Talking Points:

- US Dollar May Break Downward From Consolidation Range

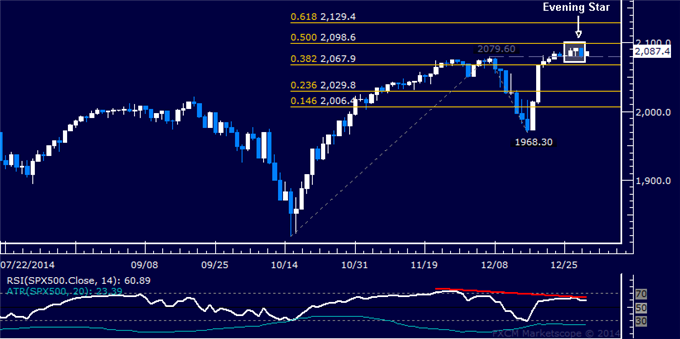

- SPX 500 Technical Positioning Warns a Downturn is Ahead

- Crude Oil at Risk of Deeper Losses, Gold Prices Aim Higher

US DOLLAR TECHNICAL ANALYSIS – Prices have flat-lined after hitting a five-year high, with negative RSI divergence warning a downturn may be ahead. Near-term resistance is at 11577, the 38.2% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 11648. Alternatively, a turn below the 11489-522 area marked by the December 8 top and the 23.6% Fib clears the way for a test of the 14.6% expansion at 11434.

S&P 500 TECHNICAL ANALYSIS – Prices have produced a bearish evening star candlestick pattern, hinting a move lower is ahead. Negative RSI divergence reinforces the case for a downside scenario. A daily close below the 2067.90-79.60 area marked by the December 5 high and the 38.2% Fibonacci expansion exposes the 23.6% level at 2029.80. Alternatively, a push above the 50% Fib at 2098.60 targets the 61.8% expansion at 2129.40.

GOLD TECHNICAL ANALYSIS – Prices pushed higher anew after a brief respite, clearing resistance marked by the 23.6% Fibonacci expansion at 1196.08. Buyers now aim to challenge the 38.2% level at 1211.85, with a break above that on a daily closing basis exposing the 50% Fib at 1224.59. Alternatively, a reversal back below 1196.08 targets the December 22 low at 1170.59.

CRUDE OIL TECHNICAL ANALYSIS – Prices are aiming to extend losses after breaking support at 58.20, the 23.6% Fibonacci expansion. Sellers now aim to challenge the 38.2% level at 54.83, with a further push beneath that targeting the 50% Fib at 52.10. Alternatively, a reversal back above 58.20 aims for the December 18 high at 63.65.