You saw how miners soared on Friday – everyone did. But do you know why it happened? This time, it’s actually quite clear…

It’s usually difficult to say what made the market move in a certain way. “Because there were more buyers than sellers” or vice-versa is the best reply, but it’s not very informative. This time, however, the rally was ignited by a specific event that can be analyzed.

The event was that the nonfarm payrolls negatively surprised the market. This happens rarely, and when it does, people tend to exaggerate its meaning, thinking that since there was a sign of economic weakness, the Fed will now cut the interest rates. Especially since it followed a relatively weak ADP employment report.

I want to clarify here what the “event” was and what it wasn’t. The fact that the jobs report was poor wasn’t that important on its own. The important thing was that it was below the market’s expectations. Whatever was expected was already discounted in the price. What we saw was weaker than that, so the markets reacted.

Now, this is where things get really interesting.

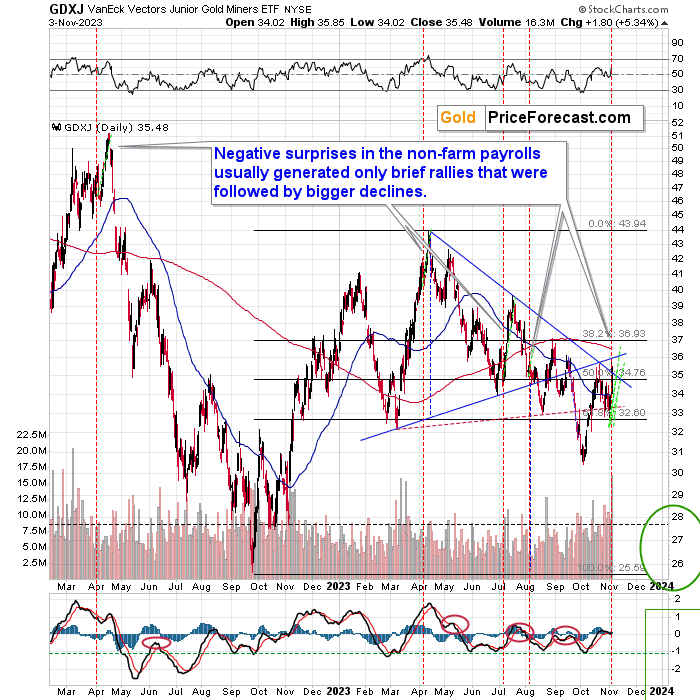

The above chart features situations (marked with orange dashed lines) when the market was previously negatively surprised by the jobs report.

The blue lines that I copied to the current situation show just how much the GDXJ rallied after the previous similar surprise from the nonfarm payroll numbers.

As you can see, Friday’s upswing was very much in tune with what happened in those previous cases. History rhymed.

To be clear – there was one case when the rally was bigger (not much bigger, though, the analogy to it would point to the GDXJ only at about $36.5), but that was when the RSI was much more oversold, so I’d say that the rally that was supposed to happen based on the surprising data, happened more or less right after its release. This also means that the rally might already be over or about to be over here.

Remember – the concern with “war” has already peaked – at least according to Google (NASDAQ:GOOGL) Trends, and this means that gold price is likely to follow shortly. Silver is likely to trade lower, too. A daily rally in mining stocks doesn’t change that.

The other reason that confirms the above is the fact that the weakest parts of the market tend to outperform right before tops and that’s exactly what we saw on Friday – junior miners were one of the weakest sectors out there, so the fact that they just moved sharply higher could be viewed as a bearish indication for the general stock market.

All in all, the daily rally in miners was sizable, but it seems that it was or will be short-lived. The medium-term trend remains down.