lines, this is shown in the Bollinger bands. We can see them coming together with a width of $30.00 between the upper and lower bands. As we all know, a squeeze in the Bollinger bands is the calm before the storm in terms of volatility.

Source: Blackwell Trader

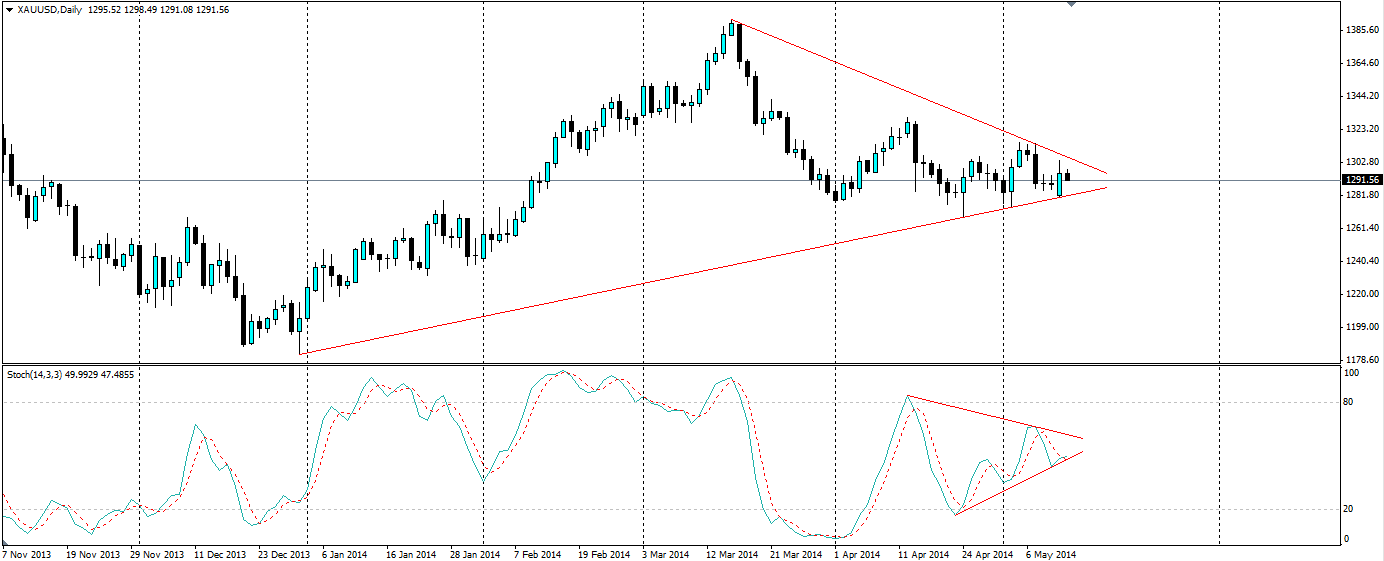

Further signs of an impending breakout can be found in the Stochastic Oscillator. There is a clear consolidation happening in the stochastic oscillator as it looks for direction. This oscillator is an indicator of momentum and it is clearly neither with the bears nor the bulls. However, this simply cannot last as the bullish support converges with the bearish resistance. Like the unstoppable force of a cannonball being shot at the immovable brick wall, something must give.

Luckily as traders we can profit from either a bullish or bearish breakout because when either line breaks down, the price is not likely to stick around for long. Setting a stop entry on either side of the shape should ensure we can catch the movement up or down. Key levels of resistance will be targeted for a movement up, such as previous highs and previous support lows will be targeted for a movement down.

The price of gold is converging into a pennant shape and volatility and the stochastic oscillator are also setting up for a breakout. The question is which way?